4 years, 2 months ago

Key tax changes to kick in today

Live MintSeveral key direct and indirect tax changes will kick in from 1 October that businesses and individual taxpayers need to take note of. Bankers would be liable to collect TCS and remit to the government; therefore, the incidence of TCS is on the remitter, said Sandeep Jhunjhunwala, partner at Nangia Andersen LLP, a tax advisory firm. Banks may start collecting tax at source even on international credit card transactions done in foreign currency, said Vikram Doshi, partner tax, PwC India. TCS on sale of goods Sellers having ₹10 crore revenue in the previous year need to collect income tax at source at the rate of 0.1% on receipt of sale consideration above ₹50 lakh.

Tax

Tcs

source

today

changes

key

duty

transactions

applicable

kick

tax

tcs

sent

income

businesses

abroad

History of this topic

3 weeks, 6 days ago

Sending money abroad? Here’s how to reclaim your TCS

Live Mint

5 months ago

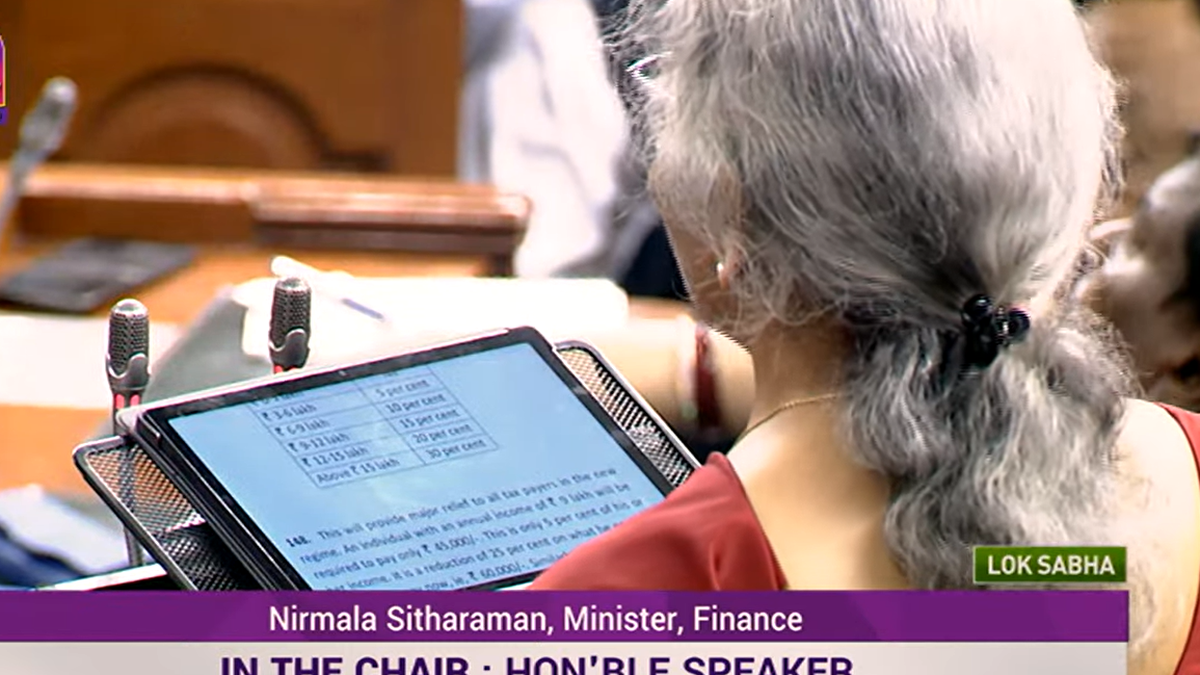

Income tax benefits, capital gains tax hike, cheaper phones | Key Budget takeaways

Hindustan Times

5 months, 1 week ago

Aim for tax simplicity: Do away with TCS on foreign remittances

Live Mint

5 months, 1 week ago

Union Budget 2024: Overseas credit card spending above ₹7 lakh may be taxed 20%

Hindustan Times

8 months, 3 weeks ago

New Tax regime rules to come into effect from today: Check deductions, rebates, changes in tax slab

India TV News

1 year, 1 month ago

Tax collection at source: Who issues a TCS certificate and when?

Live Mint

1 year, 4 months ago

What is tax collection at source on foreign remittances under LRS? An explainer

Live Mint

1 year, 6 months ago

ITR filing: Sending money outside India? Know the new income tax rule

Live Mint

1 year, 7 months ago

Explained | Will all overseas spends come under the tax net?

The Hindu

1 year, 7 months ago

As 20% TCS on foreign remittances is set to kick in, we untangle its mystery here

Live Mint

1 year, 7 months ago

Spend up to ₹7 lakh abroad with your cards without worrying about TCS

Live Mint

1 year, 7 months ago

Govt clarifies payments abroad for up to ₹7 lakh will not be taxed

Hindustan Times

1 year, 7 months ago

Tax waived on annual forex spends up to ₹7 lakh: Finance Ministry

The Hindu

1 year, 7 months ago

No Tax On Foreign Credit Card Spend Up To Rs 7 lakh

Deccan Chronicle

1 year, 7 months ago

20% tax at source for offshore credit deals

Deccan Chronicle

1 year, 10 months ago

Foreign remittances: With 20% tax collection at source, sending money abroad to pinch more; details here

Live Mint

1 year, 10 months ago

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax

The Hindu

3 years, 9 months ago

5 new income tax rules that will come into effect from 1 April

Live Mint

3 years, 11 months ago

Budget 2021: ’ Reduce tax on foreign remittance to boost overseas investments’

Live Mint

4 years, 2 months ago

5% tax on foreign tour, investments and study abroad from today: Details here

Live Mint

4 years, 2 months ago

Key tax changes kicking in from tomorrow

Live Mint

4 years, 3 months ago

Should 5% tax on foreign transfers discourage you from investing in US stocks?

Live MintDiscover Related

20 hours, 40 minutes ago

1 day, 5 hours ago

1 day, 6 hours ago

4 days, 11 hours ago

5 days, 3 hours ago

5 days, 19 hours ago

5 days, 23 hours ago

6 days, 12 hours ago

1 week, 1 day ago

1 week, 1 day ago

1 week, 3 days ago

1 week, 3 days ago

1 week, 3 days ago

1 week, 5 days ago

1 week, 5 days ago

1 week, 5 days ago

1 week, 5 days ago

1 week, 6 days ago

2 weeks ago

2 weeks ago

2 weeks, 2 days ago

2 weeks, 5 days ago

)

3 weeks ago

Top News

3 weeks ago

Trending News

3 weeks ago

)

3 weeks, 1 day ago

3 weeks, 4 days ago

3 weeks, 6 days ago

4 weeks ago

1 month ago

1 month ago

1 month ago

1 month ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

Trending News

1 month, 1 week ago

)

1 month, 1 week ago

1 month, 1 week ago

Trending News

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

Trending News

1 month, 1 week ago

)

1 month, 1 week ago