Treasury's guilty gamble with Labour's new debt definitions: ALEX BRUMMER

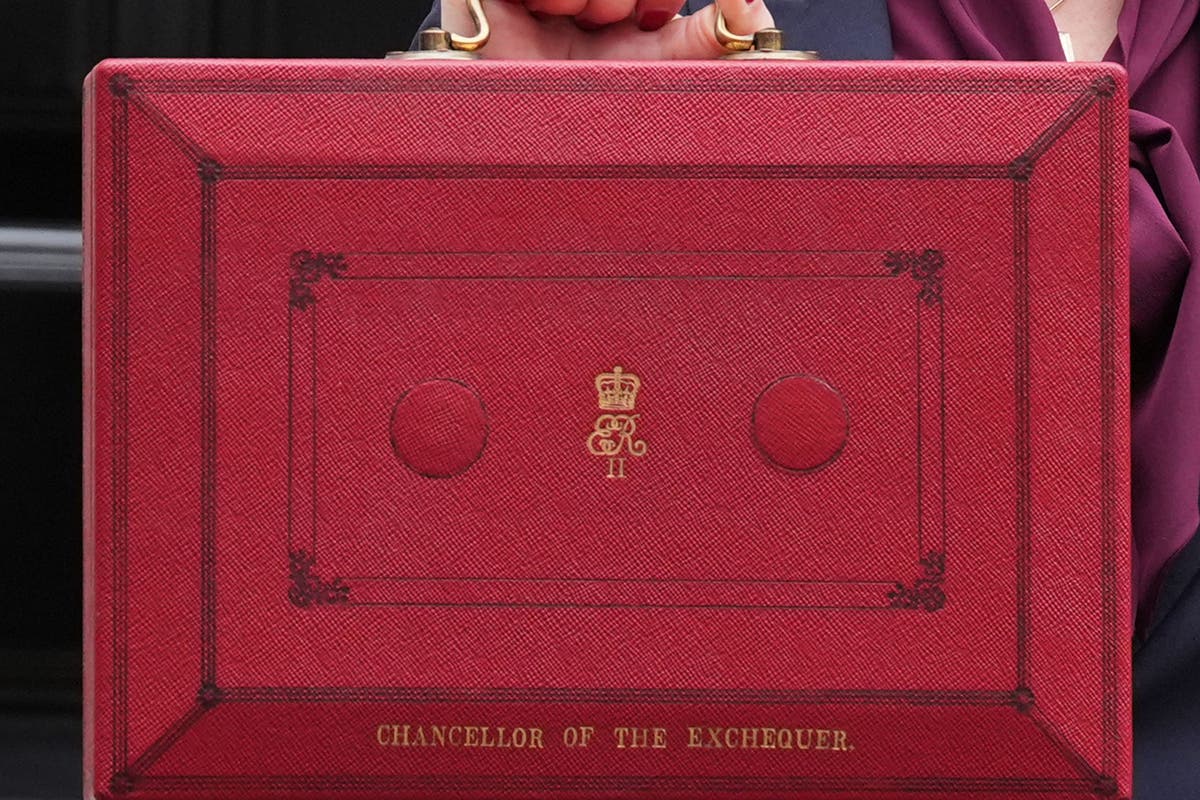

Daily MailThe gilts market has much to think about following Labour’s first Budget for 14 years. New rules: The Treasury historically has been the voice of fiscal orthodoxy and seriously worried about how interest rate costs feed borrowing and the national debt Reeves’s new interpretation of debt may give the Government more breathing space but it doesn’t make funding of the deficit any easier. The second revision to the Debt Management Office’s money raising, in the current 2024-25 fiscal year, means an enormous funding requirement of £311.5billion. The Treasury historically has been the voice of fiscal orthodoxy and seriously worried about how interest rate costs feed borrowing and the national debt. But in acceding to Labour’s new debt definitions, excluding vital liabilities from the reckoning, officials carelessly are gambling with credibility.

Discover Related