Covid-19 crisis should be used to sell health insurance for the long term

Live MintIt may come as no surprise that covid-19 has accelerated awareness about health insurance; more and more people are now buying a cover. But with covid-19 spiraling out of control and nightmarish stories of hospital experience and inflated bills slapped all over social media, panic has goaded many to consider health insurance seriously. The Insurance Regulatory and Development Authority of India wants non-life companies to mandatorily offer standard covid-19 health insurance policies that pay for covid-19 treatment. It has also allowed both life and non-life companies to offer optional defined benefit plans and other short-term health insurance plans—you can Irdai’s rationale seems to ensure more people are insured for covid-19-related medical expenses at an affordable rate, but this line of thinking has one serious flaw. A health insurance expert I spoke to on pricing said, “It’s like the forest is on fire and I have to insure a house where the fire has not reached yet.” He estimated the pricing of the standard covid-19 indemnity plan to be somewhere around that of Arogya Sanjeevani, the standard basic health insurance policy that is mandated to be sold by all insurers.

History of this topic

Soaring inflation pushes up health insurance premiums; makes standardised care costlier

The Hindu

Budget 2024: Health insurers seek more attractive tax incentives—and a regulator

Live Mint

'Accept Covid-19 as Part of Lifestyle': Don't Panic, Says Top Epidemiologist But Advises Caution

News 18

Great strides made in insurance, but there is still a long way to go

Live Mint

Ready, or not: The Hindu Editorial on rising numbers of COVID-19 cases and India’s state of preparedness

The HinduPost-COVID demand for health insurance in India shoots up by 321%: report

The Hindu

To bolster health care, governments must raise their budget allocations

Hindustan Times)

World Cancer Day 2022: How COVID-19 impacted cancer care in India

Firstpost)

Budget 2022: Why healthcare policies need to factor entire value chain from prevention, diagnosis, treatment to insurance coverage

Firstpost

Insurers tighten rules, raise rates

Deccan ChronicleYou can now get COVID-19 travel insurance. Here's what it does and doesn't cover

ABC

Vital relief: The Hindu Editorial on COVID-19 death compensation

The HinduVulnerable groups caught between two worlds amid lockdowns

The Hindu

'One-Size-Fits-All Approach Untenable': Lancet Experts Recommend 8 'Urgent Actions' To Tackle Covid Resurgence In India

ABP News

How can India prepare for the third wave

Hindustan Times

To prepare for the third wave of Covid-19, here is what India needs to do

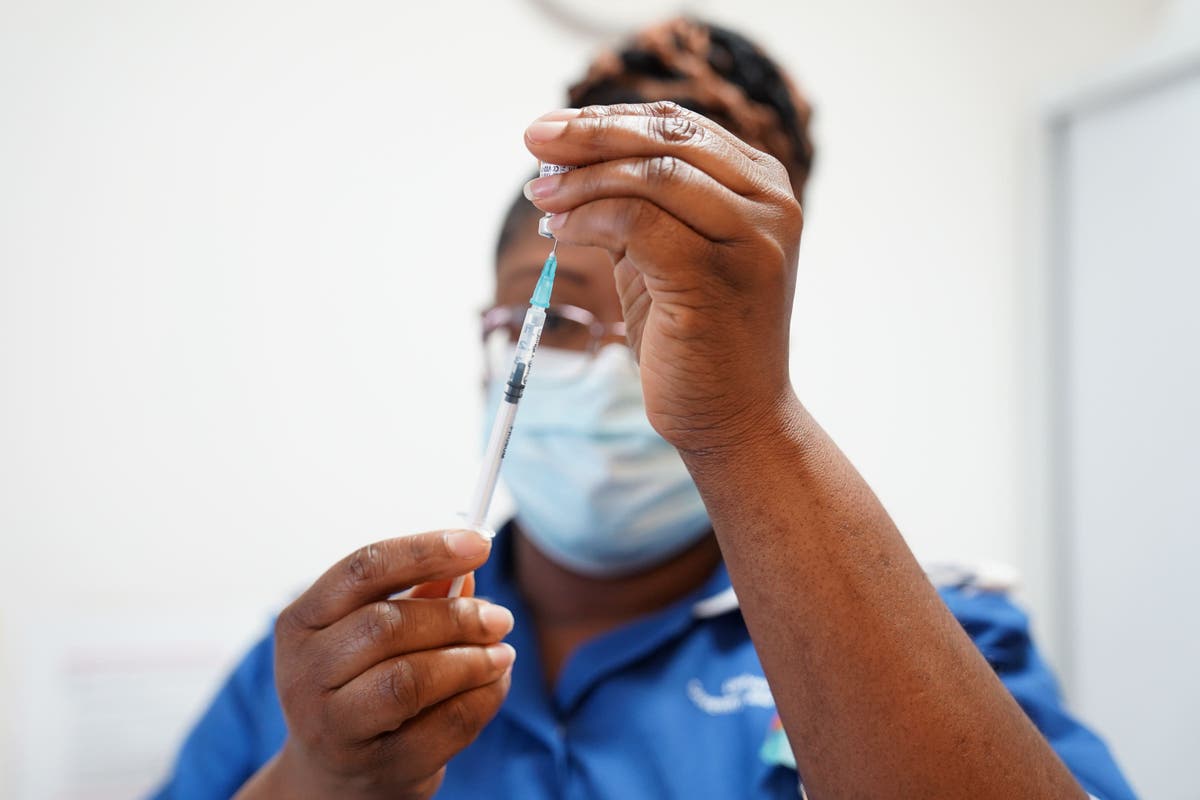

Hindustan TimesIndia has to buy time to ensure high coverage of COVID vaccination is achieved, says government

The Hindu

After surviving Covid-19, it's now a fight to get medical insurance claims

India Today

Opinion | Why India needs to improve its rickety health infrastructure

India TV News

COVID-19 crisis: CII calls for strongest national steps, curbs on economic activity

India TV News

Shadow of Long Covid: Why India needs to prepare for long-term effects of coronavirus

India Today

India must prioritise narrowing the gaps in essential medical supplies, hospital capacities: WHO

India Today

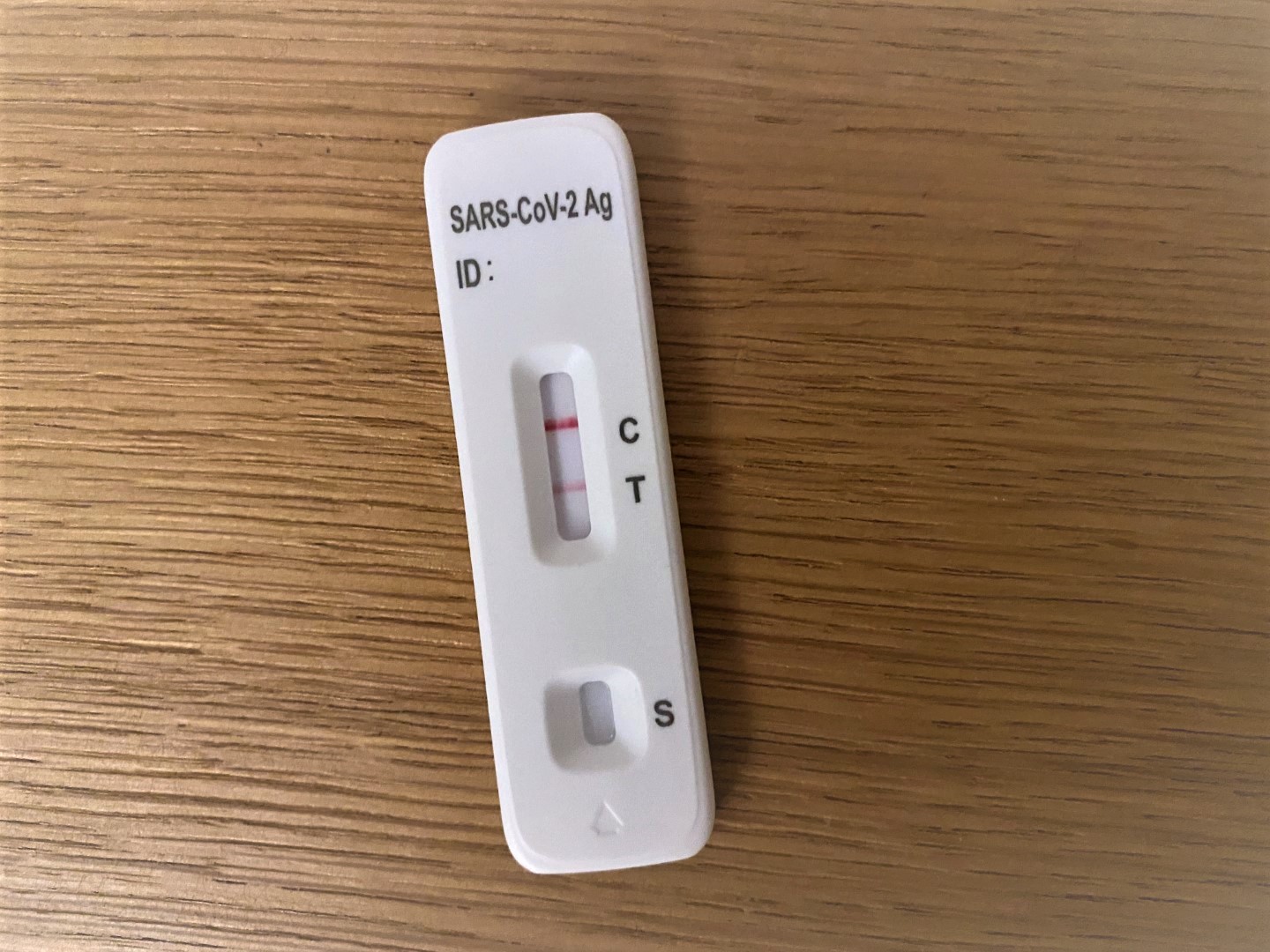

Covid-19 treatment at home: How to claim insurance, documents required and more

India Today

Did You Know Insurance Can Cover Claim For Covid Treatment At Temporary Hospital? Check Details Here

ABP News

Why health insurance is important during COVID-19 times - Explained

India TV News

Covid-19 healthcare workers left with no insurance cover, govt says new plan soon

India Today)

Union Budget 2021: Make insurance more affordable, attractive proposition for customers

Firstpost)

Covid-19 Has Shown Affordable, Accessible Healthcare Can’t Be Ignored. Budget 2021 Must Deliver on That

News 18

As long-term COVID risks rise, life insurers impose curbs: Report

Al Jazeera

The antidote for India’s healthcare woes

Live Mint

Covid-19 limited 25 million Indian couples’ access to contraceptives: UNAIDS

Live Mint

Should you renew your covid insurance? Life insurance advise for New Year

Live Mint

Covid-19 scare: Five must-have insurance covers you should buy this Diwali

Live Mint

Planning To Buy Coronavirus Health Insurance Policy? Here's How You Can Avail

ABP News

Travel insurance: which policies cover you for Covid-19?

The Independent

COVID-19: Life and health insurances are must for ’safeguarding future’, shows survey

Live Mint)

Current Phase of Covid-19 Pandemic on Multiple Trajectories in Urban, Semi-urban Areas: MoS Health

News 18

COVID-19 health insurance policies’ tenure may be extended, hints IRDAI chairman

Live MintCOVID-19: Insurance scheme for health workers extended for 6 months

The HinduCOVID-19: A chain of blunders by the Central government

The Hindu

Health insurers see slow growth in Aug as collections drop

Live Mint

Covid-19 possible second wave as India unlocks: How ready is healthcare system?

India Today

Costs of India’s covid crisis are too high

Live MintWatch | Is COVID-19 intensifying in rural India?

The Hindu)

Covid-19 Derails Essential Healthcare Services Globally, Says WHO; Sharp Disruptions in India Too

News 18

'Corona Kavach' Amid Pandemic! Here's Why You Must Consider Taking Covid-19 Health Insurance Policies

ABP News

Covid-19: Health insurance is your best bet against steep medical costs

Hindustan Times

Opinion | Not every covid patient can afford to recover at home

Live MintCoronavirus | An opportunity to reshape health care

The Hindu

Safeguarding your physical and financial well-being with COVID-19 health insurance

Hindustan TimesDiscover Related

)