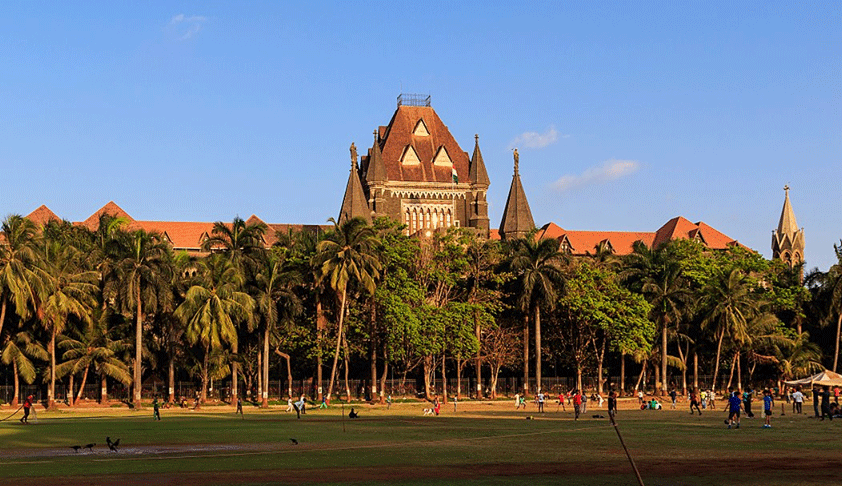

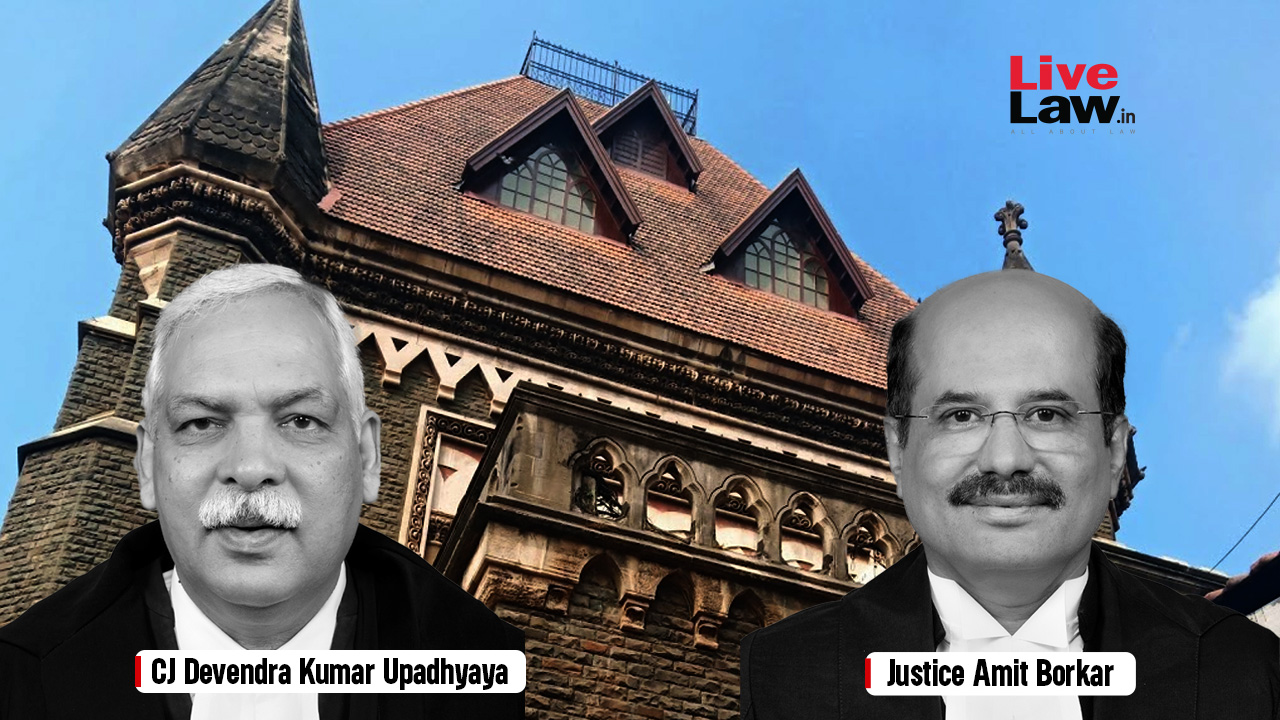

PMC Bank Crisis: Bombay HC Allows Auction Of HDIL Assets

Live LawIn a huge relief for the account holders of crisis-hit Punjab and Maharashtra Co-operative Bank, the Bombay High Court on Wednesday allowed a public interest litigation filed by one Sarosh Damania seeking auction of all Housing Development and Infrastructure Limited assets either mortgaged with the bank or attached by the Economic Offences Wing, Mumbai. In an affidavit in another PIL filed by depositors of PMC, RBI referred to its own inspection report of PMC bank dated March 31, 2018, which stated - "The bank submitted fraudulently manipulated data to RBI for sample checks, the sample of accounts picked for inspection did not contain undisclosed HDIL related accounts. Conflict of interest of Shri Waryam Singh as Chairman of PMC Bank and as a former Managing Director of HDIL was also commented upon in the report along with the attempt by the bank to show disclosed accounts of HDIL group as standard by sanction of new loans to close old NPA accounts in non-adherence of RBI Master Circular dated July 1, 2015 on IRAC norms. HDIL's counsel Vikram Chaudhari had argued that the total value of encumbered properties is Rs.11,000 crore and as per EOW's FIR, the total dues to PMC bank are Rs.4355 crore, hence the properties that are already attached by the EOW or are mortgaged with the bank can be liquidated and there was no need to auction or attach unencumbered properties.

History of this topic

PMC Bank Fraud Case: Bombay High Court Rejects Rakesh Wadhwan's Medical Bail Plea; Says He's Receiving Best Possible Treatment In Govt Hospital

Live Law)

Initial Response Looks 'Positive' for PMC Bank Resolution, Says RBI Governor

News 18

Plea to release ₹5 lakh to PMC bank depositors during COVID-19; HC seeks Centre, RBI

Live Mint

Delhi HC directs PMC Bank to file status report on asset sale of HDIL promoters

Live Mint

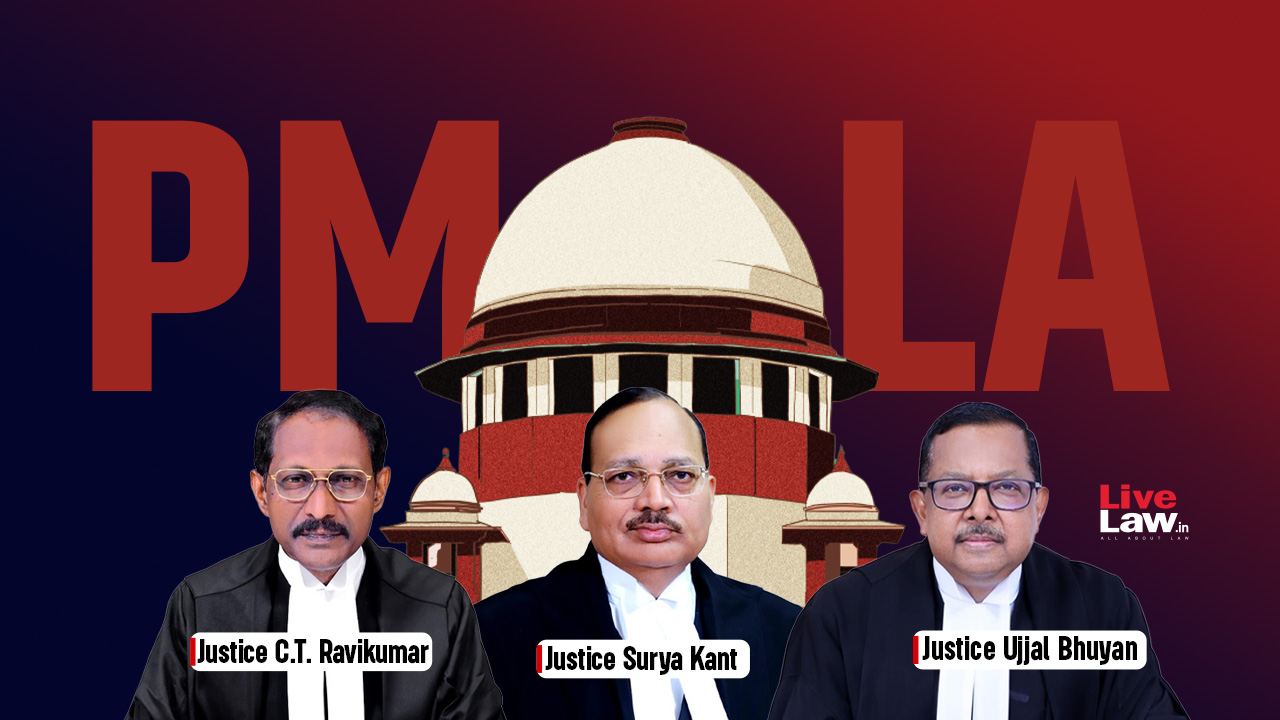

PMC Bank scam: SC stays Bombay HC order directing sale of HDIL assets to repay dues

India TV NewsPMC Bank scam: 12,000-page second charge sheet filed

The Hindu

PMC Bank scam: Depositors detained for holding protest at HDIL promoters' residence

India TV News

PMC Bank scam: SC stays HC order allowing shifting of HDIL promoters from jail to their residence

India TV News)

PMC Bank scam: SC stays Bombay High Court order allowing shifting of HDIL promoters from jail to residence

Firstpost)

PMC Bank scam: Bombay High Court sets up panel for sale of HDIL assets; next date of hearing on 30 April

Firstpost)

PMC Bank scam: HDIL MD Sarang Wadhawan's wife received Rs 70 lakh salary for working as retainer, finds ED probe

Firstpost)

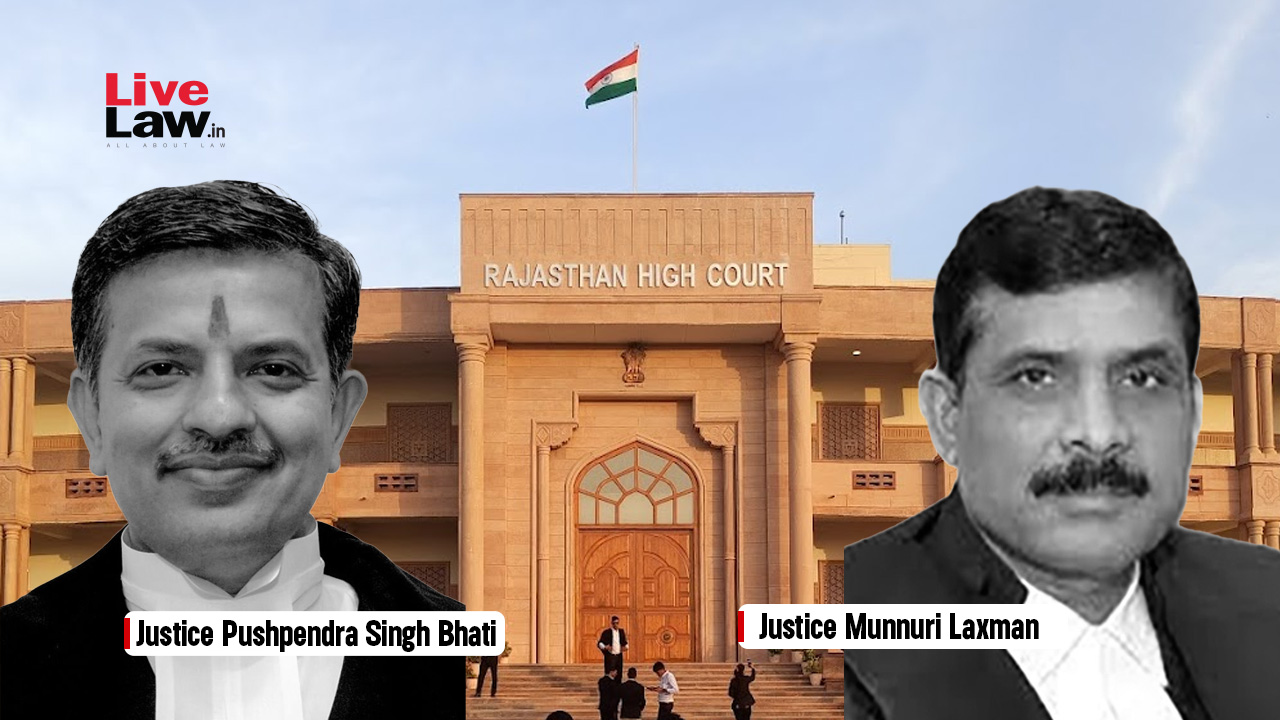

PMC Bank scam: EOW may file its first chargesheet against promoters of HDIL today; Wadhawans booked under PMLA in over Rs 6,300 cr fraud

Firstpost![Bombay HC Reserves Order In PIL Seeking Expeditious Sale Of HDIL Assets In Order To Pay Back PMC Bank Depositors [Read Petition]](https://www.livelaw.in/h-upload/2019/04/29/360387-bombay-hc-7.jpg)

Bombay HC Reserves Order In PIL Seeking Expeditious Sale Of HDIL Assets In Order To Pay Back PMC Bank Depositors [Read Petition]

Live Law

PMC Bank Crisis: Bombay HC Dismisses Petitions Challenging Withdrawal Restrictions Imposed By RBI

Live Law

PMC Bank crisis: HC junks PMC Bank depositors' plea for lifting of restrictions

India TV News)

PMC Bank scam: Nearly 78% depositors can withdraw entire deposits, says govt; efforts underway to repay customers money

Firstpost)

PMC Bank scam: Distressed depositors hold day-long protest at RBI office in Delhi

Firstpost

RBI affidavit details how it was ’cheated’ by scam-hit PMC Bank

Live Mint

PMC Bank Falsified Records, Treated NPA Accounts As Non-NPA; RBI Tells Bombay HC, Court Refuses To Interfere With Withdrawal Restrictions

Live Law

Bombay High Court relief for SBI, other DHFL lenders

India TV News

PMC Bank crisis: Depositors of scam-hit bank meet Mumbai police chief

India TV News)

PMC Bank scam: RBI governor Shaktikanta Das says closely monitoring situation, forensic audit underway

Firstpost)

PMC Bank scam: HDIL promoters diverted Rs 160-cr loan to three Delhi-based hotels, reveals ED probe

Firstpost)

PMC Bank scam: Bombay HC asks RBI what steps were taken to help depositors; next hearing on 19 November

Firstpost)

PMC Bank scam: Depositors continue protest seeking payback; police detains three agitators

Firstpost)

PMC Bank scam: Court extends HDIL promoters Rakesh Wadhawan, son Sarang's ED custody till 24 October

Firstpost)

Scam-hit HDIL appoints property consultant Knight Frank to value 40 land assets valued at Rs 8,000 cr

Firstpost)

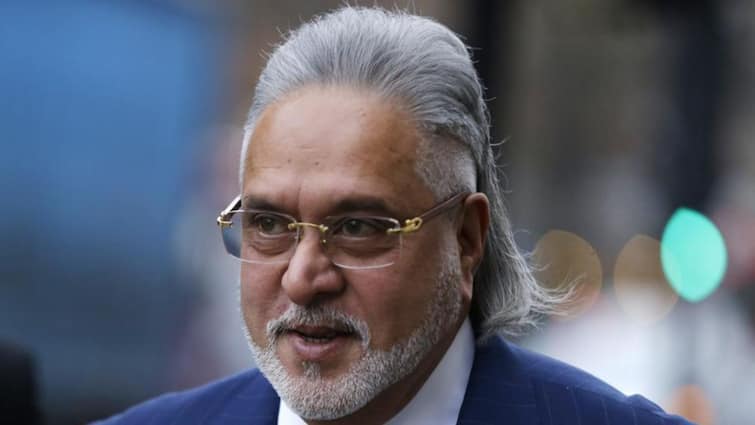

HDIL promoters Wadhawans write to RBI, investigating agencies to sell their attached assets to repay PMC Bank loans

Firstpost)

Shiv Sena MPs meet RBI governor Shaktikanta Das, request him to redress issues related to scam-hit PMC bank's customers

Firstpost

PMC Bank Crisis: Former chairman, HDIL directors sent to police custody till October 16

India TV News

PMC Bank customers can now withdraw up to Rs 40,000 as RBI enhances limit

India Today

80% of PMC customers will get money back: Amit Shah

India Today

Former PMC Bank chariman, HDIL directors sent to police custody till October 16

India Today

PMC Bank scam: ED identifies assets worth Rs 3,830 crores for seizure

India Today

Will discuss PMC Bank issue with PM: Fadnavis tells depositors

India Today)

PMC Bank case: ED attaches HDIL promoter's 5-acre bungalow near Mumbai in money laundering probe

Firstpost

PMC bank case: ED seizes bungalow near Mumbai

India TV News

PMC Bank case: Former chairman, HDIL directors sent to police custody till 14th October

Live Mint)

PMC Bank scam: Shares of HDIL hit lower circuit, fall 4.73% on reports of EOW to include auditors in probe

Firstpost

PMC Bank fraud: Police likely to probe HDIL auditors soon

India Today

PMC Bank crisis: ED seizes another plane, cars, speed boat from Wadhawans' Alibaugh bungalow

India Today

PMC Bank case: HDIL directors remanded in police custody till October 9

Hindustan Times)

PMC Bank crisis: After arrest of HDIL promoters, ED raids 6 Mumbai locations, slap money laundering charge

Firstpost

PMC Bank crisis: ED raids 6 locations in Mumbai, slaps money-laundering charge

India TV News

PMC Bank crisis: ED raids six locations in Mumbai, registers case against bank officials

India Today

PMC Bank scam: Chairman Rakesh Wadhawan, son sent to police custody till Oct 9

India Today

PMC Bank officials deposited money directly into HDIL bosses' personal accounts: Mumbai Police

India Today

PMC Bank case: ED seizes 6 premium cars, attaches properties of Wadhawans

India Today

PMC Bank crisis: HDIL CEO, MD had properties worth Rs 3,500 crore; arrested

India TV NewsDiscover Related

![Delhi High Court Half Yearly Digest: July To December 2024 [Citations 734 - 1394]](https://www.livelaw.in/h-upload/2024/07/01/547073-delhi-high-court-half-yearly-digest-2024.jpg)

![Consumer Cases Weekly Round Up:[ 23rd December – 29th December 2024]](https://www.livelaw.in/h-upload/2024/07/14/549673-1500x900481610-consumer-law-weekly-round-up.jpg)

![Real Estate Weekly Round Up:[16 th December – 22 nd December 2024]](https://www.livelaw.in/h-upload/2024/12/03/574379-real-estate-weekly-digest.jpg)

![Jammu & Kashmir And Ladakh High Court Annual Digest [Part I]](https://www.livelaw.in/h-upload/2024/12/19/577411-jammu-and-kashmir-high-court-annual-digest-2024.jpg)

)

![Kerala High Court Monthly Digest: December 2024 [Citations: 766 - 828]](https://www.livelaw.in/h-upload/2024/09/03/559124-750x450519604-750x450456553-408710-kerala-high-court-monthly-digest.jpg)