Reserve Bank 'grappling' with house price boom questions, internal documents show

ABCAustralia's central bank is "grappling" with questions about risky first-home buyers and a strong increase in home loans, according to meeting notes and internal discussions about the nation's white-hot housing market. Key points: As house prices soar, Reserve Bank economists are wondering if first-home buyers are riskier than other borrowers Lending standards are tighter and approval times are blowing out A "good deal" of the HomeBuilder subsidy is bringing forward construction that would have happened anyway The documents, obtained from inside the Reserve Bank of Australia using the Freedom of Information process, reveal senior staff hold concerns the HomeBuilder program may not have created new investment but simply brought demand forward. April's Liaison on Current Conditions report noted sales of greenfield land remained above pre-COVID levels: "because of continued support from the scaled back HomeBuilder program and low interest rates. "New home lending has gone through the roof in recent months as first-home buyers, upgraders and renovators storm back on to the property scene, driven by a practical need for more space and bolstered by record low rates and government programs," she said.

History of this topic

Budget 2024: Huge funds injection promises billions to build homes quicker - here are the Aussies most likely to benefit

Daily Mail

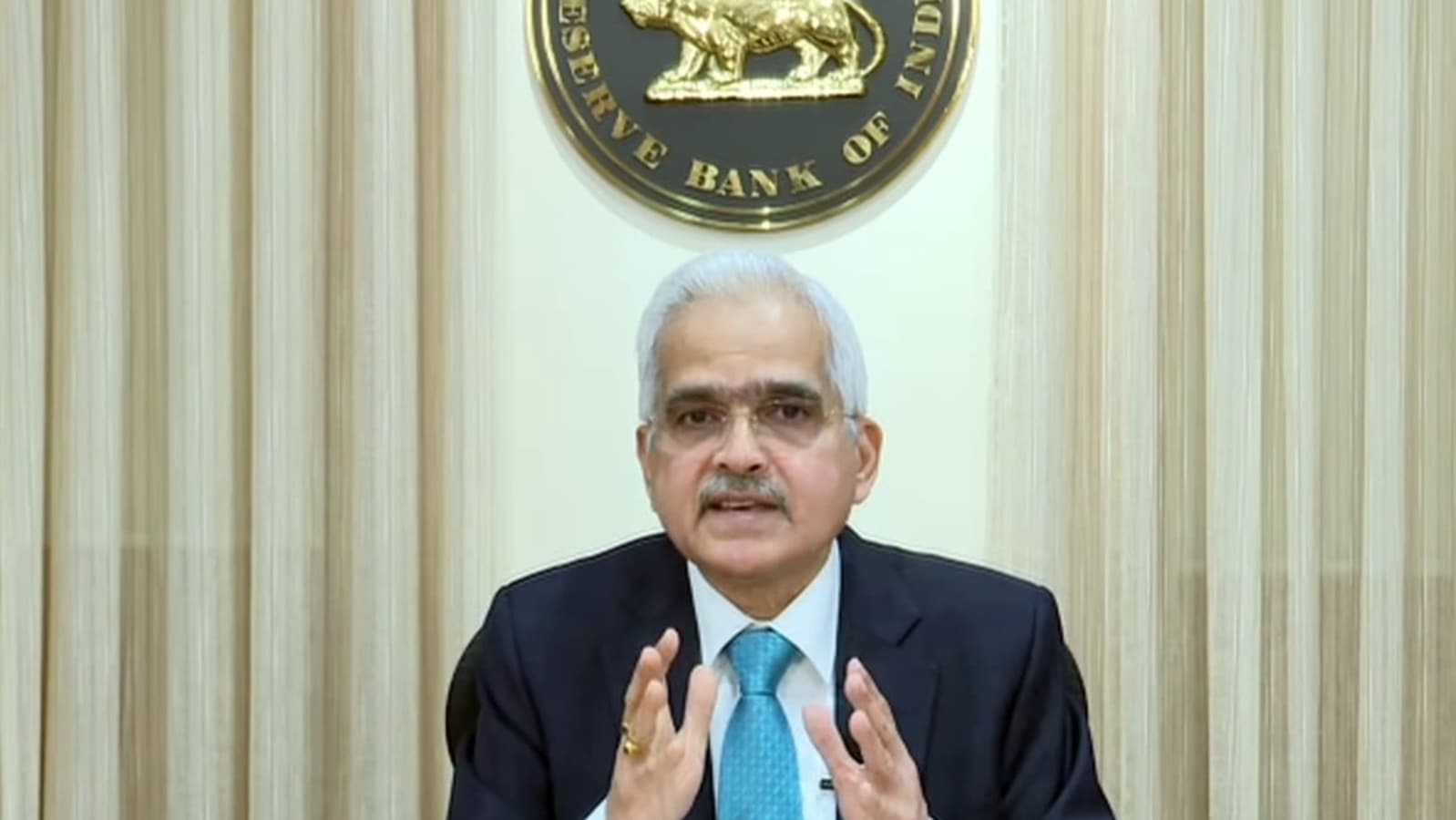

Reserve Bank of Australia Governor Michele Bullock reveals why business failures are at the highest level in a decade and Labor's new policy to address construction skills shortages

Daily MailReserve Bank raises interest rates for eighth straight month

ABCHomeBuilder and first home buyer grants made housing less affordable says Reserve Bank

ABCDiscover Related