Explained | Why is the U.S. SEC cracking down on crypto exchanges?

The HinduThe story so far: The U.S. Securities and Exchange Commission is cracking down on cryptocurrency exchanges. Binance stressed its intention to defend itself “vigorously.” It pointed out that as a U.S. regulator, the SEC’s control over the trading platform was limited because Binance was not a U.S. company. “Any allegations that user assets on the Binance.US platform have ever been at risk are simply wrong, and there is zero justification for the Staff’s action in light of the ample time the Staff has had to conduct their investigation,” said Binance, insisting that all user assets on Binance and affiliate platforms were “safe and secure.” Zhao, meanwhile, used the number ‘4’ to signal his Twitter followers to not give in to “FUD” - a crypto slang acronym referring to fear, uncertainty, or doubt - and said that the media had received the SEC complaint before he did. However, major crypto company heads have been wary of the SEC’s invitations for negotiation, especially in light of the SEC’s history of taking legal action against cryptocurrency companies it claims are breaching U.S. securities laws. In a detailed response to the Wells notice sent by the regulator in March, Grewal pointed out that the SEC, instead of developing a regulatory framework for crypto, is “continuing to regulate by enforcement only.” While the Binance and Coinbase lawsuits are different in their charges, they seem to have one common goal: the SEC’s intention to bring crypto exchanges under the U.S. securities law.

History of this topic

Trump's SEC pick offers stark new reality for Wall Street: easier oversight

Politico

CEO of world’s largest crypto exchange pleads guilty and agrees to $50-million fine

LA Times

Binance, CEO Zhao to seek dismissal of US watchdog’s complaint

Al Jazeera

CoinEx banned in New York, to pay $1.8 mn in Attorney General’s lawsuit settlement

Live Mint

SEC lawsuits against cryptocurrency companies raise questions about industry’s future

Associated Press

SEC lawsuits against cryptocurrency companies raise questions about industry's future

The Independent

Regulators put the future of America’s crypto industry in doubt

Hindustan TimesU.S. steps up crypto crackdown with Coinbase suit

The Hindu

Coinbase and Binance SEC lawsuits: How the feds are strangling crypto.

Slate

Coinbase targeted by SEC in latest shot at crypto firms for allegedly skirting securities laws

Associated Press

SEC brings charges against cryptocurrency trading platform Coinbase

LA TimesU.S. SEC sues Binance, founder Zhao alleging securities law violations

The Hindu

The SEC sues Binance, unveils 13 charges against crypto exchange in sweeping lawsuit

NPR

Binance accused in SEC lawsuit of mishandling funds, violating securities laws

LA Times

Binance and Coinbase Have Been Sucked Into a Regulatory Turf War

Wired

US regulator sues top crypto exchange Binance, CEO

Al Jazeera

Coinbase warns of ‘legal threats’ amid crypto crackdown fears

The Independent

US regulator threatens Coinbase of a potential lawsuit

India TV News

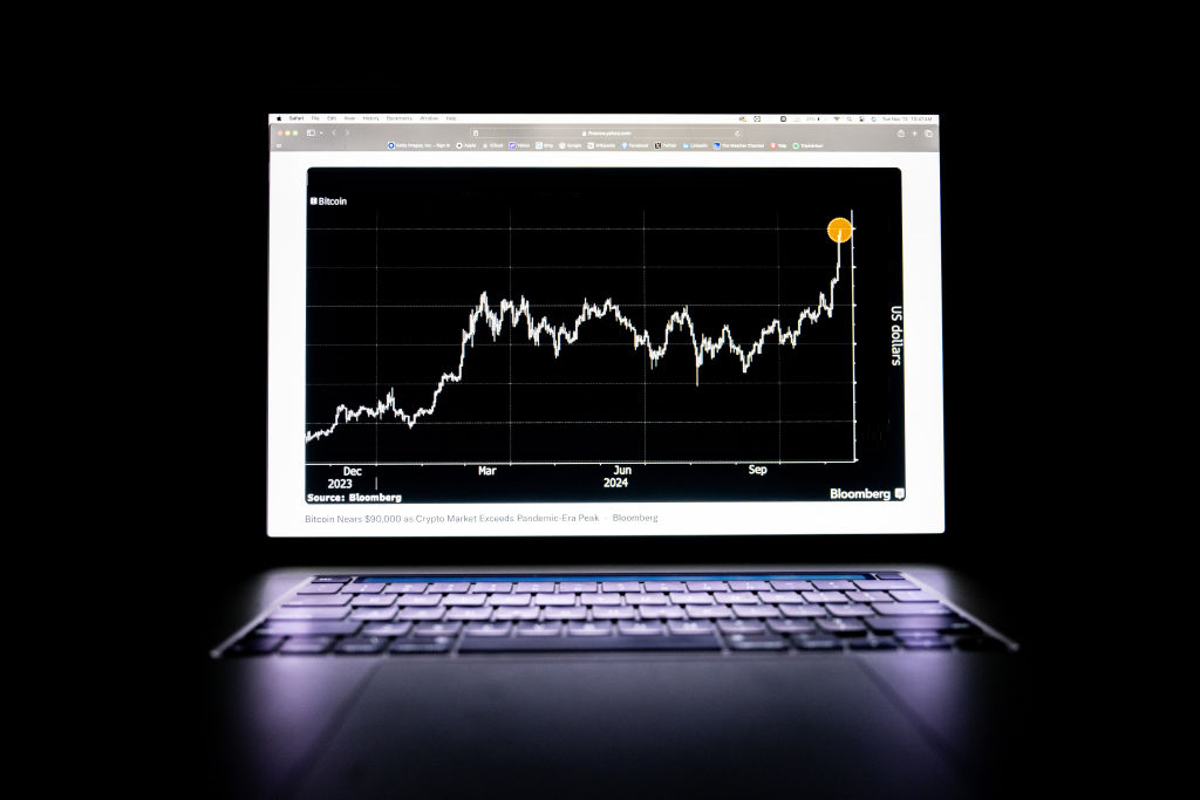

Crypto correction continues: Bitcoin hits 3-week low as SEC cracks down on unregistered securities

India TV News

US SEC Plans To Sue Crypto Exchange Paxos Over Binance USD Token Security Violations: Report

ABP News

Op-Ed: Crypto is under fire, but is this really the end for its Wild West?

LA Times

One of Crypto’s Giants Just Fell

Slate

Crash of the Crypto: Why are cryptocurrency investors fleeing?

India Today

US market regulator sues cryptocurrency exchange founder for $2 billion fraud

Live MintExplained | Binance: The crypto giant facing pressure from regulators

The Hindu

SEC’s Gensler says crypto investors need more protection

Associated PressDiscover Related

)

)

)

)

)