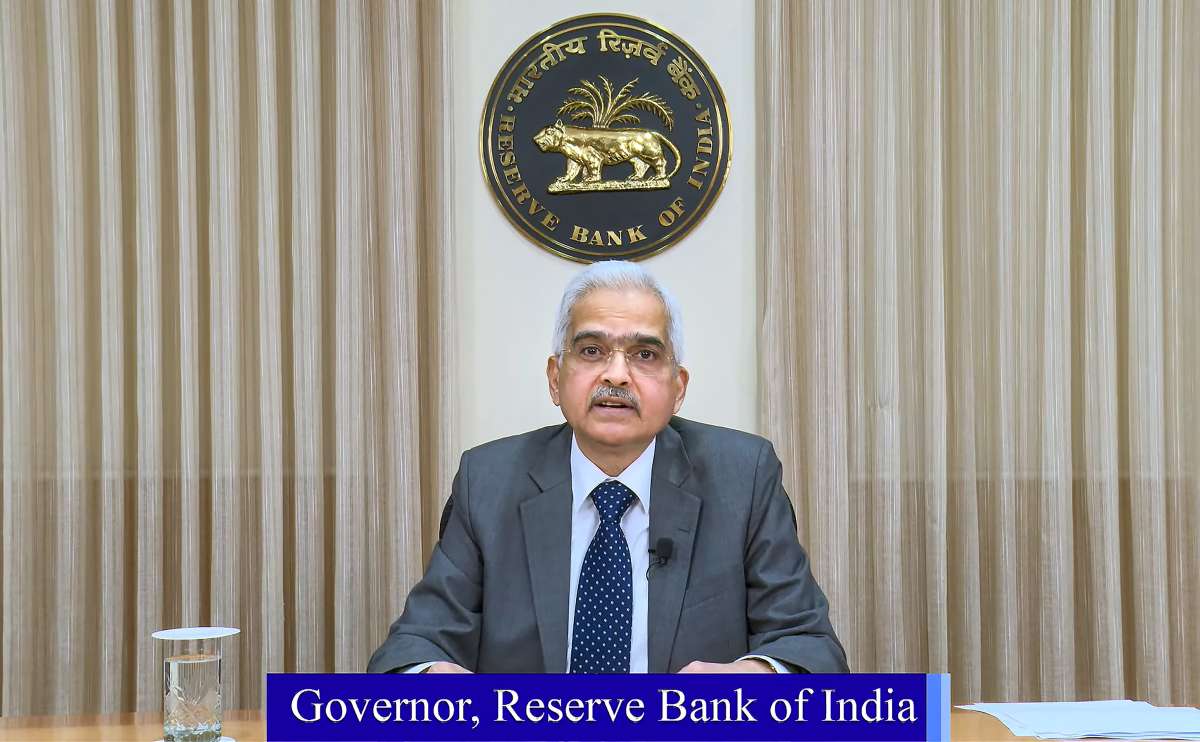

Digital lenders should stick to businesses they are licensed to do: RBI governor

Live MintMUMBAI: Digital lenders should operate within the guardrails of regulatory guidelines and adhere to the specific licences granted to them, Reserve Bank of India governor Shaktikanta Das said on Friday. Without permission if they are engaging in activities for which they have no license then it is not acceptable,” Das said at Bank of Baroda’s annual banking conference. Das said RBI cannot allow risk to build up in the system and added that within the next few weeks, it will release the much-awaited digital lending norms. In November last year, the committee set up by the central bank suggested reining in digital loan apps through a mix of regulations, including setting up of a nodal agency to verify their credentials and legislative measures to prevent “illegal lending”.

History of this topic

Govt proposes new legislation to curb proliferation of illegal lending apps

New Indian Express

Suggestions from over 100 entities on Digital Competition Bill under consideration: FM

Live Mint

The impact of technology on finance: Enhancing experiences and safety

Hindustan Times

6 key steps RBI has taken to ensure safe banking practices. Details here

Live Mint

RBI Governor says no need to worry about fintech system at the moment

New Indian Express

Harmonizing Horizons: Unravelling Digital Lending Regulations in a Global Context

Live Law

RBI enhances UPI payment limits for healthcare and education

The Hindu

7 reasons why it is essential to stay cautious of digital lending apps

Live Mint

Cooperative banks will soon be able to do compromise settlements, write-offs on NPAs: RBI Governor

India TV NewsRBI asks banks, NBFCs to promote digital payments

The Hindu

Fintech-Driven Digital Lending To Bridge Credit Gap In India, Says Report

News 18

Private quasi-regulatory entities offer digital strength

Live Mint

Mint Explainer: How to prevent the birth of digital monopolies

Live Mint

Why CCI matters for protecting customers from digital players

Live Mint

ED raid on loan apps reveals strong Chinese presence in crypto crimes

The Hindu

Explained | Why has the RBI come out with a framework to regulate digital lending?

The HinduRBI issues guidelines to regulate digital lending

The Hindu

Under RBI’s ombudsman scheme, 7,813 complaints received against digital apps and recovery agents

The Hindu

RBI To Soon Come Out With Guidelines On Digital Lending, Says Shaktikanta Das

News 18

RBI unveils guidelines for digital banking units. Here’s 10 key points

Live Mint

RBI finds 600 illegal lending apps operating in India

India Today

Let reputed industrial houses run banks

Live Mint

Fintech industry body seeks regulatory nod to act as SRO

Live Mint

Credit-starved India Cannot Achieve Double-digit Growth. It Needs Digital Banks for Lending

News 18

Beware! 600 fake money lending apps operating in India, says RBI report

India TV NewsRBI report finds 600 illegal loan apps operating in India

The Hindu

Digital lenders must help the vulnerable access productive credit

Live Mint

RBI receives complaints against 1,509 digital lending apps

India TV News

RBI received complaints against 1,509 digital lending apps

Hindustan Times

RBI panel to examine digital lending risks

Live MintRBI forms working group on digital lending

The HinduBeware of illegal digital lending apps: RBI

The HinduDiscover Related

)