Market dips amid Russia-Ukraine tensions and Fed rate cut uncertainty

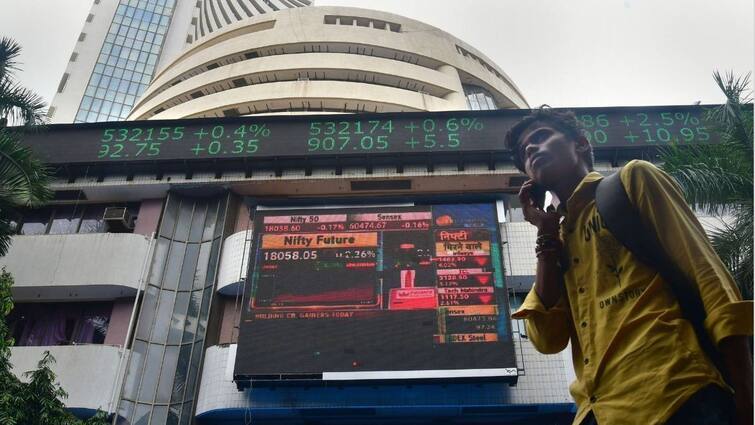

New Indian ExpressNEW DELHI: The Indian equity markets witnessed a sharp sell-off on Thursday, with the benchmark indices BSE Sensex and NSE Nifty 50 declining by approximately 1.5% each. The drop was primarily driven by heavy selling in IT stocks amid uncertainty over US interest rate cuts and escalating geopolitical tensions following Russia’s renewed attacks on Ukraine’s energy infrastructure. The overnight sell-off in the US, spurred by uncertainties over the Federal Reserve’s rate-cut trajectory and rising geopolitical tensions, triggered a correction in IT and consumer discretionary stocks,” said Vinod Nair, Head of Research at Geojit Financial Services. Manish Bhandari, CEO and Portfolio Manager at Vallum Capital Advisors, commented, “The market is factoring in solid growth but persistent inflation, which could delay the Federal Reserve’s rate cuts despite prior signals. However, the recent cooling of bond yields by 85 basis points over three days suggests optimism that inflation may ease in the near term.” Bhandari remained positive on the IT sector, highlighting its prospects amidst a US manufacturing resurgence and opportunities for Indian IT firms to capitalize on this growth.

History of this topic

Stock markets continue to decline, Sensex ends 1,200 points lower, Nifty slips 364 points

Hindustan Times

Nifty 50, Sensex today: What to expect from the Indian stock market on December 20

Live Mint

Sensex nosedives 1,100 points, Nifty falls below 23,600; IT stocks tumble

India Today

Fed sneezes, Indian stocks catch cold

Live Mint

Stock Market Today: Sensex, Nifty slump in early trade as U.S. Fed indicates fewer rate cuts next year

The Hindu

Stock Market Today: Sensex Plummet Over 1,000 Points, Nifty Below 23,920

ABP News

Sensex ends nearly 1,000 points lower, Nifty below 24,000

India Today

Market today: Sensex, Nifty decline amid foreign fund outflows, Fed rate decision caution

Hindustan Times

Sensex, Nifty open lower as cautious investors weigh global trends

India Today

Sensex, Nifty end lower as US trade and Fed jitters spook investors

India Today

Sensex, Nifty tank in early trade dragged by banking stocks; RIL shares down 1%

India Today

Indian equity benchmarks slip as Fed rate trajectory worries hit IT stocks

Live Mint

Stock market today: Nifty 50, Sensex end lower as IT and banking stocks drag; realty stocks outperform

Live Mint

Sensex, Nifty end in red as IT stocks drag markets; Titan shares down 2%

India Today

Sensex, Nifty tank in early trade; inflation relief fails to lift market mood

India Today

Sensex falls 1,000 points: Key factors behind stock market weakness

India Today

Stock market today: Nifty 50, Sensex slip ahead of CPI data; IT stocks shine on Fed rate cut optimism

Live Mint

Stock Market Today: Sensex, Nifty Open Muted As Investors Await CPI Data

ABP News

Sensex, Nifty end lower ahead of inflation data; bearish trend persists

India Today

Sensex, Nifty open flat as inflation data keeps market on edge

India Today

Nifty, Sensex flat as markets in consolidation phase; other Asian indices surge on China's stimulus optimism

The Hindu

Sensex, Nifty close flat; IT leads way, rupee hits record low

India Today

Stock Market Today: Sensex, Nifty Settle Lower As Investors Await Inflation Numbers

ABP News

Sensex, Nifty open flat; Godrej consumer shares fall 9%

India Today

Sensex, Nifty end lower as FMCG stocks witness decline; Godrej Consumer down 9%

India Today

Top Gainers and Losers today on 6 December, 2024: Tata Motors, Bajaj Auto, Adani Ports & Special Economic Zone, Cipla among most active stocks; Check full list here

Live Mint

Sensex, Nifty end higher as banking stocks rally on RBI rate cut hopes

India Today

Week Ahead: Auto sales, RBI Policy, FII outflow, global cues among key market triggers for Sensex, Nifty 50

Live Mint

Sensex, Nifty 50 rebound a day after stock market crash. Experts unveil this investment strategy amid volatility

Live Mint

Share Market Today: Sensex Sheds 700 Points; Nifty Below 24,100. IT, Auto Drag

ABP News

Stock Market Today: Nifty 50, Sensex snap 2-day winning run on profit booking; tech stocks extend rally

Live Mint

Sensex, Nifty end marginally lower; Adani Green shares down 7%

India Today

Share Market Today: Sensex Rises 993 Points, Reclaims 80K; Nifty Ends Above 24,200

ABP News

Share Market Today: Sensex Drops 550 Points; Nifty Around 23,330. Adani Group Top Loser

ABP News

Stock market today: Sensex, Nifty 50 snap 7-day losing run despite sharp profit taking at higher levels

Live Mint

Nifty IT index slips over 3% as US Fed likely to lower pace of rate cuts

Live Mint

Sensex, Nifty extend losses amid weak rupee and IT sector decline

India Today

Sensex, Nifty open in red dragged by decline in IT stocks; RIL shares down 1%

India Today

Stock market today: Sensex, Nifty 50 slide for 6th day as bears continue to rule Dalal Street; FMCG pack worst hit

Live Mint

Nifty Midcap and Smallcap indices fall over 10% from recent peaks, enter correction territory

Live Mint

Stock market crash: Sensex, Nifty 50 nosedive for 6th straight session. Experts list out these five crucial reasons

Live Mint

Sensex drops 1,000 points, Nifty slips below 23,600 amid stock market turmoil

India Today

GIFT Nifty slips 45 points: What to expect in today's market session

India Today

Sensex, Nifty end in red as FII selling offsets IT gains; RVNL tanks 6%

India Today

Sensex, Nifty erase Trump-fuelled gains as focus shifts to Fed rate decision

India Today

Sensex, Nifty take a hit after Trump boost

New Indian Express

Sensex, Nifty continues downward trend, selling continues despite Donald Trump's victory in US

India TV News

Stock market today: Sensex, Nifty 50 stage smart rebound, jump nearly 1%; bank & metal stocks lead gainers

Live Mint

Indian stock market: 6 key things that changed for market overnight - Gift Nifty, FII selling to rising oil prices

Live MintDiscover Related