China Credit Investors Brace for More Surprises From Hidden Debt

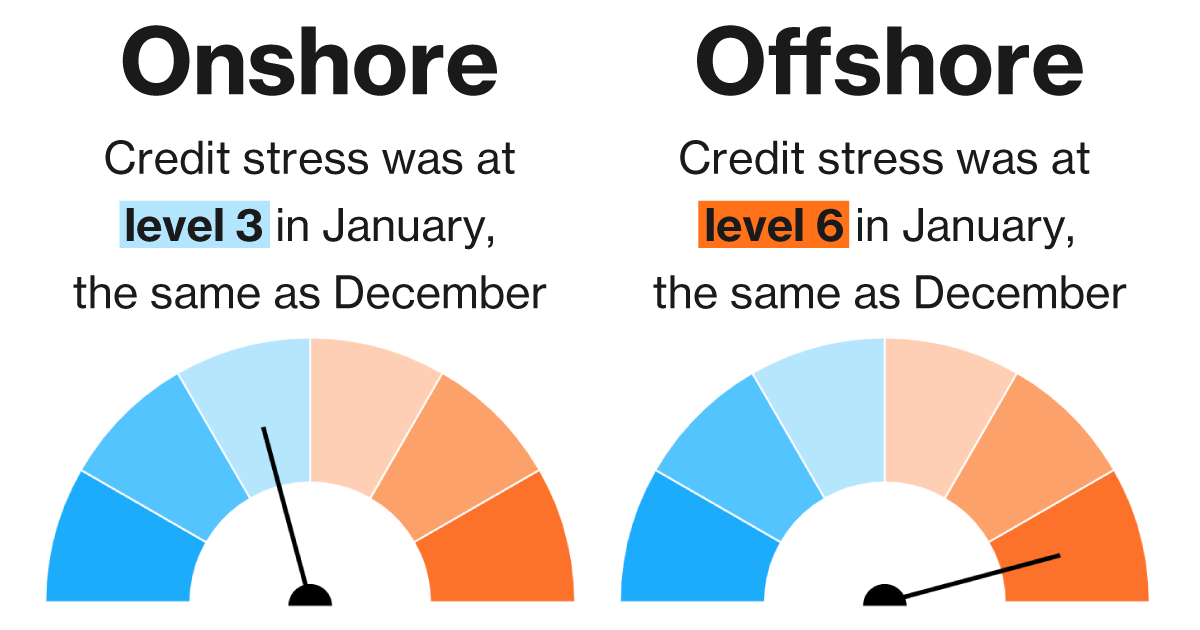

BloombergChina Credit Investors Brace for More Surprises From Hidden Debt China Credit Tracker Share this article China’s credit markets are ushering in the new year with a fresh bout of stress, as scrutiny of hidden debt among the nation’s developers adds to turmoil in a sector facing mounting bills and limited fundraising options. Distress in the nation’s $870 billion offshore debt market remained elevated during a volatile January, Bloomberg’s China Credit Tracker shows. Concerns about unreported debt at Logan Group Co., China’s 20th-largest developer by sales last year, helped drag down the broader sector in recent days as bondholders question the liquidity of firms whose finances were long considered more sound than the likes of China Evergrande Group. Dive into the methodology behind Bloomberg’s China Credit Tracker Bondholders are learning to price in these risks: bad-debt manager China Huarong Asset Management Co. last year triggered an unprecedented crisis of confidence in the firm’s financial health after it failed to meet its results deadline.

History of this topic

China unveils new ‘hidden debt’ scheme for local governments

Hindustan Times

How China plans to cut hidden debt in massive shakeup

New Indian Express

China’s 10-year bond yields drop amid $1.4 billion debt refinancing program, more stimulus awaited

Live MintChina approves $840B plan to refinance local government debt, boost slowing economy

Associated Press

Foreign holdings of Chinese bonds see net increase of $20b in July

China Daily

China's commercial banks resilient against risks: regulator

China Daily

Milestone of CCB shows growing role of RMB

China Daily

China seen continuing to cut US debt holdings

China Daily

One-sided rating methodology lacks objectivity

China Daily

China may pare its US debt holdings

China DailyChinese stocks slide as investors maintain caution after US inflation report

Associated Press

Everything China’s doing to rescue its battered stock market

Live MintOrder to liquidate property giant China Evergrande is just one step in fixing China’s debt crisis

Associated Press

China's top-selling to world's most indebted developer: What is Evergrande crisis

Hindustan Times

China weighs more stimulus, considers $139 billion of special bonds: Report

Live Mint

China: Loan defaults hit record high, over 8.5 million people blacklisted

Op India

Chinese developer Evergrande risking liquidation if creditors veto its plan for handling huge debts

The Independent

The $2 trillion interest bill that’s hitting governments

Live Mint

From deflation to high debt burden: Here’s 5 things happening in Chinese economy

Live Mint)

Money Morass: Desperate China to refocus on stressed BRI borrowers, hanging projects

Firstpost

Don’t rule out a financial crisis in China

Live Mint

Recovery gains momentum, growth forecast raised

China Daily

China stock investors say worst yet to come in property crisis

Live Mint

China's great wall of debt driving ‘unsustainable’ increase in borrowing, IMF warns

The Telegraph

What does China Evergrande’s debt restructuring entail?

Live Mint

Can China’s Evergrande Group survive amid mounting debts, depleting resources?

Live MintChina Evergrande reports its debt rose to $340 billion in 2022. It plans meetings with creditors

Associated PressBRI a tool for development, not debt traps

China Daily

Asian stocks sink before US Congress votes on deal to avoid debt default

Associated Press

China's property sector support fails to lure bond investors

Hindustan Times

Xi’s Covid Zero Policy Prolongs Stress in China Real Estate Debt Market

Bloomberg

China's Evergrande baffled (and worried) after lenders claim $2 billion in cash

Hindustan Times)

Laos opens picturesque railway built on a mountain of Chinese debt

Firstpost)

Chinese real estate behemoth Evergrande, one other firm default on $1.6 billion in bonds

Firstpost

China’s Evergrande defaults on dollar debt

Al Jazeera

Evergrande crisis: US Fed warns China’s property problems could hurt global markets and the US economy

CNNExplained: Why China's property crash isn't a Lehman Brothers moment

The Hindu

China's economy slows as Beijing wrestles with debt

The Independent

As Evergrande fears linger, Beijing says it’s time for companies to pay their offshore debts

CNN

Evergrande shares plunge as Chinese property developer faces another debt deadline

The Independent

China’s real estate crisis: Evergrande and these developers are already in trouble

CNN

China’s real estate crisis: Evergrande and these developers are already in trouble

CNN

Fear of China’s Evergrande Contagion Spreading to Global Commodity Markets Looms Large

News 18

China's debt trap: BRI countries owe China close to 385 billion USD in hidden debt, reveals report

Op IndiaChina's Great Wall of Debt: can it afford a default?

ABC

Chinese banks try to calm fears about developer’s debts

Associated Press

As Evergrande stock sinks, Chinese conglomerate puts on a brave face but will Beijing bail it out?

CNN

The Delta Covid variant is hitting China’s economy hard, and a property crunch is looming

CNN

Evergrande, Chinese property giant, warns again that it could default on its enormous debts

CNNDiscover Related

)