)

Aadhaar-PAN Linking Last Date June 30: What Happens if You Miss Deadline

News 18The central government had extended the deadline to link Permanent Account Number and Aadhaar card, considering the pandemic situation in the country. In its notification, the Central Board of Direct Taxes has said if anyone fails to link PAN card to Aadhaar card, it will become inoperative. It also clarified that in case user slink their PAN with Aadhaar Card after the deadline passes, then the PAN card will “become operative from the date of intimation of Aadhaar number.” In Budget 2021, the central government added a new section 234H in the Income tax Act, 1961, where a fee can be levied from individuals if their PAN is linked with Aadhaar after the due date. According to income tax laws, if an individual’s PAN becomes inoperative because of not linking it with Aadhaar by June 30, and such person is required to furnish or quote PAN, then it shall be deemed that they have not furnished/intimated/quoted the required document.

History of this topic

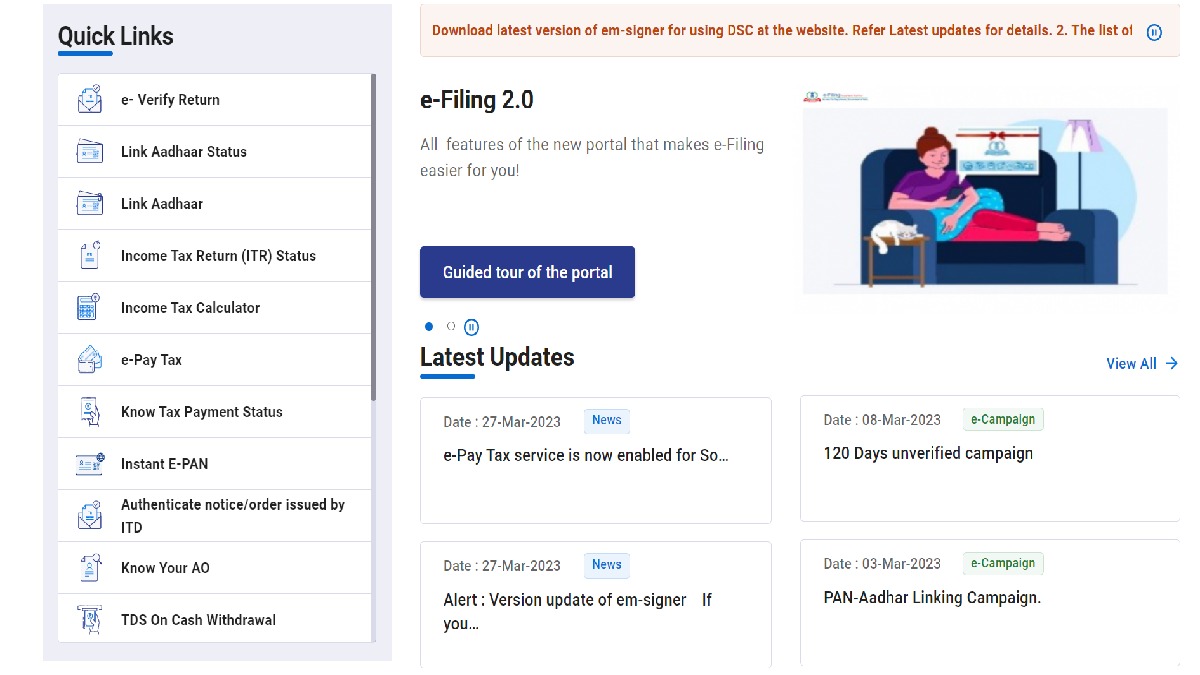

PAN-Aadhaar link last date approaching soon: Step-by-step guide for online process

India TV News

PAN-Aadhaar link now mandatory – Check deadline

India Today

Income Tax department issues fresh reminder on PAN-Aadhaar linking to avoid higher TDS. Check details

India TV News

How to Link PAN with Aadhaar by May 31 to Avoid Income Tax Notice? Know Latest CBDT Guidelines

News 18

Higher TDS not required if PAN linked with Aadhaar by May 31

New Indian Express

PAN Aadhaar Link Verification: Worried About Linking Status? Check Using These Methods

News 18

PAN inoperative for failing to link PAN-Aadhaar before July 1? Follow this step

Hindustan Times

Failed to link Aadhaar-PAN before July 1? Here’s how to activate inoperative PAN

Live Mint

PAN Aadhaar Link Deadline Today: Easy Steps To Check PAN-Aadhaar Link Status Online

News 18

PAN-Aadhaar Linking Deadline: How To Pay Rs 1,000 And Link Two Key Documents Today

News 18

PAN Aadhaar Link Last Day Today: Will Govt Extend Deadline?

News 18

Last chance to link PAN and Aadhaar before midnight or face consequences

India TV News

PAN-Aadhaar Linking Trouble: Not Able To Link? Here's What You Need To Do Now

News 18

PAN-Aadhaar link last date nearing, here is what to do if linking fails

India Today

Aadhaar-PAN Link: Last Date, Status Check, Penalty And Fees; Clear All Doubts Here

News 18

Aadhaar-PAN Link Deadline Soon: Key Tasks To Suffer If Your PAN Is Deactivated

News 18

PAN-Aadhaar Linking, Higher EPF Pension, And Other Important Personal Finance Deadlines In June 2023

ABP News

PAN-Aadhaar Linking, Higher EPFO Pension Deadlines To End In June; Check Details

News 18

PAN-Aadhaar Link Check: Know Status Online Before Last Date, Step-By-Step Guide

News 18

Check this new update on PAN-Aadhaar linking

Hindustan Times

How to check your PAN-Aadhaar link status online: A step-by-step guide

India TV News

PAN-Aadhaar Link Deadline Extended: Now Do You Need To Pay Fine?

News 18

Aadhaar, PAN details now mandatory for investing in small savings schemes: Govt

Hindustan Times

Centre extends deadline for linking PAN with Aadhaar till June 30

Deccan Chronicle

Why Does Govt Want PAN-Aadhaar Linkage? Explained as Deadline Extended till June 30

News 18

PAN, Aadhaar card linking deadline extended by three months to June 30

Hindustan TimesDeadline for linking PAN-Aadhaar extended beyond March 31

The Hindu

PAN-Aadhaar link: Last date to link these two cards extended to June 30

Business Standard

Date for linking PAN-Aadhaar extended: Check new date

India TV News

Aadhaar-PAN Linking Not Mandatory For These Individuals, Check Details Here

News 18

NPS subscribers need to link PAN with Aadhaar by Mar 31. If not..?

Live Mint)

You Will Have To Pay Extra Taxes If PAN Is Not Linked With Aadhaar By March 31

News 18

How to Check If Your PAN is Already Linked With Aadhaar? Check Here

News 18

PAN Aadhaar Linking Last Date March 31: Know Steps to Link Online, Fees, Penalty

News 18

PAN Aadhaar Not Linked? After March 31, Be Ready To Face These Consequences

News 18

PAN Aadhaar Link: Deadline Ends In Just 10 Days, Know How To Link Both The Documents

News 18

How To Link PAN With Aadhaar; These Services Will Stop If You Don't Do It By March 31

News 18

March 31 Last Date To Link PAN With Aadhaar; Here's A Step-By-Step Guide For Taxpayers

News 18

PAN card-Aadhaar linking deadline on March 31: Who should link, what happens if you do not

India Today)

KYC Update: Sebi Asks Investors To Link PAN With Aadhaar By March 31, Check Details

News 18)

How To Link PAN And Aadhaar With Penalty Before March 31, 2023?

News 18

Deadline for Aadhaar-PAN link nears: What are the benefits for linking?

Live Mint

PAN-Aadhaar link: Know people exempted from this process

Hindustan Times

PAN-Aadhaar Link Not Compulsory For These People

News 18

PAN-Aadhaar Not Linked? You Will Face These Consequences After March 31

News 18

PAN-Aadhaar Linking Deadline Nears: How To Link, How To Check If Your PAN Is Already Linked

News 18

Step-by-step guide to check if your PAN-Aadhaar is linked as deadline nears

Hindustan Times

Still not linked PAN and Aadhaar? here is how to link through SMS by March 31 2023

India Today

How to link PAN and Aadhaar before March 31 deadline

India Today

How to check if your Aadhaar is linked with PAN

India TodayDiscover Related