5 months ago

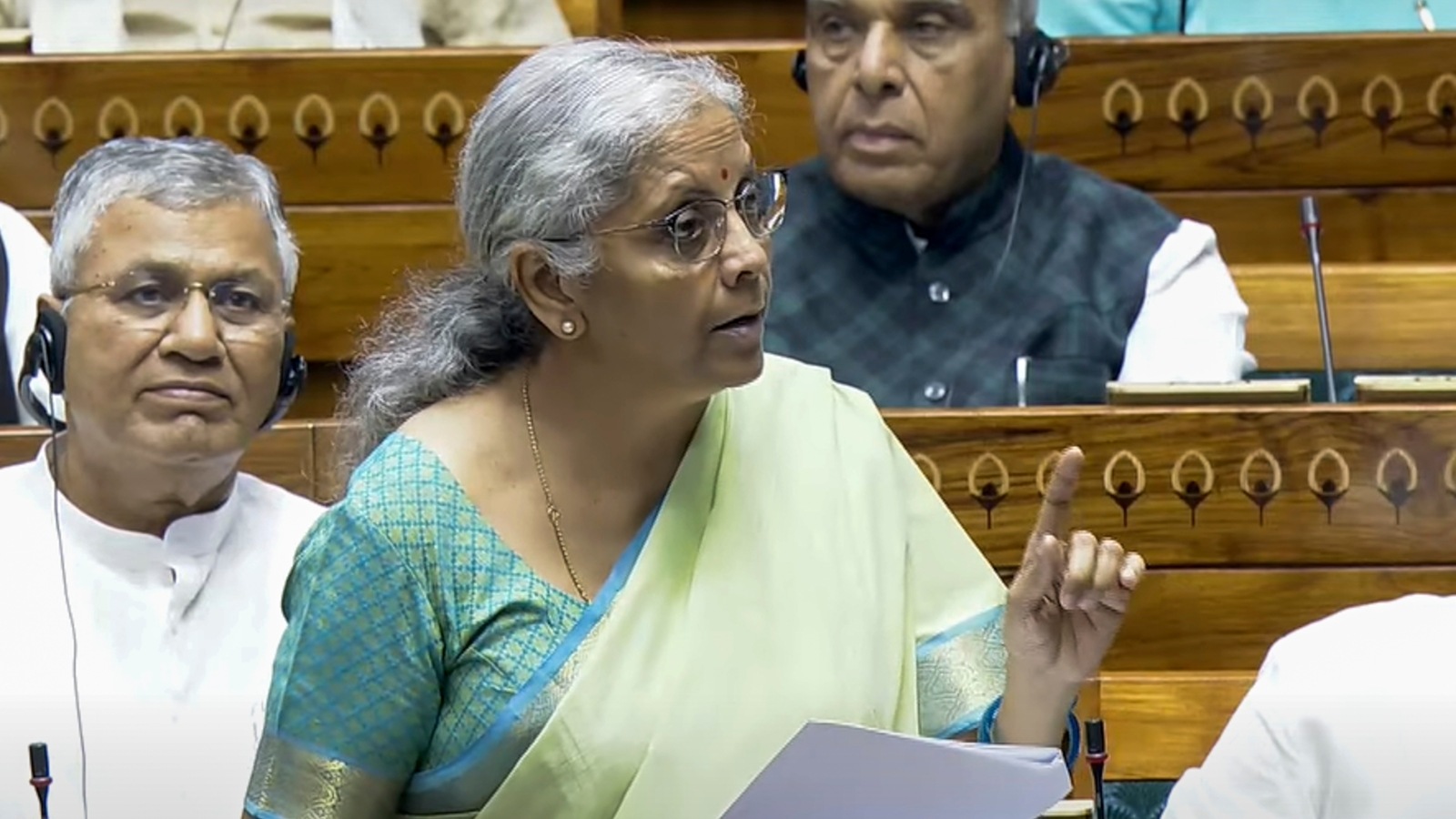

Budget: Centre proposes to increase STT, capital gains tax

Hindustan TimesFinance Minister Nirmala Sithraman on Tuesday said the government has decided to increase the rate of securities transaction tax on futures and options trade. Meanwhile, Sitharaman also announced an increase in both long-term and short-term capital gains tax. Sitharaman announced that short-term capital gains on "specified" financial assets will henceforth attract a tax rate of 20 per cent instead of 15 per cent. Long-term gains on all financial and non-financial assets will attract a tax rate of 12.5 per cent instead of 10.0 per cent. "Unlisted bonds and debentures, debt mutual funds and market-linked debentures, irrespective of the holding period, however, will attract tax on capital gains at applicable rates," Sitharaman said.

Financial

Tax

Capital Gains Tax

Capital

Capital Gains

Sitharaman

Gains

Nirmala Sitharaman

Stt

Budget Cent

assets

financial

stt

centre

capital

sitharaman

tax

budget

cent

nirmala

increase

survey

securities

proposes

gains

History of this topic

4 months, 2 weeks ago

FM Nirmala Sitharaman announces amendment to LTCG tax proposal, offers new options

Hindustan Times

4 months, 2 weeks ago

Centre to ease long term capital gains tax for sale of properties

Hindustan Times

4 months, 3 weeks ago

On discarding indexation for long-term capital gains | Explained

The Hindu

4 months, 3 weeks ago

India's FY25 Budget Simplifies Capital Gains Tax

Deccan Chronicle

4 months, 4 weeks ago

Changes in long-term capital gain tax to benefit most real estate investors: Revenue Secy

Hindustan Times

4 months, 4 weeks ago

Budget 2024: Taxation related to capital gains in equity market transactions will affect you— THIS is how

Live Mint

4 months, 4 weeks ago

Budget 2024 | STT hike to curb excessive speculation in F&O market: Sunil Damania of MojoPMS

Live Mint

4 months, 4 weeks ago

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

5 months ago

Watch: Budget 2024 | What’s in it for markets and investors?

The Hindu

5 months ago

Budget 2024: Capital gains taxes hiked, indexation benefit discontinued for property sale

Hindustan Times

5 months ago

Union Budget 2024 India: Sensex, Nifty Take Big Hit As Govt Hikes Capital Gains Tax

ABP News

5 months ago

Budget 2024 Capital Gains taxation: Corporate tax for foreign companies slashed to 35%, charities, cruise operations taxation revised

The Hindu

5 months ago

LTCG and STCG in Budget 2024: FM Sitharaman announces raising of taxes; check new rates here

Live Mint

5 months ago

Big change in capital gains tax, LTCG increased to 12.5%. Check details

India Today

5 months ago

Union Budget 2024: How will the stock market react to capital gains tax changes in the budget?

Hindustan Times

5 months ago

Jefferies' Chris Wood on Budget 2024: India should have no capital gains tax

Hindustan Times

5 months ago

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

7 months, 2 weeks ago

FM Sitharaman Denies Rumors of Sweeping Tax Changes

Deccan Chronicle

1 year, 10 months ago

Budget 2023 Key Highlights: Are You Under New Tax Regime? Nirmala Sitharaman Has Good News for You

News 18

1 year, 10 months ago

Budget 2023: Will FM Sitharaman revise the long-term pending income tax exemptions limit?

India TV News

1 year, 11 months ago

Budget 2023: Why investors wish for easing in long term capital gains?

Live Mint

1 year, 11 months ago

ICYMI: The history of capital gains tax in India

Live Mint

2 years, 10 months ago

Budget 2022: No change in income tax slabs announced

India Today

2 years, 10 months ago

India Budget 2022: What analysts expect from FM Nirmala Sitharaman

Live Mint

2 years, 11 months ago

Union Budget 2022-23: Global debt investors may get tax relief

India Today)

3 years, 10 months ago

Union Budget 2021: Nirmala Sitharaman takes braver route to fix economy by not levying more tax

FirstpostDiscover Related

5 days, 19 hours ago

6 days, 19 hours ago

6 days, 19 hours ago

1 week, 4 days ago

2 weeks, 4 days ago

)

2 weeks, 6 days ago

2 weeks, 6 days ago

3 weeks, 6 days ago

Trending News

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

Trending News

1 month, 1 week ago

)

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

Trending News

1 month, 1 week ago

1 month, 2 weeks ago

1 month, 2 weeks ago

1 month, 3 weeks ago

1 month, 3 weeks ago

2 months ago

2 months ago

2 months ago

2 months, 1 week ago

2 months, 2 weeks ago

2 months, 3 weeks ago

2 months, 4 weeks ago

3 months, 2 weeks ago

3 months, 3 weeks ago

4 months ago

4 months ago

4 months ago

4 months, 1 week ago

4 months, 1 week ago

.jpg)

4 months, 2 weeks ago

4 months, 2 weeks ago

4 months, 2 weeks ago

4 months, 2 weeks ago

4 months, 2 weeks ago