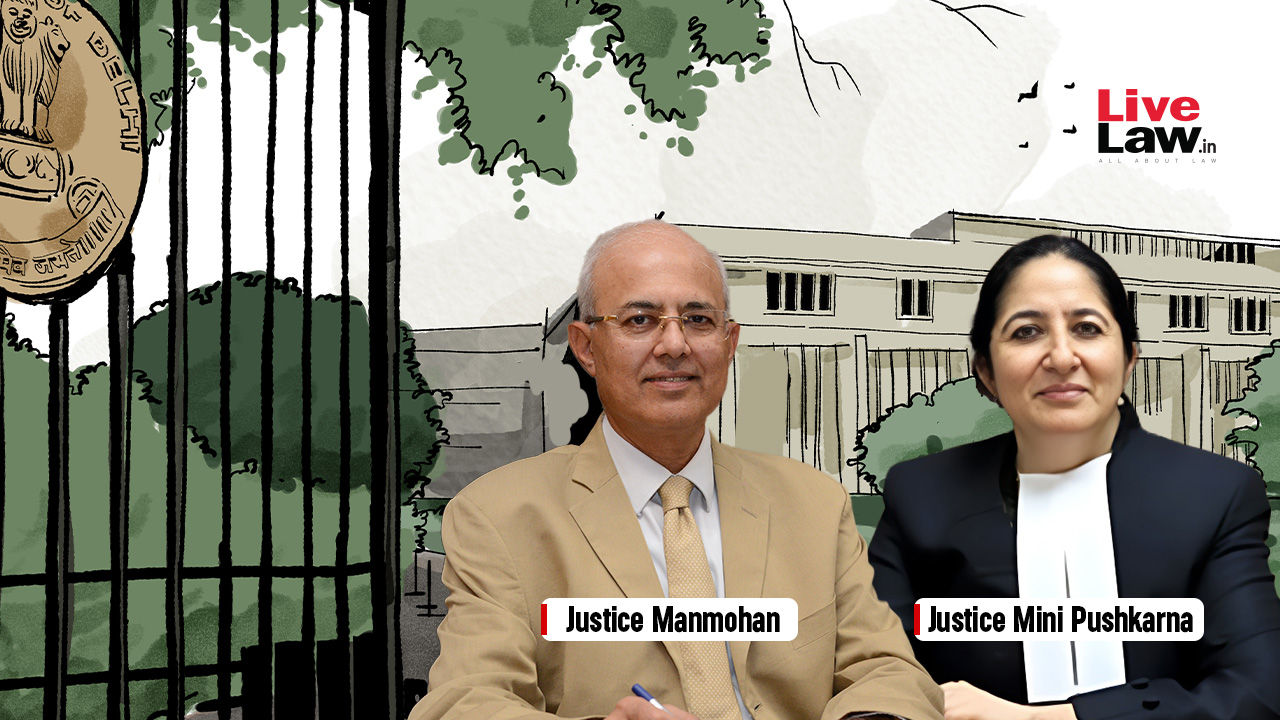

Investment In Shares In Indian Subsidiary 'Capital Account Transaction', Not Income: Delhi High Court

Live LawThe Delhi High Court has held that investment in shares by a company in its Indian subsidiary is a “capital account transaction” which does not give rise to any income. Placing reliance on the earlier decision of Delhi High Court in Nestle SA v. Assistant Commissioner of Income Tax, the bench comprising of Acting Chief Justice Manmohan and Justice Mini Pushkarna held “It is settled law that investment in shares in an Indian subsidiary cannot be treated as 'income' as the same is in the nature of “capital account transaction” not giving rise to any income.” Factual Background The petitioner in leading petition, M/s Angelantoni Test Technologies SRL, is a foreign company and is a resident of Italy. Further, reliance was placed on Divya Capital One Private Limited vs. Assistant Commissioner of Income Tax Circle 7 Delhi & Anr., wherein the Delhi High Court had held “'Whether it is “information to suggest” under amended law or “reason to believe” under erstwhile law the benchmark of “escapement of income chargeable to tax” still remains the primary condition to be satisfied before invoking powers under Section 147 of the Act'.” Accordingly, the Court set aside the notices issued under Section 148A of the Income Tax Act and all consequential proceedings. Case Title: M/S Angelantoni Test Technologies Srl V. Assistant Commissioner Of Income Tax, Circle Int Tax 1 & Ors Citation: 2024 LiveLaw 25 Counsel for Petitioners: Mr. Ved Jain, Ms. Nischay Kantoor, Ms. Soniya Dodeja, Mr. Salil Kapoor, Ms. Ananya Kapoor, Mr. Sumit Lalchandani, Mr. Vibhu Jain, Mr. Kamal Sawhney, Mr. Nikhil Agarwal, Mr. Nishank Vashishtha, Mr. Tarun Gulati, Sr. Advocate with Ms. Ishita Farsaiya, Mr. Apoorv Shukla, Mr. Pursoth Kannan, Mr. Kumar Visalaksh, Mr. Udit Jain, Mr. Arihant Tater, Mr. Ajitesh Dayal Singh.

History of this topic

Long Term Capital Gain On Sale Of Shares By Mauritius Company Is Not Liable To Be Taxed In India: ITAT

Live Law

Investment Made From Share Premium Without Any Noticeable Business Activity, Legitimacy Of Income Not Established: Calcutta High Court

Live Law

Direct Tax Cases Weekly Round-Up: 5 To 11 May 2024

Live Law

Direct Tax Cases Weekly Round-Up: 7 April To 13 April 2024

Live Law

Registration Of Shares In Favor Of The Pledgee As The "Beneficial Owner" Does Not Amount To A Sale Of Shares: Delhi High Court

Live Law

Direct Tax Cases Weekly Round-Up: 31 March To 6 April 2024

Live Law

Direct Tax Cases Weekly Round-Up:3 March To 9 March 2024

Live Law

Bombay High Court Weekly Roundup: February 26 To March 3, 2024

Live Law

Investments Made Through Banking Channels Can't Be Disbelieved, Onus On Revenue To Prove Otherwise: Allahabad HC

Live Law

Tax Cases Weekly Round-Up: 05 November To 11 November, 2023

Live Law

Capital Gains Can’t Be Added As Unexplained Cash Credit For Sale Of Penny Stock: Bombay High Court

Live Law

Claim That Investment In Shares Was A Capital Account Transaction, Non-Application Of Mind By AO: Delhi High Court Quashes Reassessment Notice

Live Law

Tax Cases Weekly Round-Up: 18 December to 24 December 2022

Live Law

Tax Cases Weekly Round-Up: 30 October To 5 November 2022

Live Law

Onus To Prove Identity, Creditworthiness And Genuineness Of Transaction Lies On Assessee: Pune ITAT

Live LawDiscover Related

![[Taxation Law] Market Research, Promotional Activities, Training Or Deployment Of Software Are 'Auxiliary Functions' Under DTAA: Delhi HC](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

![[Taxation Law] Market Research, Promotional Activities, Training Or Deployment Of Software Are 'Auxiliary Functions' Under DTAA: Delhi HC](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

![Delhi High Court Monthly Digest: November 2024 [Citations 1193 - 1304]](https://www.livelaw.in/h-upload/2022/02/01/408682-delhi-high-court-monthly-digest.jpg)

_1653629830547_1734242852120.jpg)