Paytm answers if customers need to pay fee on UPI payments

Hindustan TimesDigital payments firm, Paytm, on Wednesday clarified doubts over National Payments Corporation of India’s latest circular notifying that an interchange fee of up to 1.1% will be applicable on merchant UPI transactions from April 1. In a tweet, the financial tech firm urged to not spread misinformation as it said that “no customer will pay any charges on making payments from UPI either from bank account or PPI/Paytm Wallet.” Paytm on Wednesday urged to not spread misinformation after NPCI's new rule on digital payments through UPI. “Regarding NPCI circular on interchange fees & wallet interoperability, no customer will pay any charges on making payments from #UPI either from bank account or PPI/Paytm Wallet. We will pay 15 bps of charges to banks for adding more than ₹2,000 using UPI, and will also earn 15 bps when any other wallets use Paytm bank to add more than ₹2,000 using UPI.” Earlier in the day, NPCI also clarified the same as it issued a statement and said, “UPI is free, fast, secure and seamless.

History of this topic

Now, you will be able to transfer ₹5 lakh in a single UPI transaction under THIS category: Check details

Live Mint

Paytm starts migrating users to new UPI IDs: What changes for you?

Hindustan Times

Paytm stock gains for 4th consecutive day: Is the worst over?

Hindustan Times

Yes Bank, Axis Bank go live on Paytm's UPI platform: What you need to do

Hindustan Times

Paytm share price up 5% after NPCI grants third-party app license: Will it recover?

Hindustan Times

Paytm Gets TPAP License from NPCI for UPI Payments

Deccan Chronicle

Paytm share price drops 5% ahead of Payments Bank deadline: Will fall continue?

Hindustan Times

Paytm gets third-party app license from NPCI to perform UPI transactions

India TV News

Will @Paytm UPI Work After March 15? Here's What Users Need To Know

News 18

NPCI to examine Paytm's third-party app request for UPI: RBI

Hindustan Times

Do you have @Paytm UPI handle? RBI has a message for you

India Today

Paytm, Axis Bank to apply this week for third-party route for UPI: Report

Hindustan Times

Paytm set to operate as third-party app for UPI: Report

Hindustan Times

Will UPI service continue on Paytm? Company's response

Hindustan Times

UPI will continue to operate as normal, working with other banks for continuity of service: Paytm

India TV News

RBI's action against Paytm Payments Bank explained

Hindustan Times

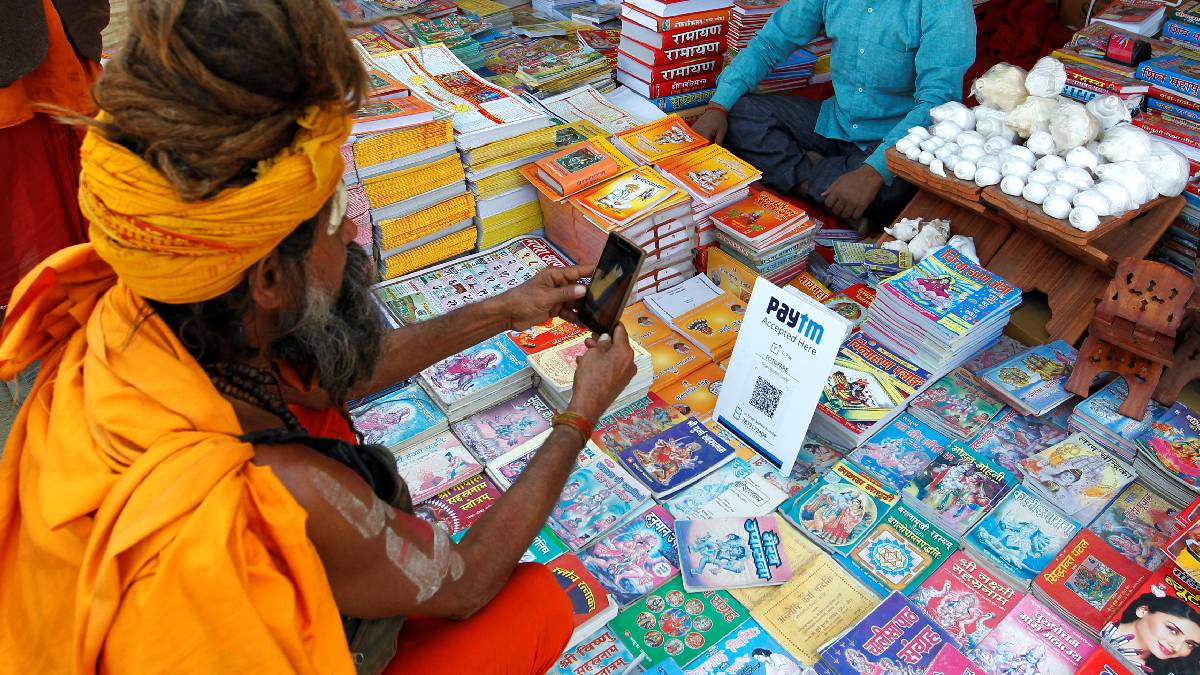

From Kirana Stores To Chai Shops, Paytm Credit Card On UPI Is A Gamechanger For Payments

ABP News

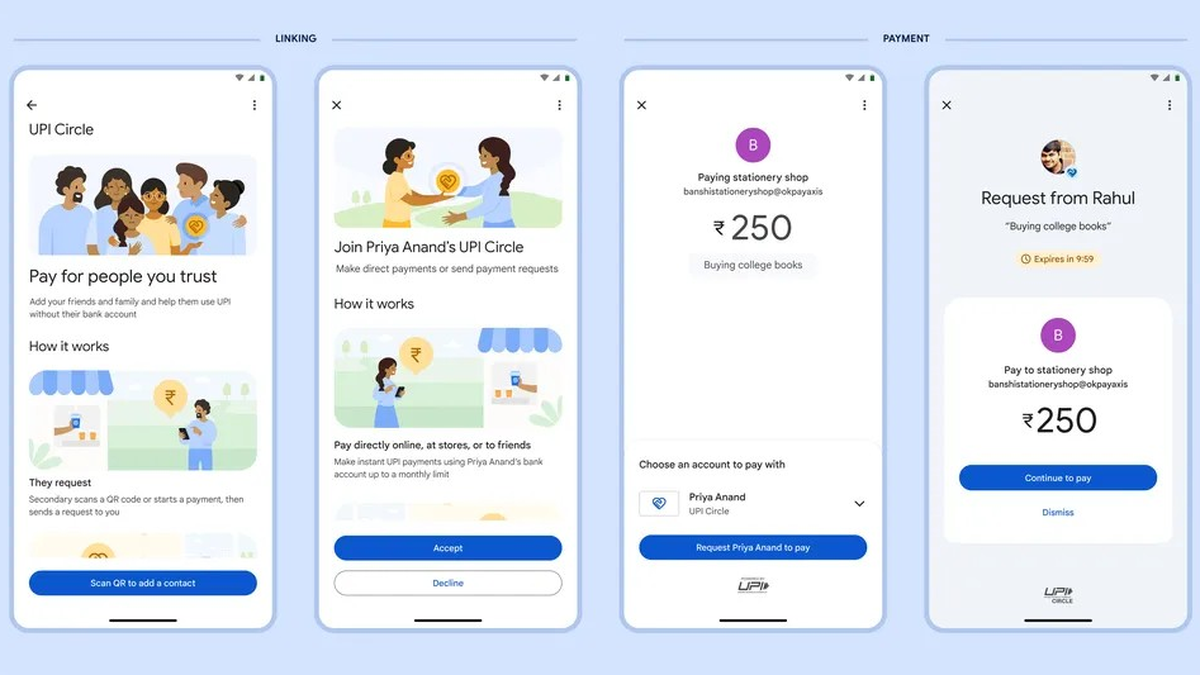

5 new ways to use UPI payments as 2024 begins with these rule changes

Hindustan Times

India’s Growth Story is Linked to Progress Made on Digitisation and Its Access

The Quint

Apple Pay set to launch in India, talks underway with NPCI: All details here

India TV News

All your questions about transactions made with PPIs via UPI, explained

The Hindu

How can you make payments using a credit card via UPI: Step-by-step guide

India TV News

NPCI says no charge on 'normal' UPI payments; but is free service sustainable?

Hindustan TimesNo charge on normal UPI payments: NPCI

Deccan Chronicle

Gpay, Paytm, other users need not worry about new surcharge; Know reason

Hindustan Times

'Main Payment Nahi Karega': UPI Charges For Over ₹2000 Transaction Trigger Meme Fest

News 18

What's Changing With UPI Merchant Transactions from April 1? EXPLAINED

News 18

UPI Is Free And Safe! Customers Pay Nothing, Only PPI Merchant Transactions Pay Interchange Fee: NPCI

News 18

PPI Wallet transactions of over ₹2,000 on UPI to attract 1.1% charge from April 1, 2023

The Hindu

UPI Merchant Transactions To Carry Interchange Fee From April 1; Check Threshold And Other Details

News 18

Will online payments become costlier? NPCI recommends this…

Hindustan Times

No, UPI payment will not be charged extra because NPCI 1.1 per cent fee has a fine detail you need to know

India Today

UPI merchant transactions above Rs 2,000 via PPIs to attract 1.1% interchange fee: NPCI issues new rules

India TV News

Paytm Payments Bank Enables UPI LITE For Faster Small-Value Transactions

ABP News

RBI allows UPI-based transactions for inbound travellers to India

The Hindu)

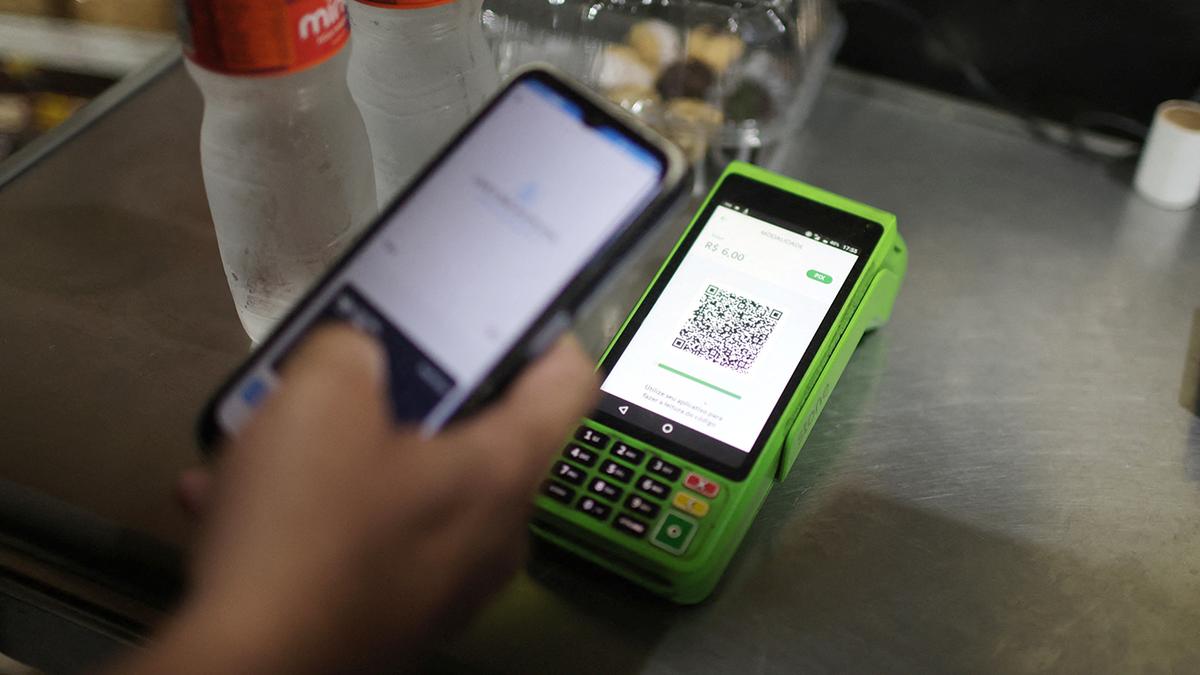

India's UPI and Singapore's PayNow are now linked: How will this benefit users?

Firstpost

How UPI Has Become A Strong Revenue Source For Fintech Pioneer Paytm

The Quint

Paytm's UPI Lite will now let users make payments without using PIN

India Today

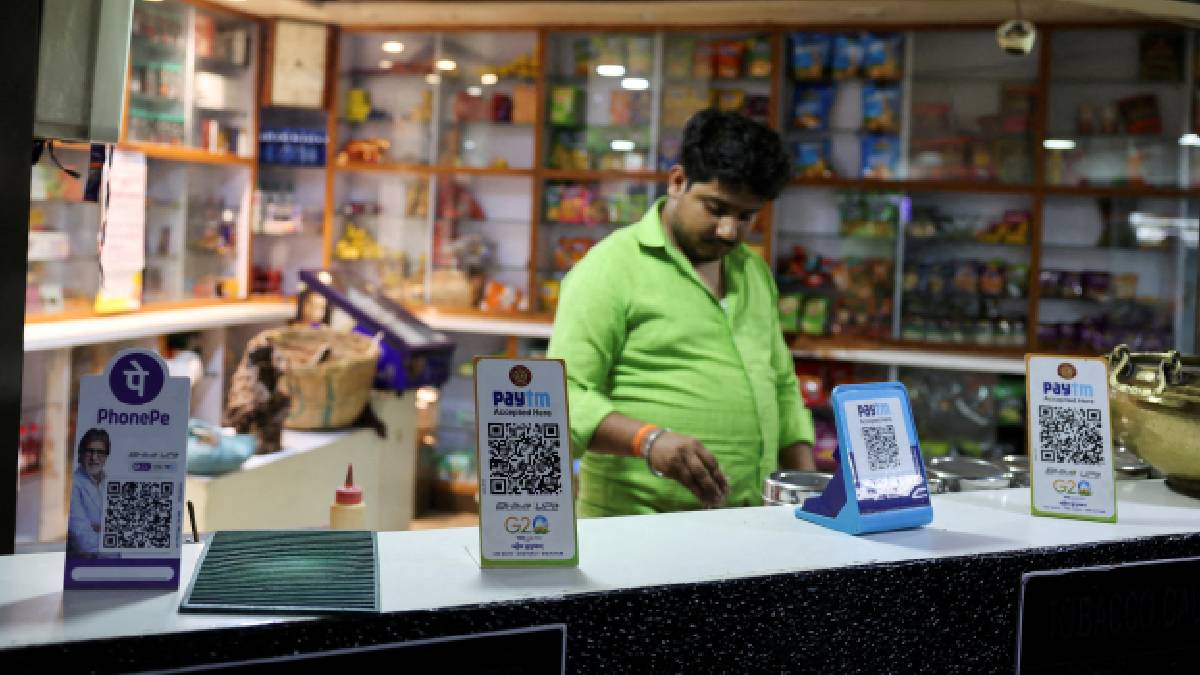

Paytm launches G20-theme QR Code to celebrate India’s presidency: Know-more

India TV News

No charges on using RuPay credit card for UPI transactions less than ₹2,000

Hindustan Times

Should UPI Charge a Fee? Global Payment Lobby Wants It, RBI Must Ensure Otherwise

News 18

No Consideration to Levy Any Charges for UPI Services: Finance Ministry

News 18

UPI: the dawn of digital fintech nirvana

The Hindu

How Will UPI-Credit Card Linking be Different from Credit Card Payment on Paytm, MobiKwik?

News 18

RBI allows credit cards to be linked to UPI; Rupay credit cards first in line

The Hindu

Paytm Money allows HNI investors to bid higher amount of up to ₹5 lakh for IPOs

Live Mint

Paytm Bank barred from adding new customers

Deccan Chronicle

UPI Payment Without Internet, Smartphone: RBI to Launch UPI for Feature Phones Today

News 18

RBI to soon float paper on reasonableness of charges on transactions via digital payments

India TV NewsDiscover Related

_1653629830547_1734242852120.jpg)