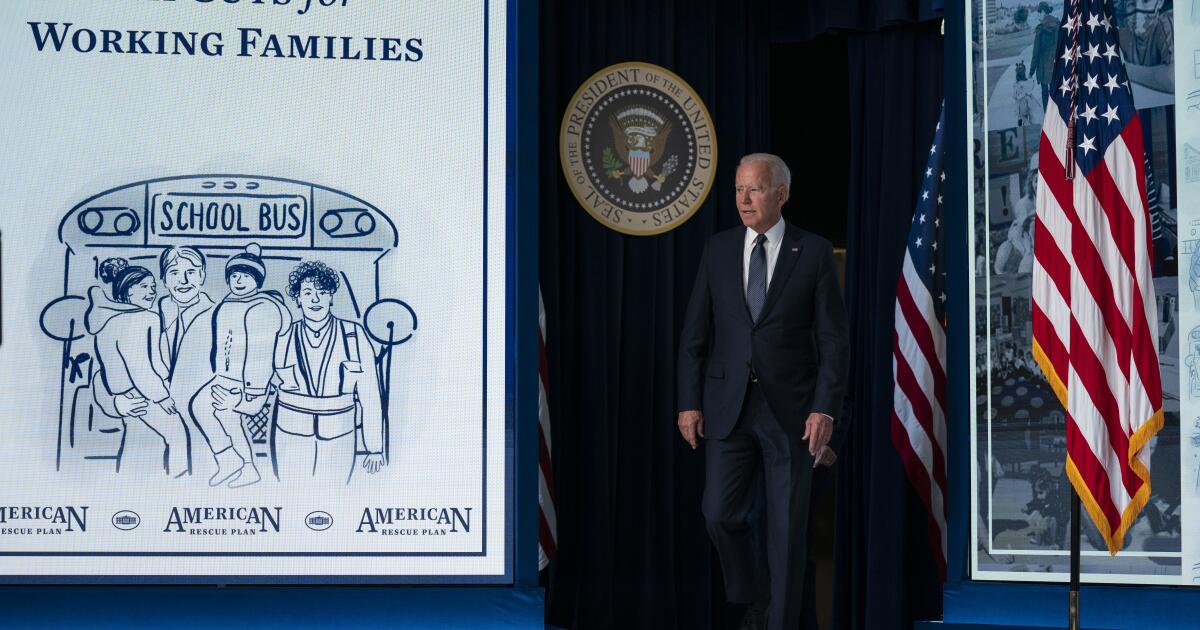

IRS chief expects new child payments to start this summer

Associated PressWASHINGTON — It’s a strain, but the head of the IRS said Tuesday he expects to meet the July 1 deadline in the new pandemic relief law for starting a groundbreaking tax program aimed at reducing child poverty. In testimony at a Senate hearing, IRS Commissioner Charles Rettig said it will cost nearly $400 million and require the hiring of 300 to 500 people to get the new monthly payment system and electronic portal in place for the child tax credit. The new child tax credit “is not targeted to pandemic relief, and risks the loss of billions of taxpayer dollars in fraudulent and improper payments,” Rep. Kevin Brady of Texas, the senior Republican on the House Ways and Means Committee, wrote in letters to Biden administration officials. In addition, he told the senators, the new electronic portal for processing the child tax payments “will be as user-friendly as possible.” Rettig at the hearing also acknowledged that the national gap between federal taxes owed and actually collected is more than double, at about $1 trillion annually, than official government estimates have indicated.

History of this topic

How a ‘game-changer’ child tax credit for families became a priority for Harris, Vance

LA TimesSenate rejects legislation that would expand child tax credit and restore business tax breaks

Associated Press

US Child Tax Credit 2024: Who is eligible for the benefit?

Hindustan TimesHouse passes bill to enhance child tax credit, revive key tax breaks for businesses

Associated Press

Lawmakers announce bipartisan effort to enhance child tax credit, revive tax breaks for businesses

LA TimesLawmakers announce bipartisan effort to enhance child tax credit, revive tax breaks for businesses

Associated Press

You’re not getting child tax credit checks anymore. Here’s why

LA Times

Editorial: Congress can help struggling families by reviving the expanded child tax credit

LA Times

Study: Child poverty rising after tax credit expires

Associated Press

Child Poverty Spiked After Tax Credit Expired, Early Research Suggests

Huff Post

Child tax credit: Brace for a smaller tax refund if you got monthly payments in 2021

CNN

Op-Ed: One huge cost of letting the expanded child tax credit die? Harm to developing brains

LA Times

COVID-expanded child tax credit benefit nears lapse

Associated Press

What’s in, and what’s out, as House nears vote on Biden bill

Associated Press

Child tax credit tussle reflects debate over work incentives

Associated Press

What’s in, and what’s out, as Democrats trim Biden bill

Associated Press

Biden’s Build Back Better plan explained: What it is and what’s in it

CNN

Child tax credit starts hitting US families’ bank accounts

Associated Press

How the expanded child tax credit payments work

Associated Press

The Expanded Child Tax Credit Is Here. Here's What You Need To Know

NPR

What you need to know about the expanded child tax credit

LA Times

Parents Are Already Budgeting For New Child Tax Payments

Huff Post

White House Seeks To Boost Awareness Of Checks Coming To Parents

Huff Post

Biden will start sending monthly child tax credit checks up to $300 to 39 million families

Daily Mail

Parents Will Start Getting Monthly Checks From The Government Starting July 15

Huff Post

New Monthly Child Tax Credits Are Starting To Go Out. Here's What It Means For You

NPR

Stimulus checks and pandemic aid make it even more important to file a 2020 tax return

CNN

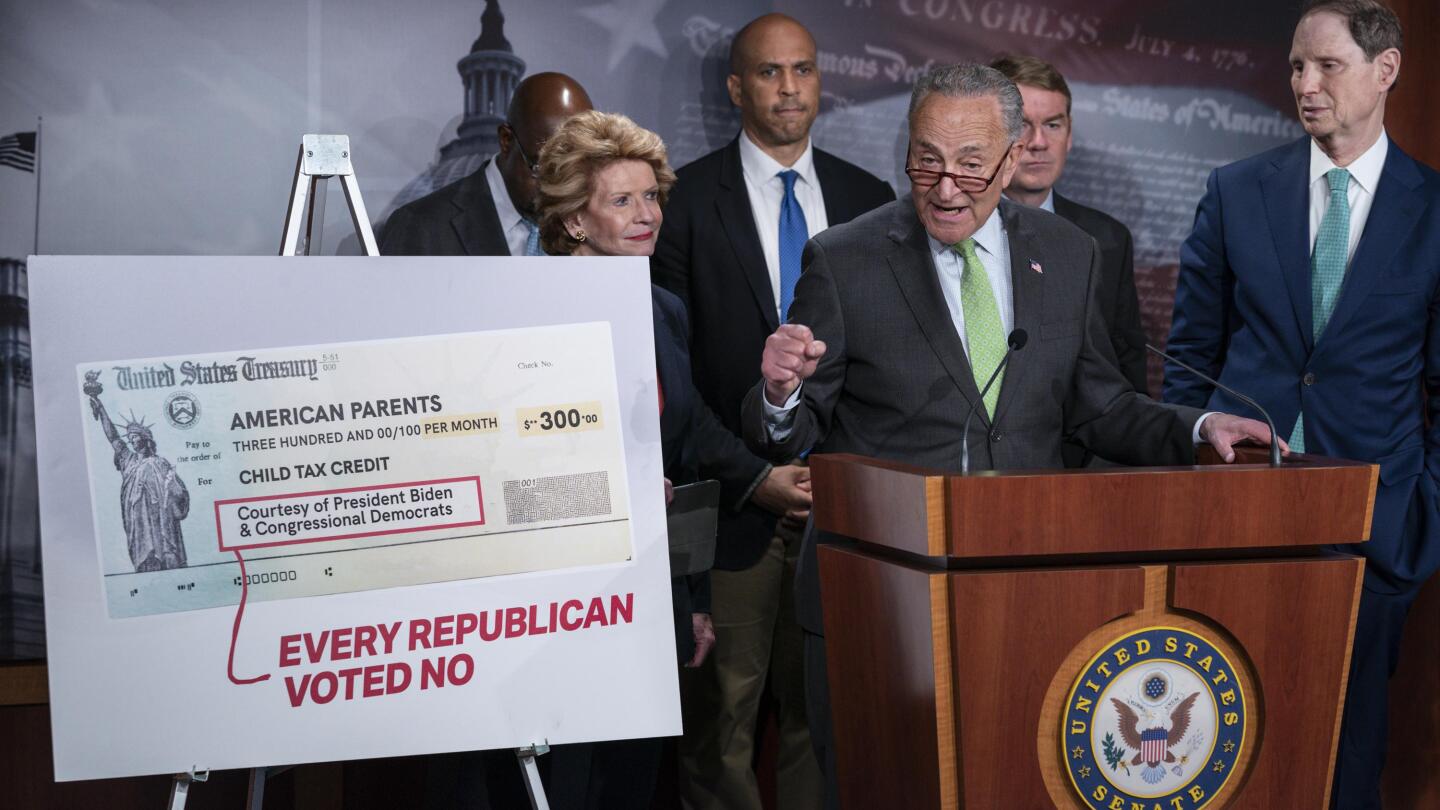

Republicans Tar New Child Benefit As Welfare Without Work

Huff Post

Biden to propose free preschool, as speech details emerge

Associated Press

Parents Would Keep Getting Monthly Checks Under Joe Biden's 'American Families Plan'

Huff Post

The Most Consequential Policy In The COVID-19 Relief Law Is Still A Big Mystery

Huff Post

Child Tax Credit: Millions of parents could soon get up to $3,600 per child

CBS News

Democrats Have Passed Their COVID-19 Bill. Now Comes The Hard Part.

Huff Post

What you’ll get from the stimulus: Child tax credit, unemployment and more

CNN

Child tax credit expansion sets up showdown with GOP

Associated Press

Americans can get $1,400 COVID cheques in days, tax experts say

Al Jazeera

Democrats Say Relief Programs Could Become This Generation's New Deal

NPR

House democrats to introduce $3,000 child benefit legislation

Hindustan Times

Democrats unveil $3,000 child benefit as part of Biden relief package

CNN

Biden Plan To Expand Child Tax Credit Could Help Lift Millions Of Kids Out Of Poverty

NPRDiscover Related