Home, car loans will get cheaper

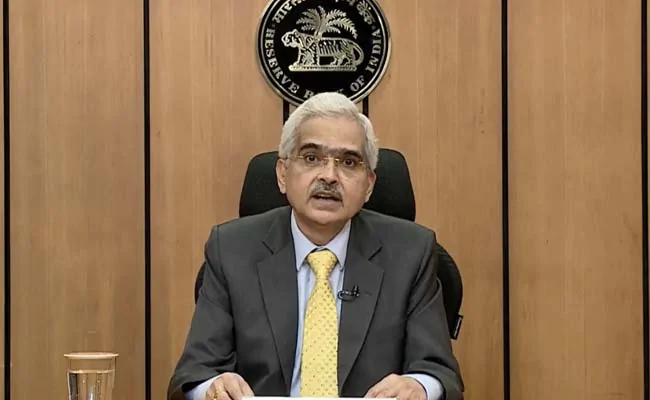

Deccan ChronicleMumbai: As expected, the Monetary Policy Committee of the Reserve Bank of India on Thursday unanimously voted to keep the policy repo rate unchan-ged even as predicting a higher inflation at 6.5 per cent in April-June quarter and a lower economic growth at six per cent in the next fiscal. In a bid to lower interest rates for housing, auto, and micro small and medium enterprise loans and push bank credit growth, the Reserve Bank of India Thursday relaxed the requirements for banks to maintain the cash reserve ratio for these loans. The RBI announced a new ECB-style long-term repo operations facility to give banks long-term liquidity by conducting term repos of one-year and three-year tenors of up to Rs 1 lakh crore at the policy rate. The central bank revamped the liquidity framework by dismantling quantitative ceilings for liquidity operations at the weighted average call rate versus one per cent of net demand and time liabilities; increasing scope to conduct longer-term variable rate repo/reverse repo operations exceeding 14 days and improving communications and transparency on liquidity operations.

History of this topic

RBI warns against spillover of unsecured loan stress

Live Mint

Microlenders wake up to hangover after credit party

Live Mint

SBI hikes loan interest rates from today, EMIs for personal, auto loans to rise | Check details

India TV News

Good news for bank fixed depositors! RBI hints at further FD interest rate hike

Live Mint

Home Loan, Car Loan EMIs to Increase as RBI Hikes Repo Rate by 35 bps; What Should Borrowers Do

News 18Mortgage borrowers and renters told to brace for big financial hit by December

ABC

How loan EMIs, bank FDs could be impacted by RBI’s interest rate hike

Live Mint

SBI Raises Minimum Home Loan Rate To 7.55%; Know Latest Lending, Deposit Rates

News 18)

Home Loan to Remain Cheaper: RBI Relaxes Loan-to-Value Rules till March-end Next Year

News 18

Home Loan, Car Loan EMIs and Bank FDs: How will RBI MPC Announcements Impact your Budget?

News 18RBI microfinance proposals that are anti-poor

The Hindu

Invest with care in small finance banks as they also cut rates

Live Mint

MFIs may get to set interest rates

Hindustan Times

High NPAs, sticky interest rates

India Today)

Bank Credit Grows 5.51% and Deposits 11.11%, Shows Latest RBI Data

News 18

RBI announces incentive for lending to MSME, home, auto sectors

India TV News)

Half dozen public sector banks cut lending rates by up to 25 bps; home, auto loans to become cheaper

Firstpost)

Canara, Corporation Bank, others introduce repo linked loan products to meet 1 October deadline

Firstpost

SBI to adopt repo rate as external benchmark for all floating rate loans from Oct 1

India TV News)

No stressed MSME loan can be declared NPA till March 2020; govt asks banks to hold loan melas in 400 districts from 3 Oct

Firstpost)

RBI mandate to link retail, MSME loans with external benchmark rates is credit negative for banks: Moody's

Firstpost

RBI external benchmark for bank loans credit negative: Moody's

The Quint)

RBI makes it mandatory for banks to link retail loans for housing, MSMEs with external benchmarks from 1 October

Firstpost

SBI home loan EMIs to drop from today

Live Mint

SBI, Indian Overseas Bank reduce interest on home, auto loans post-RBI cut

India TV News

No change in retail lending, deposit rates anytime soon

Live Mint

Opinion | Banking sector was positive on retail finance

Live Mint

Concerns on credit supply to small businesses a myth: SBI report

Live Mint

The need for a boost to MSME sector

Live MintDiscover Related