From Apr 1, these 10 big income tax rule changes to be effective. Details

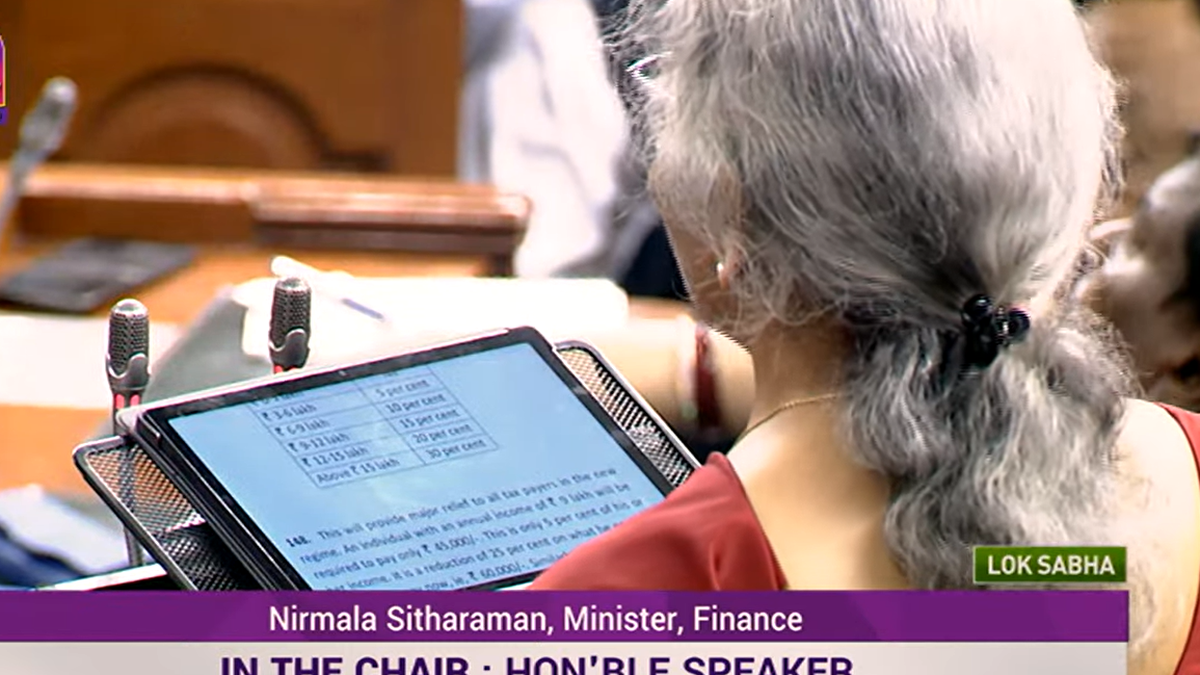

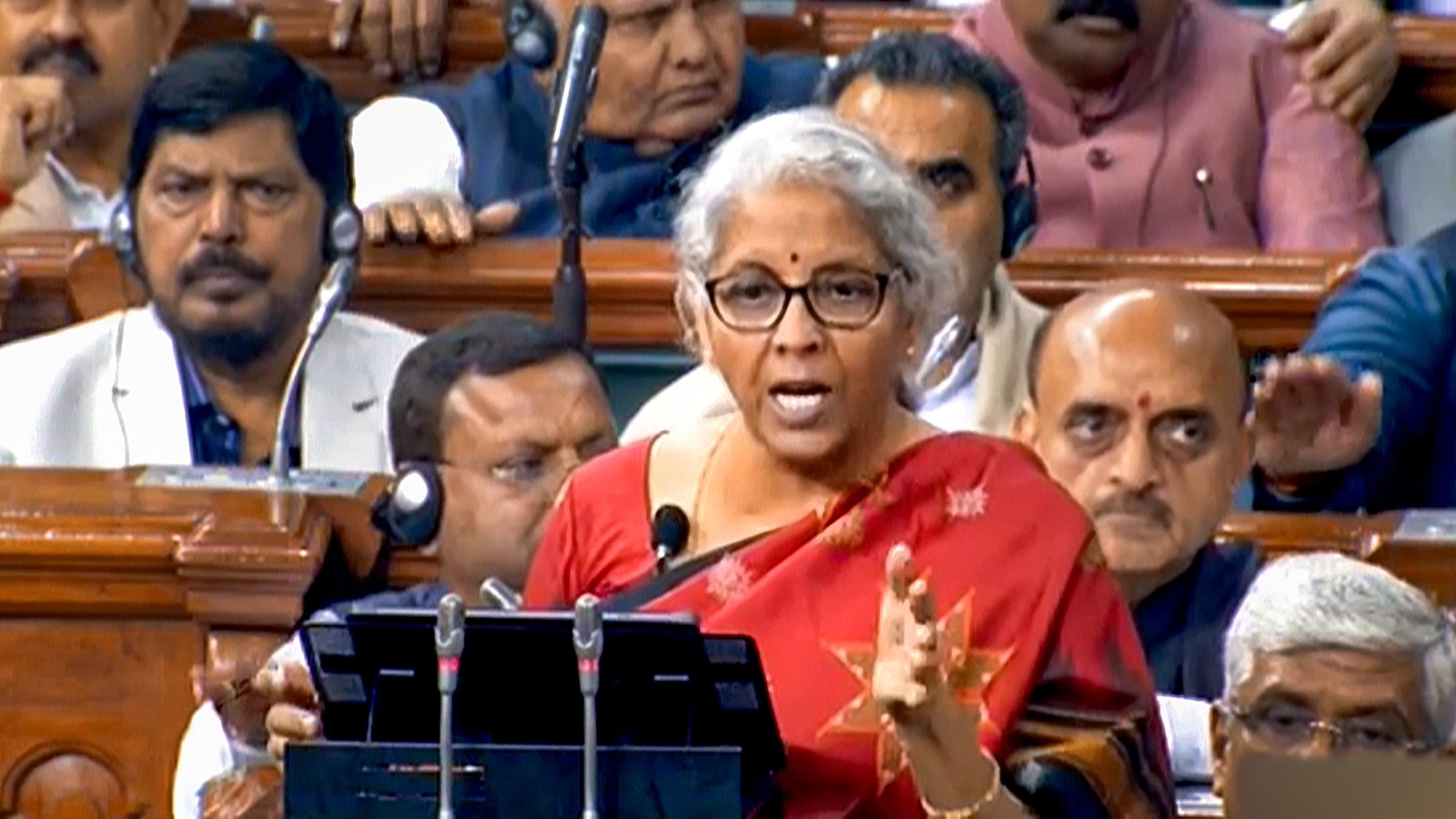

Hindustan TimesThe new financial year 2023-24 will begin on April 1 and the announcements made by Union finance minister Nirmala Sitharaman in the annual Feb 1 Union budget will come into effect as soon as FY23 kicks in. Representational Image Here are, therefore, the 10 major income tax rule changes effective from April 1: Default tax regime: As announced by the finance minister, the new tax regime will be the default regime if, while submitting returns, a person does not state which of the two regimes – old or new – will they submit the return under. This facility has now been extended to the new regime, and, therefore, a salaried person with an yearly income of ₹5.15 lakh or more, will benefit by ₹52,500. Income tax slabs: The new tax rates are: Yearly salary up to ₹3 lakh: Nil ₹3 lakh- ₹6 lakh: 5% ₹6 lakh to ₹9 lakh: 10% ₹9 lakh to ₹12 lakh: 15% ₹12 lakh to Rs15 lakh: 20% Above ₹15 lakh: 30% LTA: The leave travel allowance encashment limit, which was ₹3 lakh since 2002, now raised to ₹25 lakh. Benefits for senior citizens: Maximum deposit limit under senior citizens savings scheme extended to ₹30 lakh from ₹15 lakh, to ₹9 lakh from ₹4.5 lakh and to ₹15 lakh from ₹7.5 lakh for monthly income scheme.

History of this topic

Income tax share from below ₹10 lakh group shrinks over 10 years, high earners dominate

Live Mint

It is time India started indexing tax slabs and exemptions with inflation

Live Mint

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

New income tax regime: Check how much tax you will pay now

India Today

Budget 2024: Time to opt out of old tax regime? Explained

Hindustan Times

Income tax benefits, capital gains tax hike, cheaper phones | Key Budget takeaways

Hindustan Times

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times)

Calculation: Will you pay more income tax or less after Budget 2024 changes?

Firstpost

Afternoon briefing: New tax regime slabs revised in Budget 2024; IIT Delhi's submission to SC in NEET row; and more

Hindustan Times

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

New tax regime slabs revised, standard deduction hiked to Rs 75,000. Details here

India Today

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

Budget 2024: Taxpayers, you can expect these 6 income tax benefits on July 23

Hindustan Times

Budget 2024: This change to old income tax regime can provide relief to millions

India Today

Gold prices rise 7.60% this month. Which income tax rules apply and how?

Hindustan Times

New Tax regime rules to come into effect from today: Check deductions, rebates, changes in tax slab

India TV News

Major Income Tax Reforms Effective From April 1: What You Need To Know

ABP News

Budget 2024: No change in tax regime this year; check old, new tax slabs

India TV News

More Than 5 Crore Taxpayers Opt for New Tax Regime 2023

News 18

10 Income Tax Rules That Are Changing From April 1, 2023

News 18

New tax regime, rules to roll out from Apr 1. Here’s what taxpayers need to know

Live Mint

Everything To Know About the New Income Tax Regime 2023

Hindustan Times

New income tax regime: How to save tax if annual income is above ₹7 lakh?

Live Mint

How taxes are calculated on salary above ₹7 lakh in new regime? A quick view

Live Mint

New Tax System Less Complicated…Every Indian Should Make A Choice: FM to News18

News 18

Income tax clarity day after Budget 2023: Which scheme works best for you

India Today

Budget 2023: This is how much tax you can save under New Tax Regime

Live Mint

Opt new tax regime if deduction, exemption claims less than Rs 3.75 lakh: Official

India Today

Budget 2023: How the new tax regime is different from the existing one

Hindustan Times

What Budget document tells us about new Income Tax slab

Hindustan Times

Budget 2023: Old income tax slab vs new income tax slab

India Today

Budget 2023: Big hike in tax exemption on encashed leaves for non-govt staff

Hindustan Times

No income-tax upto Rs 7 lakh in new tax regime

Deccan Chronicle

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax

The Hindu

Budget 2023 new income tax slabs: How to calculate your tax

Hindustan Times

Budget 2023: No income tax up to ₹7 lakh, revised tax slabs for new regime

Hindustan Times

Budget 2023: How are old and new income tax slabs different from each other

Hindustan Times

Income Tax Slabs: Tax Rates Under Old And New Regime Ahead of Union Budget 2023

News 18

Budget 2023: Govt increases income tax rebate to Rs 7 lakh per annum | 5 major announcements

India TV News

Centre mulls cutting tax rates in new income tax regime

Live Mint

5 new income tax rules that will come into effect from 1 April

Live MintUnion Budget 2021 | Income tax calculator

The Hindu)

Budget 2021: Know All About the Existing Income Tax Slabs

News 18Discover Related

)