1 year, 8 months ago

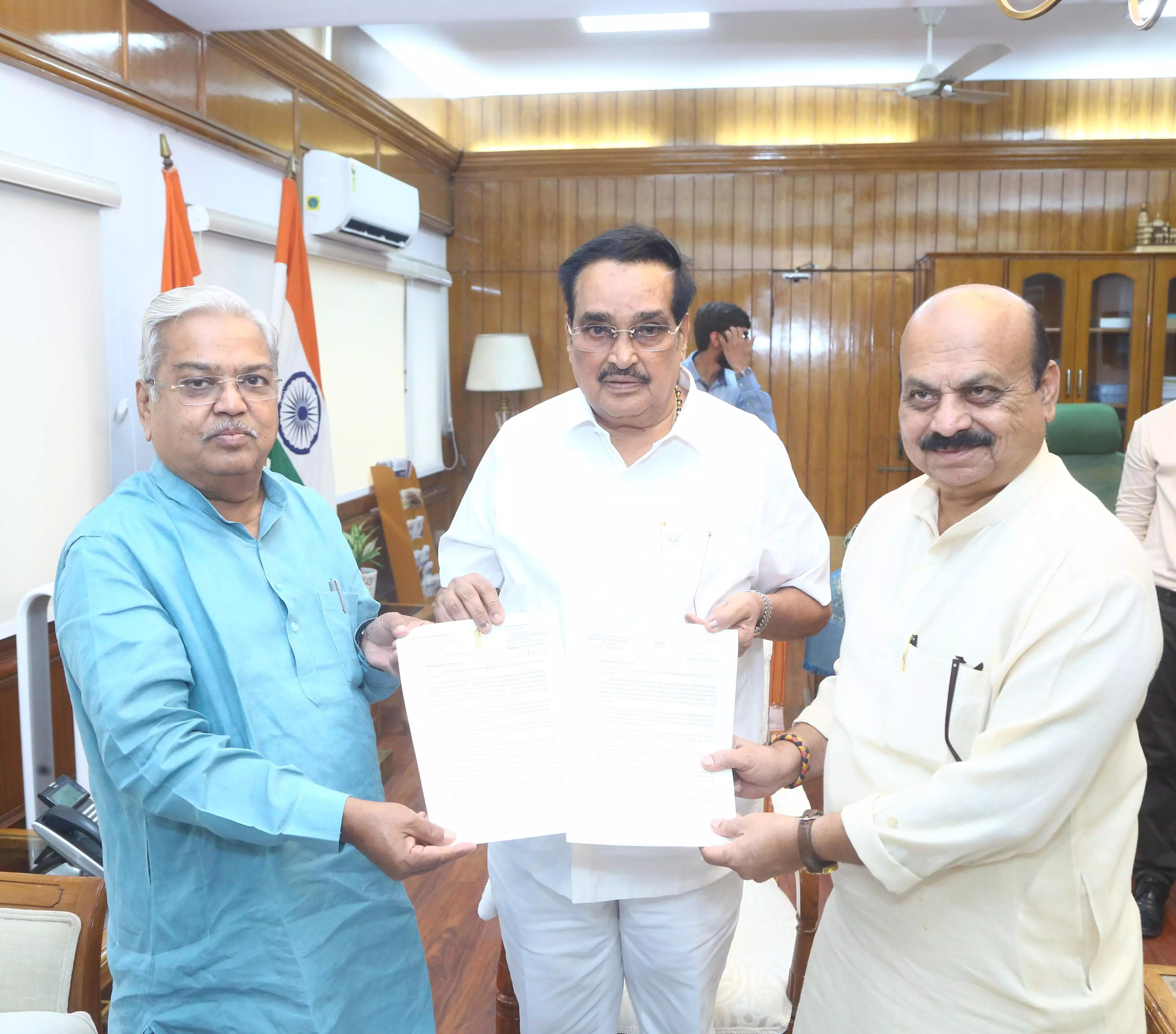

CBDT Notifies Income Tax Exemption To Bhadohi Industrial Development Authority

Live LawThe Central Board of Direct Taxes has notified income tax exemption to Bhadohi Industrial Development Authority.The Bhadohi Industrial Development Authority is an authority constituted by the state government of Uttar Pradesh.The exemption is granted in respect of money received from the disposal of land or 90-year lease of immovable properties; money received by the way of lease rent. The Central Board of Direct Taxes has notified income tax exemption to Bhadohi Industrial Development Authority. The Bhadohi Industrial Development Authority is an authority constituted by the state government of Uttar Pradesh. The notification shall be effective if the Bhadohi Industrial Development Authority does not engage in any commercial activity.

Industrial Development

Received

Authority

Immovable Properties

Cbdt

Income Tax Exemption

Bhadohi

Tax Exemption

Properties Money

Bhadohi Industrial Development Authority

immovable

tax

exemption

bhadohi

notifies

lease

received

industrial

development

income

authority

properties

money

cbdt

History of this topic

4 months, 1 week ago

UIDAI income exempted from I-T for five years

Deccan Chronicle

10 months, 2 weeks ago

Direct Tax Cases Monthly Round Up: January 2024

Live Law

1 year ago

CBDT Notifies Income Tax Exemption To Chhattisgarh Rajya Beej Pramanikaran Sanstha

Live Law

1 year, 3 months ago

CBDT Allows Income Tax Exemption To Unique Identification Authority Of India

Live Law

1 year, 5 months ago

CBDT Notifies 'Yamuna Expressway Industrial Development Authority’ For Exemption Under Sec. 10(46)

Live LawDiscover Related

![[Taxation Law] Market Research, Promotional Activities, Training Or Deployment Of Software Are 'Auxiliary Functions' Under DTAA: Delhi HC](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

Top News

3 days, 21 hours ago

![[Taxation Law] Market Research, Promotional Activities, Training Or Deployment Of Software Are 'Auxiliary Functions' Under DTAA: Delhi HC](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

Top News

3 days, 21 hours ago

4 days, 20 hours ago

5 days, 12 hours ago

5 days, 16 hours ago

1 week ago

1 week, 1 day ago

1 week, 6 days ago

)

2 weeks, 6 days ago

3 weeks ago

3 weeks, 1 day ago

Trending News

1 month ago

1 month ago

1 month ago

1 month ago

1 month ago

1 month, 1 week ago

1 month, 1 week ago

![[Income Tax] Assessing Authority Can't Reassess Prior Years Without Inquiry While Determining Relevant Year's Assessment: Kerala High Court](https://www.livelaw.in/h-upload/2024/05/30/542245-justice-jayasankaran-nambiar-justice-syam-kumar-kerala-hc.jpg)

1 month, 1 week ago

2 months ago

2 months, 2 weeks ago

2 months, 4 weeks ago

3 months, 1 week ago

3 months, 2 weeks ago

3 months, 3 weeks ago

4 months ago

4 months ago

4 months, 1 week ago

4 months, 1 week ago

4 months, 2 weeks ago

4 months, 3 weeks ago

4 months, 3 weeks ago

4 months, 3 weeks ago

4 months, 4 weeks ago

5 months ago

5 months ago

5 months, 1 week ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 3 weeks ago

5 months, 3 weeks ago

5 months, 4 weeks ago