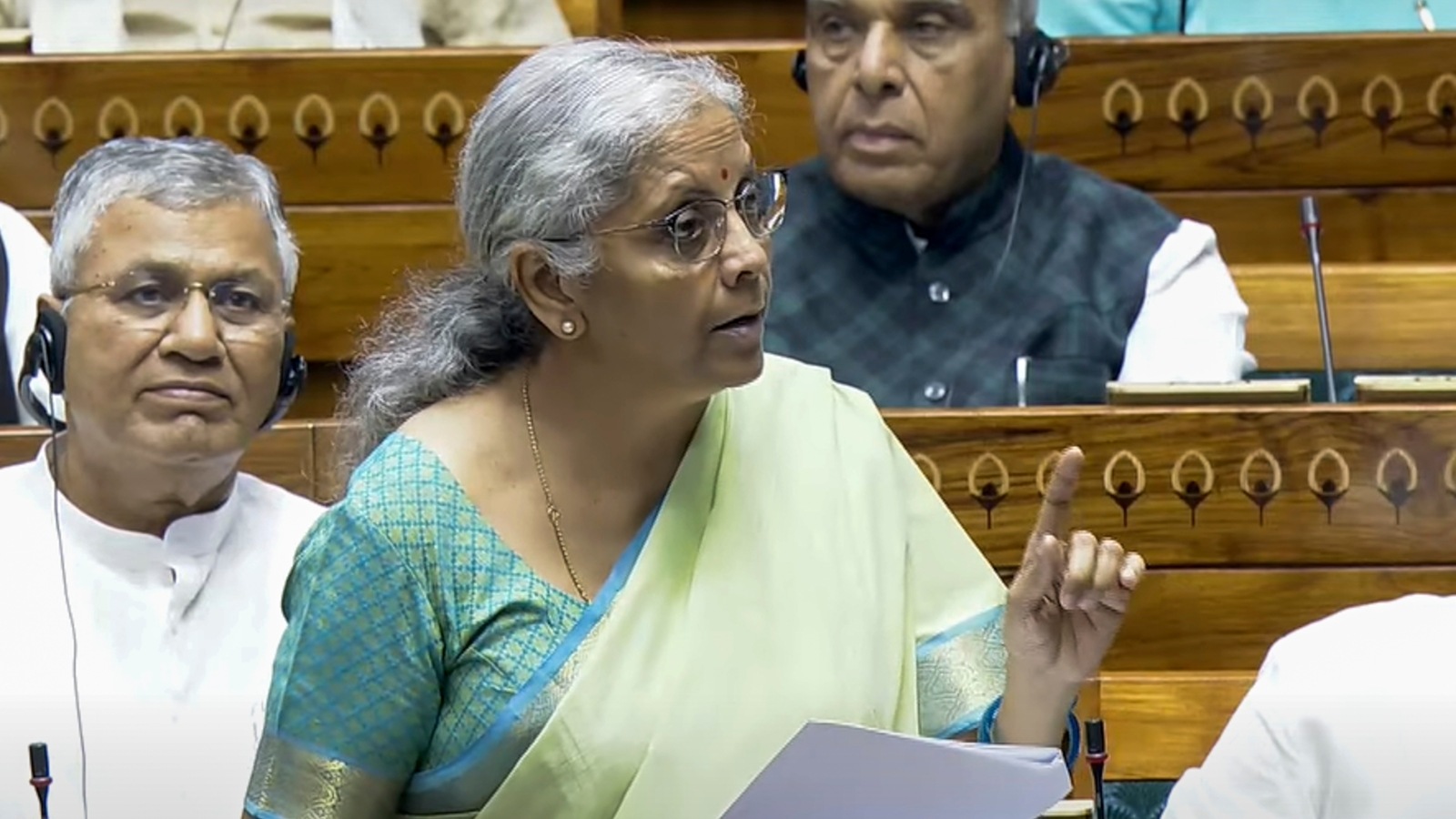

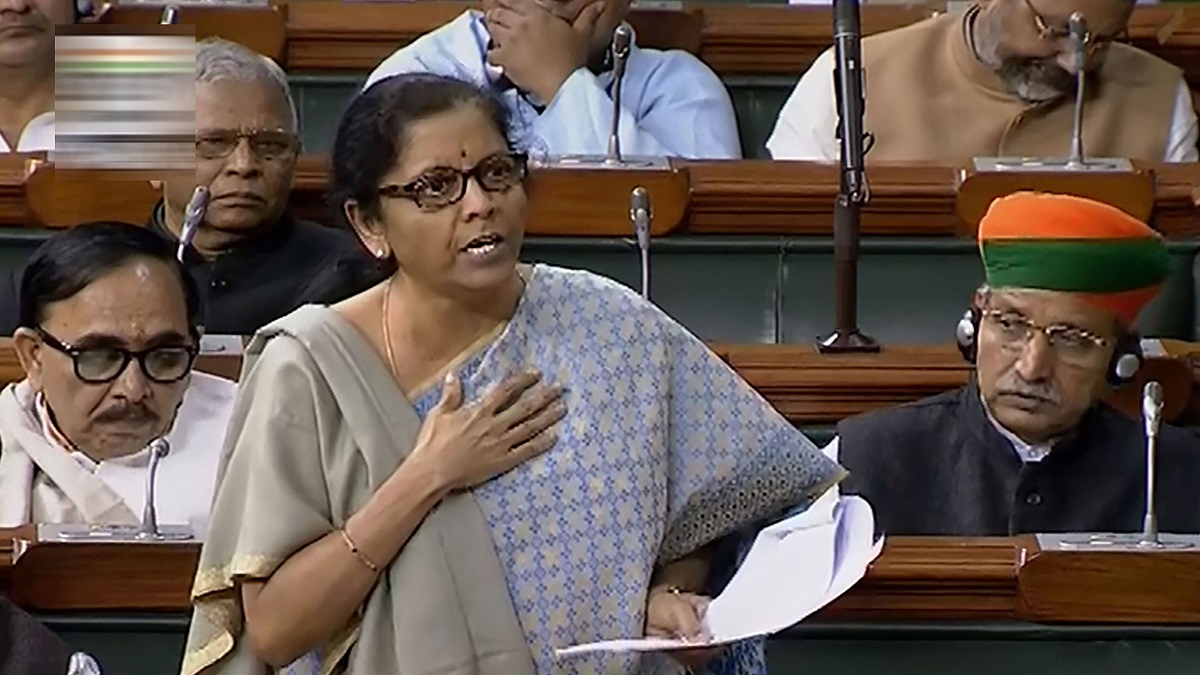

Nirmala Sitharaman on LTCG amendment: 'We have courage to change'

Hindustan TimesFinance minister Nirmala Sitharaman said that the new amendments to Finance Bill 2024 will not impose any additional tax burden concerning the long-term capital gains tax on real estate sales. Replying to the House discussion on the Finance Bill in the Lok Sabha, the minister said: “Every time we present the Budget…I have gone around the country to various destinations, met tax professionals, industry, traders, and all stakeholders, taken their view and brought in amendments, so that the Budget will be represented to the common people aspirations.” Union Finance minister Nirmala Sitharaman speaks in the Lok Sabha during the Monsoon session of Parliament, in New Delhi. This comes after the Centre brought a new amendment to the Bill which allows taxpayers to choose between a 12.5 per cent LTCG tax rate without indexation and a 20 per cent rate with indexation for property acquired before July 23, 2024. Nirmala Sitharaman told Lok Sabha, “Without drastically increasing taxes, we have brought in a simplified taxation regime and eased compliance.

History of this topic

.jpg)

The Concerns Around Budgetary Changes Made to Indexation and the LTCG Structure

The Quint

Big relief for homeowners as government gives options on long term capital gains tax

Hindustan Times

Capital gains tax on real estate: Lok Sabha passes Finance Bill, amends LTCG tax provision on immovable properties

The Hindu

LTCG amendment: Experts cheer decision to restore indexation benefit for property. Why this govt move matters

Live Mint

FM Nirmala Sitharaman announces amendment to LTCG tax proposal, offers new options

Hindustan Times

Parliament Monsoon Session: Lok Sabha passes Finance Bill 2024

India TV News

Lok Sabha passes Finance Bill, amends LTCG tax provision on immovable properties

New Indian Express

Indexation back in real estate as taxpayers get rate choices

Hindustan Times

Relief for homeowners: Realty experts welcome Centre’s decision to ease long term capital gains tax for sale of property

Hindustan Times

Centre to ease long term capital gains tax for sale of properties

Hindustan Times

On discarding indexation for long-term capital gains | Explained

The Hindu

Changes in long-term capital gain tax to benefit most real estate investors: Revenue Secy

Hindustan Times

Govt has no plan to reconsider real estate LTCG tax changes, says report

Live Mint

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

2001: The year that divides property sellers under new Budget tax rules

Hindustan Times

Indexation benefits on property removed, sparks concern. What it means for you?

India Today

Budget 2024: Capital gains taxes hiked, indexation benefit discontinued for property sale

Hindustan Times

Budget 2024: Capital gains taxes hiked, indexation benefit discontinued for property sale

Hindustan Times

Budget 2024: No indexation benefit for property sales; new LTCG rate fixed at 12.5%

Live Mint

LTCG and STCG in Budget 2024: FM Sitharaman announces raising of taxes; check new rates here

Live Mint

Budget 2024: Selling old property to attract more tax. Here's why

India Today

Big change in capital gains tax, LTCG increased to 12.5%. Check details

India Today

FM Sitharaman Denies Rumors of Sweeping Tax Changes

Deccan Chronicle

No changes in income tax rates, slabs, announces Nirmala Sitharaman

Hindustan Times)

Union Budget 2023-24: Modi government tweaks tax provisions to make new tax regime attractive

Firstpost

Budget 2023: How Nirmala Sitharaman attempted to simplify tax experience

Live Mint

Budget 2023: New vs Old Income Tax Regime

News 18

Budget 2023: Will FM Sitharaman revise the long-term pending income tax exemptions limit?

India TV News

India Budget 2022: What analysts expect from FM Nirmala Sitharaman

Live Mint

India’s sovereign right to tax intact after amendment: FM

Live Mint

Rajya Sabha approves Tax Amendment bill to end retrospective taxation

Live MintUS body hails India's move to withdraw retrospective tax law

The Hindu

Govt amends Income Tax Act, retrospective tax rule junked

India TV News

BREAKING : Centre Introduces Taxation Laws Amendment Bill To Nullify Retrospective Tax Demand Provision Brought By Finance Act 2012

Live Law

Direct tax collection up 5 per cent till November: Sitharaman

India TV News

FM Nirmala Sitharaman shrugs off pleas by FPIs on super-rich tax

Live Mint

FM Nirmala Sitharaman shrugs off pleas by FPIs on super-rich tax

Live Mint

Seven indirect tax related laws being amended: Nirmala Sitharaman

Live MintDiscover Related

)

)