As long-term COVID risks rise, life insurers impose curbs: Report

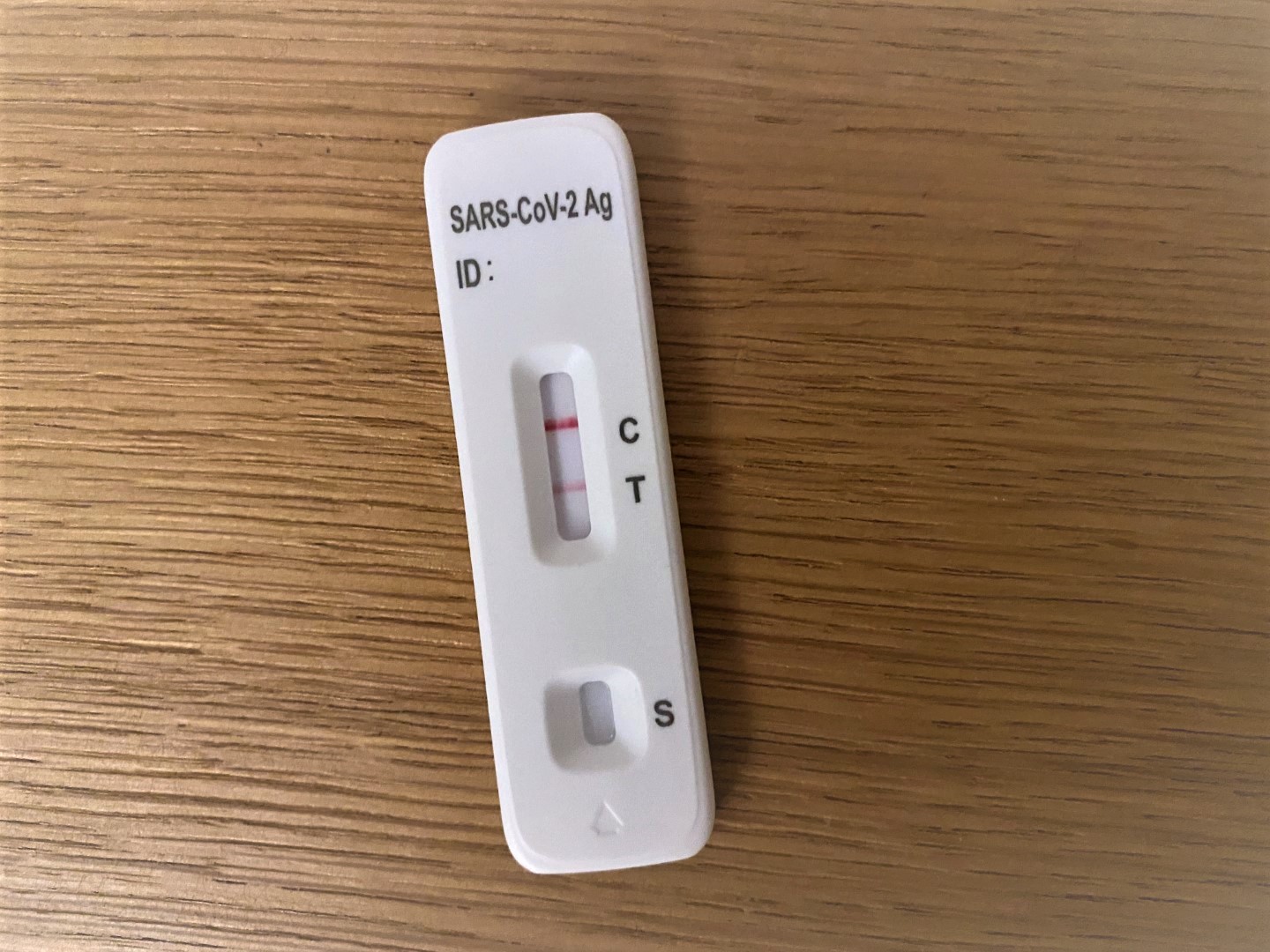

Al JazeeraSome insurers are imposing waiting periods before COVID patients can apply for coverage, industry sources tell Reuters. Global life insurers are taking steps to curb payouts stemming from the coronavirus pandemic, including long-term health consequences that are not fully understood, industry sources told the Reuters news agency. Life insurers, including Prudential Financial Inc, and Aviva PLC, are now imposing waiting periods before COVID-19 patients, including those who have recovered, can apply for coverage, executives and spokespeople said. “We have attempted as a company to strategise about modelling this and have made some headway but are far from the crystal ball that is able to predict this,” said Dr Paulo Bandeira Pinho, chief medical director of Optimum Re Insurance Co. Optimum has met with life-insurer customers, including Prudential Financial, to map out long-term risks and possible financial impacts. “As the long-tail effects become better understood, our approach to underwriting may adjust as necessary.” Since April, British life insurer LV= has postponed applications from anyone who was diagnosed with COVID-19, experienced symptoms or lived with someone who got sick, according to an underwriting policy on its website.

History of this topic

Insurers tighten rules, raise rates

Deccan Chronicle

Life Insurance Policy Rule Changed: Had Covid? Wait for 3 Months to Buy a Policy Now

News 18

Term insurance premium set to rise up to 40% from December 2021 | Know why

India TV News

How two million Covid victims could be DENIED vital insurance

Daily Mail

Why health insurance is important during COVID-19 times - Explained

India TV News)

Union Budget 2021: Make insurance more affordable, attractive proposition for customers

Firstpost

New COVID-19 lockdowns imperil global economy’s recovery

Al Jazeera

Should you renew your covid insurance? Life insurance advise for New Year

Live Mint

The race to covid-19 vaccine: Insurers unfazed by risks of clinical trials

Live Mint

COVID-19: Life and health insurances are must for ’safeguarding future’, shows survey

Live Mint

Opinion: The pandemic shows America can’t afford its dysfunctional health insurance system

CNN

Impact of Covid-19 on healthcare premiums still unclear, insurers say

Dutch News

Too soon to speculate about Covid-related premium increases: Health insurers

NL TimesCoronavirus | An opportunity to reshape health care

The Hindu

Safeguarding your physical and financial well-being with COVID-19 health insurance

Hindustan Times

Covid-19 crisis should be used to sell health insurance for the long term

Live Mint

Covid-19, an opportunity for health insurance, but are we there yet?

Live MintDiscover Related