)

Can India’s UPI Payment Model be Replicated in US and Europe? Tech Diplomacy Could Make it Happen

News 18Bitcoin’s price tumbled last month following the news that regulators in China would ban domestic banks from dealing in cryptocurrencies. In response, China, India along with several countries’ central banks have floated ideas for a Central Bank Digital Currency, a digital representation of a nation’s currency backed by blockchain technology. Indeed, seeing the success of Google Pay in India using the UPI architecture, the company wrote to the United States Federal Reserve supporting a similar interbank real-time payments architecture called FedNow in the country. This was done in India to bring more competitiveness in India’s bank payments landscape where customers could pick bank applications with better user experience to access funds from their account. For example, though Jack Ma’s Ant Financial’s fortunes have taken a huge setback following Chinese regulators’ crackdown on his internet conglomerate, the idea of using QR codes for payments has been co-opted by the UPI in India.

History of this topic

NPCI's International Arm Plans To Expand UPI To 4-6 New Countries In 2025

ABP News_1653629830547_1734242852120.jpg)

UPI achieves record 15,000 crore transactions worth ₹223 Lakh Crore by Nov 2024

Hindustan Times

India’s digital payments to grow threefold from 159 bn to 481 bn by FY29: PwC re

Live Mint

India to introduce UPI payment service in Maldives

The Hindu

UPI Disruptions Not NPCI's Fault, Banks' Outdated Tech Is Responsible, Says RBI Guv

News 18

Adani Group to enter UPI, digital payment, credit card business to compete Google and Reliance: Report

Live MintNPCI inks pact with Bank of Namibia for developing UPI-like instant payment system

The Hindu

Tech Tonic | The gaps in India’s digital payments ecosystem need plugging

Hindustan Times

India plans to curb Google, PhonePe’s dominance in mobile payments: Report

The Hindu

Paytm gets third-party app license from NPCI to perform UPI transactions

India TV News

UPI now accepted in Nepal: How it works and other key details

Hindustan Times

RBI and Nepal's Central Bank sign terms for UPI-NPI integration

Op India)

India's UPI system leading in cross-border payment, says US treasury official

FirstpostIndia's UPI system leading in cross-border payment: U.S. treasury official

The Hindu

US Treasury official commends India's UPI system for cross-border payment leadership

India TV News

NPCI unveils a suite of digital-payment products

The Hindu

India in talks with countries in LatAm, Africa for UPI, RuPay

Live Mint

Digital Rupee CBDC RBI Governor Shaktikanta Das Can Prove To Be Game Changer For Cross-Border Payments:

ABP NewsIndia ranks first in digital payments made globally: Report

Deccan Chronicle

Apple In Talks With UPI Apps To Launch Apple Pay Service In India: What It Means

News 18

Apple Pay set to launch in India, talks underway with NPCI: All details here

India TV News

How RBI’s proposed new payment system will be different from UPI, NEFT, RTGS

Live Mint

India, Russia plan RuPay-Mir card use amid West sanctions on Moscow

Hindustan Times

From Local To Global: UPI Opens Doors To International Shopping For Indian Buyers

News 18)

From Your Sabziwala to Countries Like Singapore, How UPI Has Changed the Way You Pay - News18

News 18

DC Edit | UPI may be a game-changer

Deccan Chronicle

UPI payment available for international travellers visiting Delhi, Mumbai, Bengaluru airports – Details

India TV News

Inbound Travellers From G20 Countries Can Avail UPI Facility At Three Airports, Says RBI

ABP News

RBI allows UPI-based transactions for inbound travellers to India

The Hindu)

India's UPI and Singapore's PayNow are now linked: How will this benefit users?

Firstpost

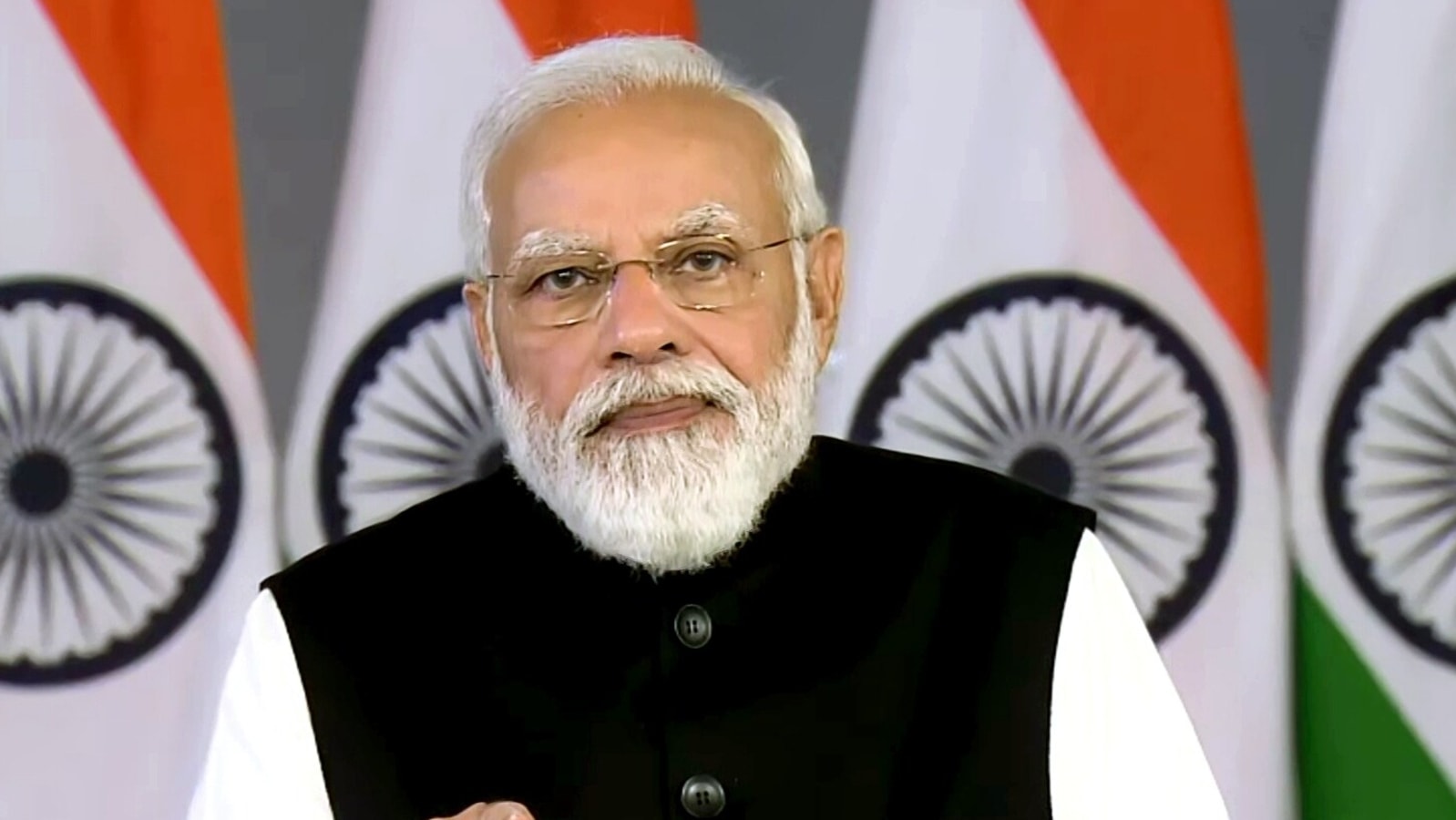

Digital transactions to soon exceed cash in India: PM Modi

Deccan Chronicle

India, Singapore launch linkage of real-time payment systems

The Hindu

Digital payments will soon overtake cash transactions: PM Modi on UPI-PayNow link between India, Singapore

India TV News

Explained | India’s UPI push

The Hindu

India records more digital payments than US, UK, Germany & France: Vaishnaw

Hindustan TimesNRIs from 10 countries can use UPI with their international mobile numbers

The Hindu

RBI’s digital rupee useful in overseas payments: IMF

Deccan Chronicle

Time is right for a digital rupee

Hindustan Times

RBI Mulls Addressing Monopoly of PhonePe, Google Pay in UPI Space; Deputy Guv Explains

News 18

UPI expands further globally; Indian travellers to U.K. to enjoy hassle-free digital transactions

The Hindu

UPI will Act as Delhi’s Digital Bridge to Drive Rupee Across Global Payment Corridors

News 18

UPI: the dawn of digital fintech nirvana

The Hindu

RBI unveils Payments Vision 2025 with intent to increase e-payments

India TV News

RBI allows credit cards to be linked to UPI; Rupay credit cards first in line

The Hindu

The design principles we should employ to shape India’s techade

Live Mint

Modi govt 8 years: How India outpaced world in UPI, digital payments

India TV News

Nepal to Become First Country to Deploy India's UPI Platform

News 18

Nepal to become first country outside India to adopt UPI-based payment system

India TV News

Govt testing UPI Lite to allow payments without internet

Live Mint

PM Modi talks of India's ‘bouquet of hope’ at World Economic Forum

Hindustan TimesDiscover Related

)

)

)