How to overcome the dilemma of financial planning

Live MintSridhar, 52, is among the many people I have interacted in his age group who are facing difficult money-related decisions. Figuring out how to fund a sudden increase of 2-4 times the amount needed for a financial goal is baffling many individuals and has become one of the most asked questions. Given the ease of obtaining loans, education loan or loan against gold and/or mortgaging a property are the other options considered to fund the shortfall. Frankly, it is impossible to double or triple savings for a goal in a 2-year period and while loans are preferred over withdrawing EPF, Indian parents need to have their children contribute heavily towards the repayment of these loans. At every stage of life, evaluating the changing needs realistically and adapting the financial plan to the new normal can result in lesser reliance on loans and leaving retirement funds to compound for a purpose filled future.

History of this topic

“Financial planning for us was about giving our sons the best education, not building a dream home”: Dalveer Singh

Live Mint

Should you fund your child's foreign education with savings, a loan, or both?

Live Mint

78% Wealthy Indian Parents Send Kids Abroad Without Adequate Financial Planning: Report

ABP News

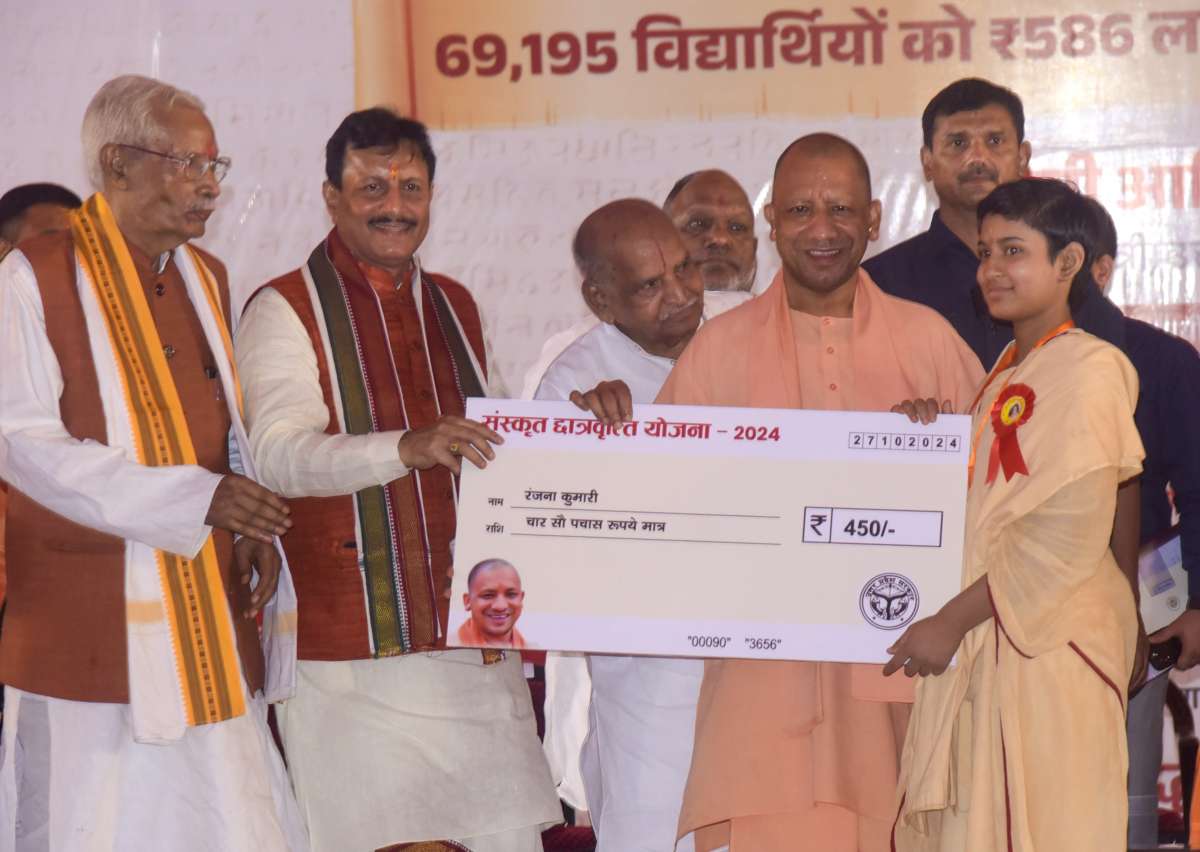

Odisha to roll out ₹2659 crore scholarship for undergraduate and PG students

Hindustan Times

How much should I invest in a SIP for my child’s education?

Live Mint

How do I plan my investments for daughter’s higher education?

Live Mint

Financial planning: How to plan for your child’s future?

Live Mint

How to save enough for your child’s education abroad?

Live Mint

Preparing to fund your child’s higher education? All the things you should know

Live MintDiscover Related