Budget 2022: 8 key tax-related expectations

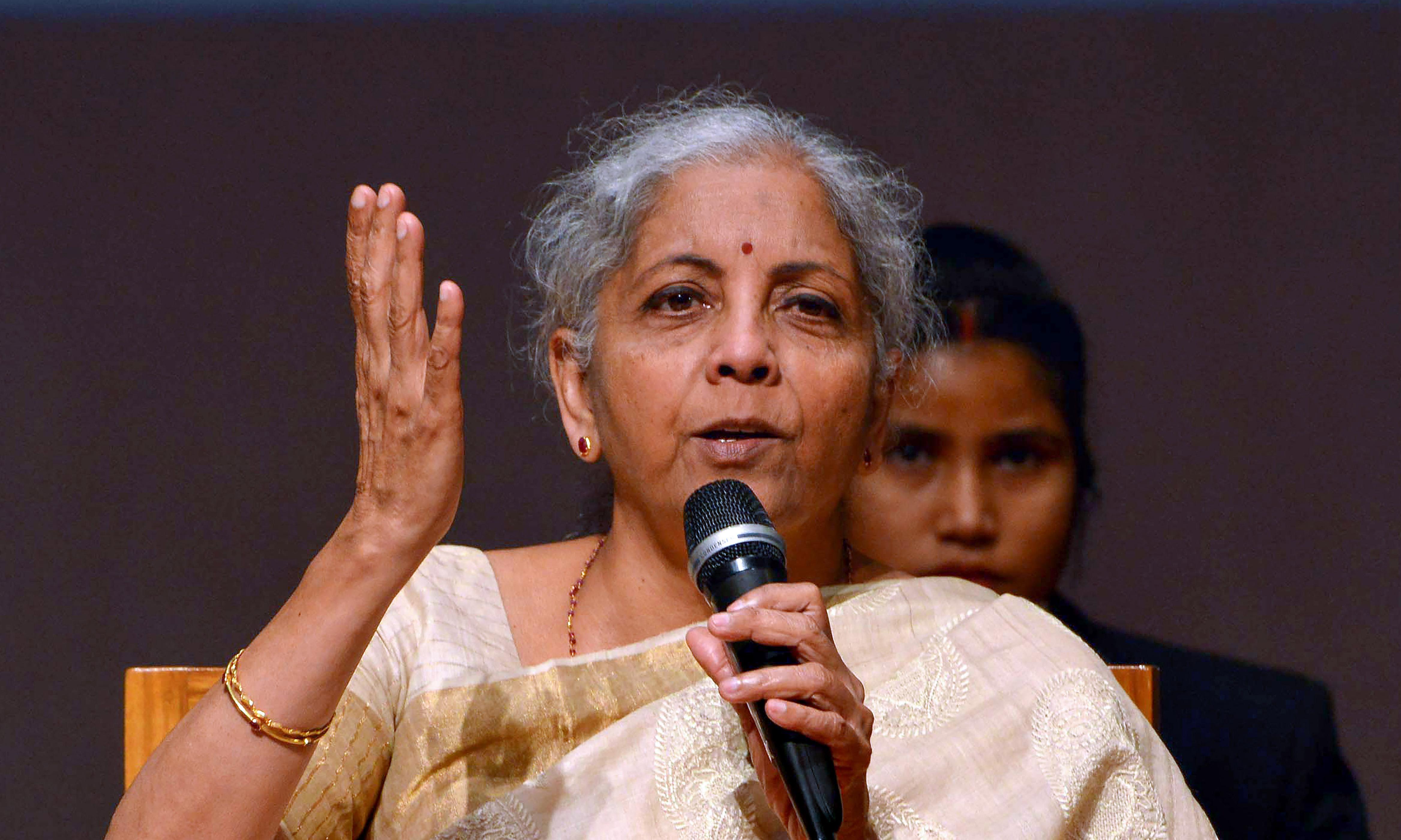

India TodayFinance Minister Nirmala Sitharaman is set to present her fourth Union Budget on Tuesday at a time when India’s economic recovery faces fresh challenges. Here are top expectations of taxpayers and corporates: DIRECT TAXES In the Union Budget 2022, 80C deduction available up to Rs 1.5 lakh a year should be revised upwards significantly. INDIRECT TAXES Rationalisation of Customs duty structure for EV and ancillary components, renewable energy generation devices and related components is likely in the upcoming Union Budget. EXTENSION OF CUSTOMS CUTY EXEMPTION Extension of customs duty exemption on goods imported for testing, and setting up of a customs dispute resolution forum, easing compliance with customs, and integration of the current ICEGATE, DGFT and SEZ online portal into a common digital platform are expected in Budget 2022, PTI reported.

History of this topic

)

Eyes on income tax, customs duty and capex reforms as Sitharaman begins Budget 2025 meetings

Firstpost

Can you expect major income tax changes in Budget 2025? Check details

India Today

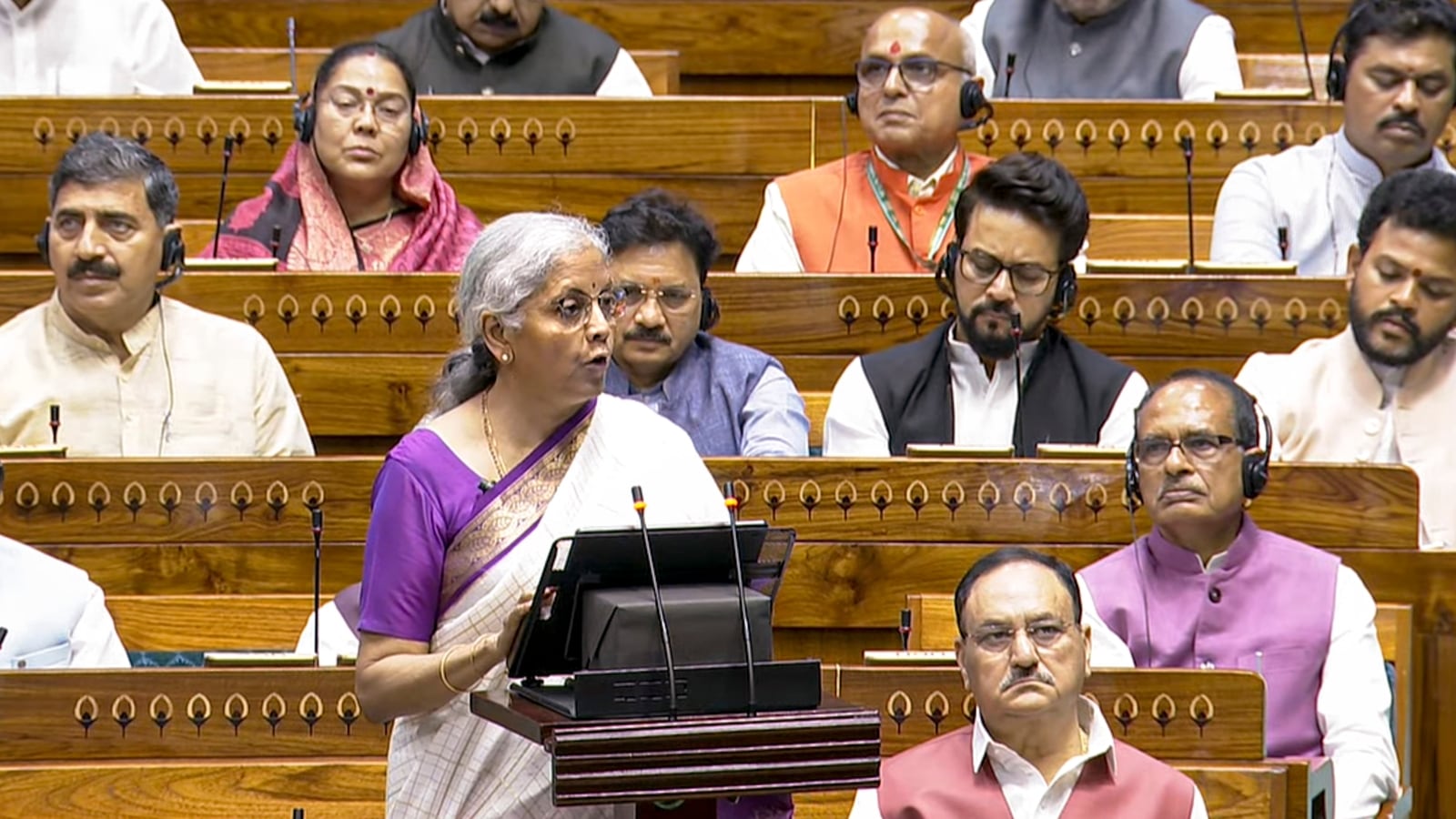

Union Budget 2024: Political Uproar Expected in Parliament Today, Watch Video | ABP News

ABP News

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

How Will Budget 2024 Impact The Aam Aadmi?

ABP News

Union Budget 2024: INDIA Alliance to Protest Against Budget Today | ABP News

ABP News)

Budget 2024 creates a template for reforms in Modi 3.0

Firstpost

Union Budget 2024: As Crypto Taxes Remain Unchanged, Here Are Top Takeaways For Investors & Market

ABP News

Union Budget 2024: Top 5 takeaways for salaried persons, job seekers

Hindustan Times

Union Budget 2024-25: No additional allocation for Chandigarh but curbs on new projects go

Hindustan Times

Letters to The Editor — July 24, 2024

The Hindu

Union budget has ‘betrayed’ people of Delhi, says Atishi

Hindustan Times

Budget 2024: The Indian middle class expected more

Hindustan Times

The budget echoes the Developed India vision

Hindustan Times

Union Budget 2024 provides blueprint for a self-reliant, developed India: U.P. CM Yogi

Hindustan TimesUnion Budget evokes mixed response from Andhra’s political leaders, industry bodies

The Hindu

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times

Watch: Budget 2024 | What’s in it for markets and investors?

The Hindu

Union Budget 2024: Here Are The Major Announcements From FM Sitharaman

ABP News

Union Budget 2024: Sector-Wise Allocation Puts Defence At The Top. Full Details Inside

ABP News

Budget 2024: Just a political exercise to protect interests of Modi govt, says Kerala Finance Minister

The Hindu

Budget 2024: How the new tax regime announced by Sitharaman will impact taxpayers?

India TV News

Budget 2024-25 CAPEX: ₹11 lakh crore allocated towards capital expenditure, 3.4% of GDP by FM Nirmala Sitharaman

The Hindu

Budget 2024: How will it impact the common people and consumers? CHECK here

India TV News

Union Budget 2024: From Smartphones To Plastic Goods, What Will Become Cheaper & Costlier? Check Out

ABP News

Union Budget 2024: Where does Centre spend the most money?

Hindustan Times

Budget 2024 Capital Gains taxation: Corporate tax for foreign companies slashed to 35%, charities, cruise operations taxation revised

The Hindu

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

Budget 2024: Income tax slabs changed, standard deduction increased. Read details

Op India

Budget 2024 Highlights on income tax: FM Sitharaman revises personal income tax slabs; taxation rates remain unchanged

The Hindu

What Budget means for taxpayers: 10 points

Hindustan Times

2024 Union Budget 2024: Mobile phones, chargers set to be cheaper as customs duty slashed

The Hindu

Budget 2024 Boost To New Tax Regime: Standard Deduction Raised To Rs 75k From Rs 50k

News 18

9 priorities of Union Budget 2024: Energy security to next-gen reforms

Hindustan Times

Union Budget 2024 India: Sitharaman Announces 5 Schemes Focusing On 4.1 Crore Youth Over Next 5 Years

ABP News

Union Budget 2024: 7 key figures to gauge Indian economy's health under Sitharaman

Hindustan Times

Union Budget 2024: What politicians expect - addressing unemployment and inflation issues, increasing fund assistance

Live Mint

Budget 2024: How stock market has performed on Budget day in last 10 years? | Know here

India TV News

Union Budget 2024 Highlights: Record High Capex In Budget Will Drive The Economy, Says PM Modi

ABP News

Income Tax Budget Highlights: Govt proposes tax cuts, more standard deduction

Hindustan Times

Budget 2024 announcements on new tax regime: Standard deduction increased, check new tax slabs

India TV News

Budget 2024 HIGHLIGHTS: Andhra Pradesh, Bihar major gainers; special focus on jobs, new tax regime

India TV News

Union Budget 2024: Read Finance Minister Nirmala Sitharaman's full speech

India Today

Budget 2024 Highlights: FM disappoints investors, rewards (some) taxpayers

Hindustan Times

Budget 2024: Date, key timings and what to expect from budget speech

India Today

Union Budget 2024: 6 new changes to income tax that the new budget may bring

Hindustan Times

Budget 2024 Expectations Highlights: Will Govt Bring Changes In Old and New Tax Regimes?

News 18

Major reforms expected by key sectors in Budget 2024, will it deliver?

New Indian Express

Sitharaman to present Budget 2024: Understanding the Budget, its impact on India's economy

India TV News

Budget 2024: Will FM Nirmala Sitharaman fulfill your income tax wishes?

India TodayDiscover Related