Column: Time to panic? The home insurance market in California is collapsing because of climate change

LA TimesAs another legislative session draws to a close in Sacramento, the problem lawmakers failed to fix is one of the most urgent facing Californians: the slow-moving collapse of the property insurance market as costs from climate disasters mount. Throughout the United States, in different geographies, we’re reaching a point where climate change is driving to an uninsurable future,” said Dave Jones, a former California insurance commissioner and current director of UC Berkeley’s Climate Risk Initiative. First, Lara will probably work to bolster the state’s FAIR plan, the insurance of last resort for many — including Newsom, who owns a home covered by it. “I’m calling on the United States Congress, Democrats and Republicans, to ensure the funding is there to deal with the immediate crises, as well as our long-term commitments to the safety and security of the American people.” This isn’t the first time FEMA has been in this predicament and it probably won’t be the last, leaving taxpayers to continually bail out the agency, so the agency can continually bail out communities destroyed by climate-change-fueled disasters. “And as whole communities lose access to insurance, the impact is going to be felt all the way through our economy.” That would be the greatest of disasters, and a place where California doesn’t need to lead on climate.

History of this topic

Letters to the Editor: Regardless of Trump, the battle against climate change is picking up. Let’s keep it going

LA Times

Solutions: As climate change worsens, so too will natural disasters. Here’s how to pay for them

LA Times

Climate change is jacking up insurance costs. Freak hurricanes like Helene only make it worse

Salon

Is this the solution to California’s soaring insurance prices due to wildfire risk?

LA Times

With fires burning again, is California becoming uninsurable?

LA Times

Editorial: California’s next affordable housing crisis is the rising cost of property insurance

LA Times

California’s home insurance crisis: What went wrong, how it can be fixed and what owners can do

LA Times

Climate change is fuelling the US insurance problem

BBC

Climate change is fuelling the US insurance problem

BBC

Column: Hate the storm? Then start getting serious about climate change

LA TimesWildfire-prone California to consider new rules for property insurance pricing

Associated Press

The scramble to fix California’s home insurance mess failed. Here’s what will happen next

LA Times

California is working on solutions to worsening climate change. Will they be enough?

LA Times

Unprecedented damage from storms is upending the insurance industry

LA Times

California insurance market rattled by withdrawal of major companies

Associated Press

Editorial: Climate change is making California more expensive. Home insurance is the latest bellwether

LA Times

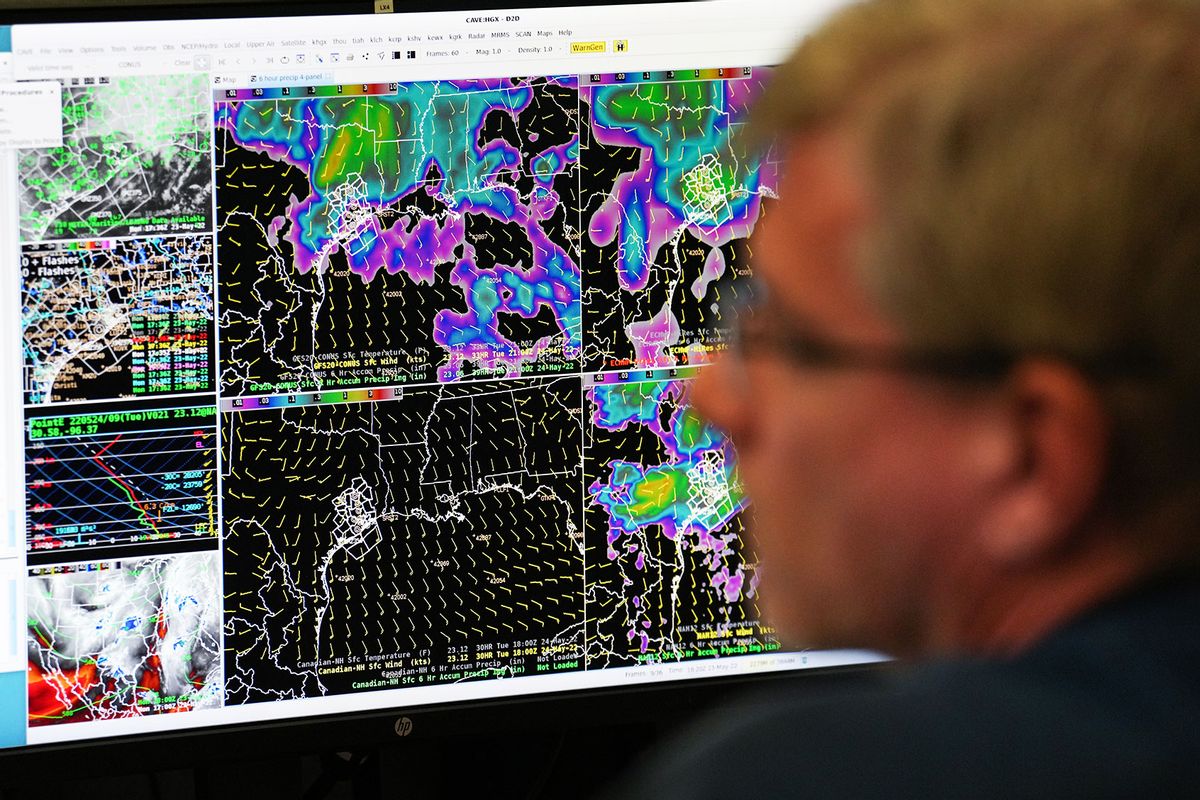

Insurance firms need more climate change information. Scientists say they can help

NPR

Review: The road to California’s energy disaster: A new history of PG&E paints a bleak picture

LA TimesHow climate change is pushing insurance stress to new extremes

ABC

Don’t Look Up director Adam McKay says home insurance cancelled over climate-linked disasters

The Independent

Majority in US concerned about climate: AP-NORC/EPIC poll

Associated Press

Editorial: Climate change is fueling extreme heat. California can do much more to save lives

LA Times

As fires burns, California moves faster on climate — maybe

LA Times

A Looming Disaster: New Data Reveal Where Flood Damage Is An Existential Threat

NPR

Opinion: Wildfires are increasingly destructive. We need to reevaluate how and where we build our homes

CNN

California is broiling and burning. Here are ideas for dealing with climate despair

LA TimesDiscover Related

)

As it happened: Huge spike in uninsured home borrowers, Cbus execs apologise to senate inquiry, Orica boss upbeat on Trump 2.0

ABC)