The key points of Sri Lanka’s plan to restructure domestic debt

Al JazeeraCentral bank of crisis-hit country outlines measures to restructure local debt as part of efforts to meet conditions of IMF bailout. The Central Bank of Sri Lanka has unveiled a far-reaching domestic debt restructuring plan aimed at restoring stability in the crisis-hit country. The long-awaited restructuring is needed to help Sri Lanka reach the IMF programme’s goal of reducing overall debt to 95 percent of gross domestic product by 2032. Under the domestic debt revamp, holders of locally issued dollar-denominated bonds such as Sri Lanka Development Bonds will be given three options, according to CBSL Governor Nandalal Weerasinghe. The first would be a treatment similar to investors in the country’s international sovereign bonds – a 30 percent principal haircut with a six-year maturity at a 4 percent interest rate.

History of this topic

Sri Lanka's ambitious governance and macro-linked bonds | Explained

The Hindu

Sri Lanka To Ink Debt Deals By Year's End: Economic Development Deputy Minister

Deccan Chronicle)

5 things about Sri Lanka's debt swap deal to end first-ever external loan default

Firstpost

IMF approves third review of Sri Lanka’s $2.9bn bailout, but warns of risks

Al JazeeraSri Lanka clinches $12.5 billion bond rework deal in pre-election dash

The HinduSri Lanka will hold presidential election on Sept. 21, its first since declaring bankruptcy in 2022

Associated Press

Sri Lanka inks pacts with OCC, China to restructure debt

Hindustan TimesSri Lanka reaches deal on debt restructuring with bilateral creditors including China and France

Associated Press

Sri Lanka finalises debt restructure agreement with official creditor committee

Hindustan Times

Sri Lanka seals debt deal with Official Creditor Committee after financial crisis

The Hindu

Sri Lanka has made 'strong progress' on debt restructuring front: IMF

The Hindu

Crisis-ridden Sri Lanka’s economic reforms are yielding results, but challenges remain, IMF says

Associated Press

Sri Lanka says debt restructure finalised by April

The Hindu

Sri Lanka will get the second tranche of a much-need bailout package from the IMF

The Independent

Sri Lanka reaches agreement with India, Paris Club on debt treatment

The Hindu

Sri Lanka confirms major debt deal with China

The Hindu

ECONOMIC PERSPECTIVES | Sri Lankan debt crisis to get worse if IMF prescription is heeded

The HinduCash-strapped Sri Lanka gets parliamentary nod for domestic debt restructuring plan

The Hindu

Sri Lankan Central Bank moots recast of pension funds, haircut on sovereign bonds

The Hindu

India Continues To Help Sri Lanka Stand Economically, But Colombo’s Love For Beijing Keeps Soaring

ABP NewsSri Lanka to restructure domestic debt amid challenges

The Hindu)

Sri Lanka has no money to hold presidential polls in 2023: Cabinet spokesman

FirstpostTimely debt restructuring crucial for Sri Lanka, says IMF

The Hindu

Sri Lankan Parliament votes to support IMF recovery program

Associated Press

Sri Lankan Parliament votes to support IMF recovery program

The Independent

Sri Lanka trying to reduce overall debt by $17 billion, president says

Live Mint

Debt crisis key priority of India’s G20 presidency, says FM in US

Hindustan Times

Crisis-hit Sri Lanka to see economic contraction in 2023: Report

Live MintSri Lanka to opt for domestic debt restructuring post-IMF bailout: Government

The HinduIMF approves $3-billion bailout for Sri Lanka; tackling corruption a key condition

The Hindu)

Sri Lanka's crisis-hit economy shrank by record 7.8% last year

Firstpost

The G20 could help fix Sri Lanka’s debt crisis. Will it step up?

Al JazeeraSri Lanka says ‘positive news’ coming from IMF on $2.9 billion package

The Hindu

Sri Lanka's central bank raises interest rates in anticipation of IMF bailout

India TV News

IMF Only Option Available to Sri Lanka to Overcome Economic Crisis, Says Wickremesinghe

News 18

IMF confirms receipt of India’s financing assurances for Sri Lanka

The Hindu

India’s helping hand for Sri Lanka | The View From India

The Hindu

Is debt cancellation the way forward for Sri Lanka?

Al Jazeera

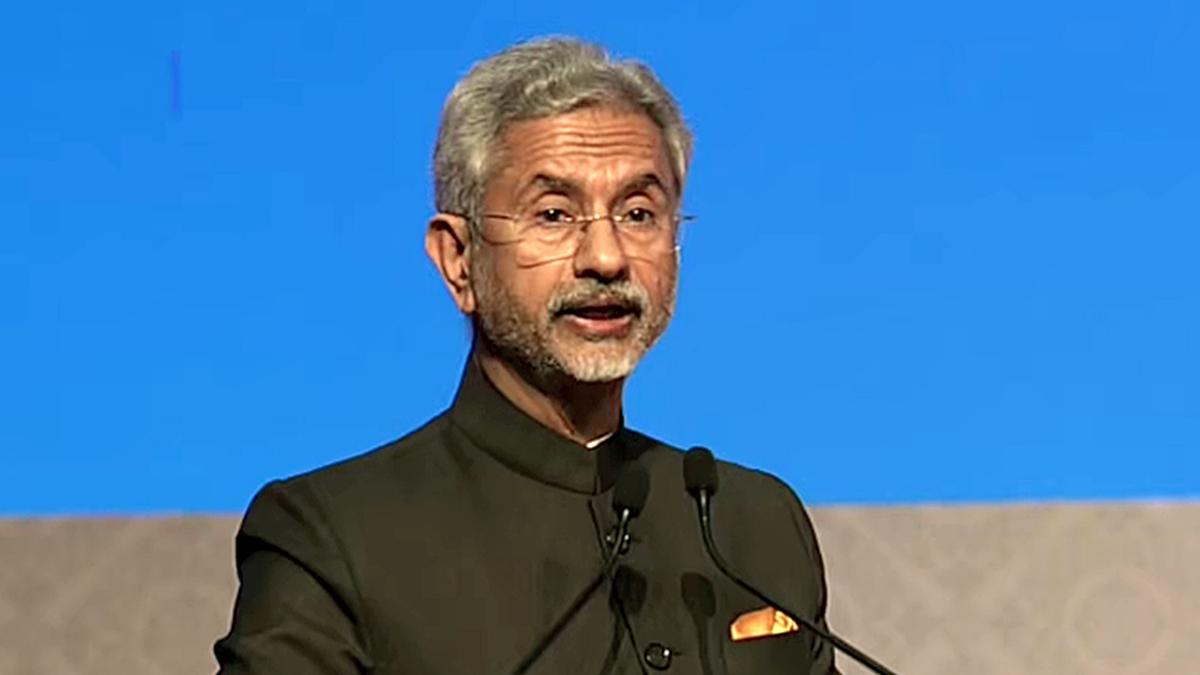

India did not wait, did what was right to help Sri Lanka: Jaishankar

The Hindu

India to ‘encourage greater investments’ in crisis-hit Sri Lanka

Al Jazeera)

Debt restructuring talks with India and China successful, says Sri Lankan President Wickremesinghe

Firstpost

India expected to send ‘positive’ message on debt during Jaishankar’s visit to Sri Lanka

The Hindu)

Jaishankar likely to visit Sri Lanka on 19 January; talks on debt restructuring expected

Firstpost

Cancel Sri Lanka’s debt, global scholars tell creditors

The HinduIndia's response to Sri Lanka’s request for debt restructuring expected by January end: Ranil Wickremesinghe

The Hindu

Sri Lanka awaiting assurances from India, China, says Central Bank Governor

The Hindu

Dragging debt talks in Sri Lanka put spotlight on Chinese loans

The Hindu

Sri Lanka to unveil debt restructuring plan to creditors amid economic crisis

Hindustan Times

The International Monetary Fund’s staff-level agreement with Sri Lanka

The HinduDiscover Related

)

)

)