Direct Tax Cases Weekly Round-Up: 04 To 10 February 2024

Live LawBombay High Court HSBC Bank Carrying On Bona Fide Banking Business In Mauritius Exempt From Tax In India: Bombay High Court Case Title: Commissioner of Income Tax Versus M/s. Case Title: Vodafone India Services Pvt Ltd verses DCIT Emphasizing that although Section 32 of Income tax Act, 1961 was amended by the Finance Act, 2021 wherein it was stated that 'goodwill' is not an intangible asset eligible for depreciation was applicable prospectively with effect from AY 2021-22, the Mumbai ITAT held that claim of depreciation of goodwill acquired pursuant to slump sale under a Business transfer agreement is allowable under Section 32. Subsequent Withdrawal Of Registration Is No Impediment In Denying Deduction U/s 35-AC On Donation Received By Charitable Trust: Mumbai ITAT Case Title: Ravindra K. Reshamwala verses Income Tax Officer Case Title: Income-tax Officer verses M/s Aashna Developers Pvt Ltd. On finding that the Revenue has grossly erred by treating the element of interest on the alleged loan as bogus in nature, the Ahmedabad ITAT held that the loan amount cannot be made subject to addition under the provisions of section 68 of the Income tax Act, 1961, since loan was taken through banking channel and was repaid in the next year along with interest through banking channel and TDS was deducted on the interest. Case Title: Kolhapur District Central Co-op Bank Kanista Sevakanchi Sahakar Pat Sanstha Ltd. verses ITO Relying on decisions of Supreme Court and High Court, the Pune ITAT directed the AO to allow the deduction u/s 80P and 80P of Income Tax Act, 1961 in respect of interest income earned from co-operative bank/scheduled bank. Ltd The Mumbai ITAT upheld the CIT's order to delete the addition made u/s 68 of the Income Tax Act, 1961 finding no unexplained cash credit in the books of assessee.

History of this topic

SC's Judgement In Abhisar Buildwell Case Doesn't Permit Reopening Of Assessments Beyond Limitation Period U/S 149(1) Of IT Act: Delhi HC

Live Law

Tax Weekly Round-Up: December 09 - December 15, 2024

Live Law

Assessee Can Confine Settlement Under Direct Tax Vivad Se Vishwas Act To Disputes Which Were Subject Matter Of Its Appeal: Delhi HC

Live Law

Tax Weekly Round-Up: December 02 - December 08, 2024

Live Law![[Income Tax Act] Placing Funds In One Account Before Transferring It To Another Does Not Attract S. 69A: Allahabad High Court](https://www.livelaw.in/h-upload/2024/12/07/575113-allahabad-high-court.jpg)

[Income Tax Act] Placing Funds In One Account Before Transferring It To Another Does Not Attract S. 69A: Allahabad High Court

Live Law![[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court](https://www.livelaw.in/h-upload/2024/10/31/568956-allahabad-high-court-prayagraj.jpg)

[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court

Live Law

Tax Weekly Roundup: November 25 - December 01, 2024

Live Law

Tax Monthly Digest: November 2024

Live Law

Finance Act, 2013 | Audit Report Determining Tax Liability Doesn't Bar Eligibility Under Voluntary Compliance Encouragement Scheme: Delhi HC

Live Law

Tax action in the Union budget for 2025-26 could set the course for Viksit Bharat

Live Mint

Tax Weekly Roundup: November 18 - November 24, 2024

Live Law

Tax Weekly Roundup: November 18 - November 24, 2024

Live Law

Recourse To Section 147 Of Income Tax Act Not Barred In Cases Where Assessing Officer Is Empowered To Proceed U/S 153C: Delhi High Court

Live Law

Supreme Court Criticises ICICI Bank For Not Defreezing Newsclick's Bank Accounts Despite Stay On Tax Recovery Steps

Live Law

When Is Action For Imposition Of Penalty 'Initiated' U/S 271C Of Income Tax Act For Failure To Deduct Tax At Source: Delhi HC Explains

Live Law![[S.263 IT Act] Revisionary Power Can Be Invoked When Order Meets Twin Conditions Of Being Erroneous, Prejudicial To Interest Of Revenue: Delhi HC](https://www.livelaw.in/h-upload/2024/10/09/565132-justice-vibhu-bakhru-justice-swarana-kanta-sharma-delhi-high-court.jpg)

[S.263 IT Act] Revisionary Power Can Be Invoked When Order Meets Twin Conditions Of Being Erroneous, Prejudicial To Interest Of Revenue: Delhi HC

Live Law

Entry Made In Dispatch Register Is Not Primary Evidence To Prove Service Of Notice On Assessee: Orissa High Court

Live Law![[Income Tax] Assessing Authority Can't Reassess Prior Years Without Inquiry While Determining Relevant Year's Assessment: Kerala High Court](https://www.livelaw.in/h-upload/2024/05/30/542245-justice-jayasankaran-nambiar-justice-syam-kumar-kerala-hc.jpg)

[Income Tax] Assessing Authority Can't Reassess Prior Years Without Inquiry While Determining Relevant Year's Assessment: Kerala High Court

Live Law

Mistake On Part Of AO Resulting In Under Assessment Of Income No Ground To Re-Open Assessment U/S 147 Of Income Tax Act: Delhi HC

Live Law

Nirmala Sitharaman reviews Income Tax Act 1961

Live Mint

High Court Rejects Income Tax Appeal, Finds No Escapement of Rs. 3.25 Crore

Live Law

Income Tax Deduction Allowable To Interest Income 'Attributable' To Cottage Industry Business: ITAT

Live Law

ITAT Weekly Round-Up: 11 To 17 August 2024

Live Law

Direct Tax Weekly Round-Up: 11 To 17 August 2024

Live Law

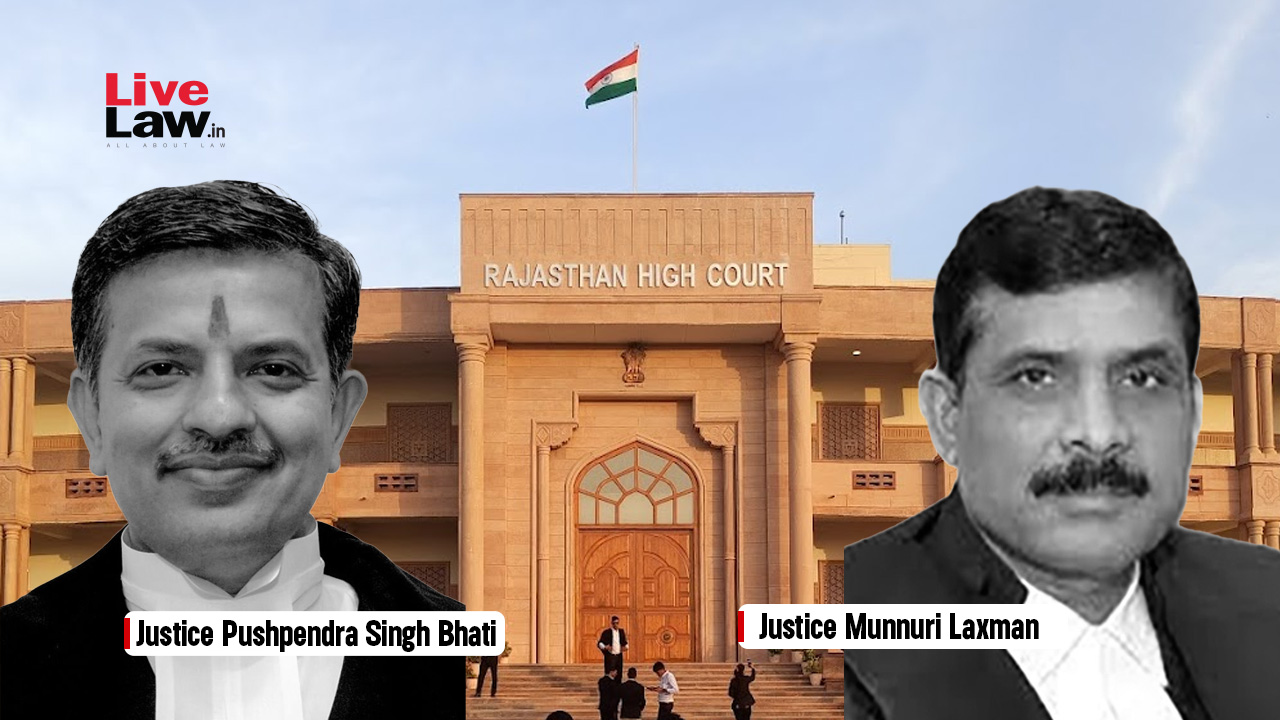

Rajasthan High Court Quashes Income Tax Reassessment As Income Tax Dept. Failed To Hold Proper Investigation

Live Law

Mistake In Calculation Of Tax As Per Sec 115BBE Can Be Rectified U/s 154 And Not U/s 263: Ahmedabad ITAT Quashes Revision Made By PCIT

Live Law

Income Tax Additions Can't Be Based On Generalised Report By Investigation Wing: ITAT

Live Law

Direct Tax Weekly Round-Up: 4 To 10 August 2024

Live Law

Tax defaults in India skyrocket by 1000% over last 10 years, litigations double: Report

Hindustan Times

No Service Tax Payable On Banking Services Rendered By PNB To RBI: CESTAT

Live Law

AO Can't Disregard ITAT's Direction To Re-examine Issue By Referring To CBDT Circular: Delhi High Court

Live Law

Indirect Tax Weekly Round-Up: 21 To 27 July 2024

Live Law

Direct Tax Weekly Round-Up: 21 To 27 July 2024

Live Law

Educational Activities Neither Business Nor Profession, Covered Under Section 2 (15) Of Income Tax Act: Delhi High Court

Live Law

Bank Charges & Bank Guarantee Charges Wrongly Included As Interest: ITAT

Live Law

Long Term Capital Gain On Sale Of Shares By Mauritius Company Is Not Liable To Be Taxed In India: ITAT

Live Law

Tax Effect In Appeals Below Monetary Limit Of Rs.1 Crore; Kerala High Court Dismisses Dept's Appeal

Live Law

ITAT Half Yearly Digest: January To June 2024 - PART II

Live Law

ITAT Half Yearly Digest: January To June 2024 - PART I

Live Law

Delhi man ends up paying ₹50,000 to CA over income tax dispute of 1 rupee: ‘Not joking’

Hindustan Times

Order Of ITSC Final And Conclusive For AY For Which Application Has Been Filed: Delhi High Court

Live Law

Indirect Tax Cases Monthly Round Up: June 2024

Live Law

Direct Tax Weekly Round-Up: 23 To 29 June 2024

Live Law

Indirect Tax Weekly Round-Up: 23 To 29 June 2024

Live Law

ITAT Cases Weekly Round-Up: 16 To 22 June 2024

Live Law

Submission Of Form-67 Is Not Mandatory For Availing Foreign Tax Credit: Delhi ITAT

Live Law

Direct Tax Cases Weekly Round-Up: 02 To 08 June 2024

Live Law

Exemption Allowable On Donations Made By One Charitable Trust To Other Charitable Institutions For Temporary Period: Delhi High Court

Live Law

Delhi HC Upholds Constitutional Validity Of Section 71(3A) Income Tax Act; Dismisses Petition Challenging Rs. 2 Lakh Cap On House Property Income Set-Off

Live Law

Indirect Tax Cases Weekly Round-Up: 26 May To 01 June 2024

Live LawDiscover Related

![[Taxation Law] Market Research, Promotional Activities, Training Or Deployment Of Software Are 'Auxiliary Functions' Under DTAA: Delhi HC](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

![[Taxation Law] Market Research, Promotional Activities, Training Or Deployment Of Software Are 'Auxiliary Functions' Under DTAA: Delhi HC](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

![Delhi High Court Monthly Digest: November 2024 [Citations 1193 - 1304]](https://www.livelaw.in/h-upload/2022/02/01/408682-delhi-high-court-monthly-digest.jpg)