This Clarence Thomas Dissent Reveals His Favorite Tactic for Constitutional Mayhem

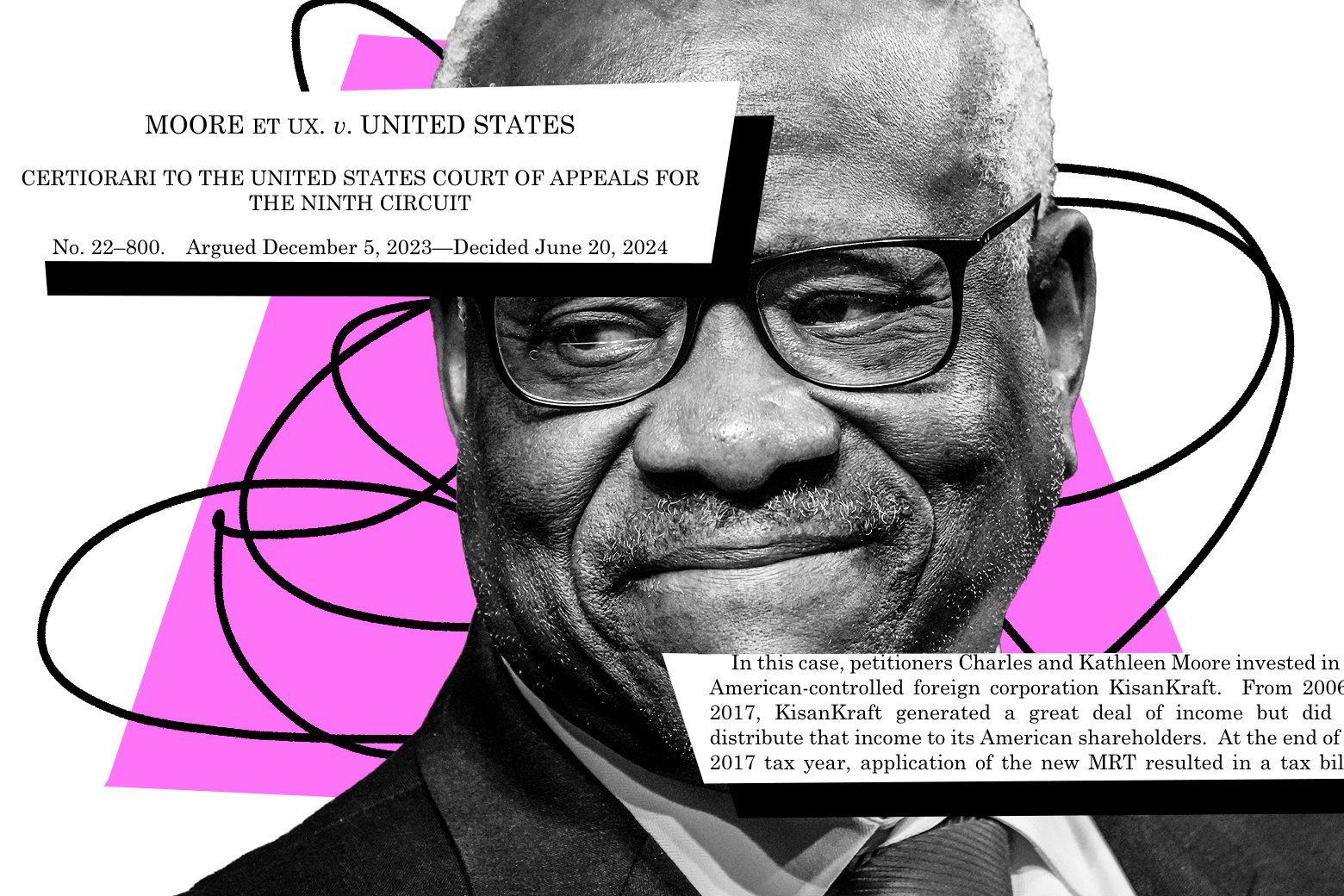

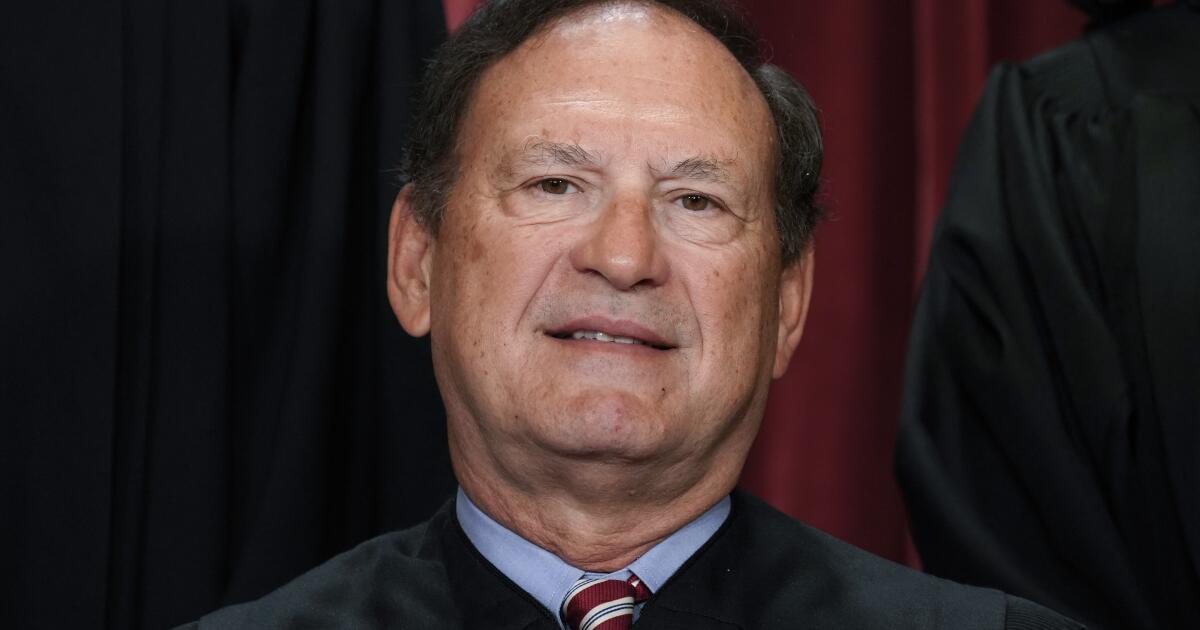

SlateThis is part of Opinionpalooza, Slate’s coverage of the major decisions from the Supreme Court this June. These lawyers argued that the tax was unconstitutional under the 16th Amendment, which allows Congress “to lay and collect taxes on incomes, from whatever source derived.” The word income, they argued, has a “realization requirement”—meaning that the money must reach a taxpayer’s pockets before the government takes a cut of it. According to the justice, the direct tax clause was part of a “delicate” constitutional balance carefully hammered out at the Constitutional Convention to protect states from an overbearing federal government. The amendment marked a “massive political repudiation” of the court’s oligarchical constitutionalism, overruling Pollock and handing Congress the sweeping power to tax income “from whatever source derived.” To Thomas, however, the 16th Amendment was barely a footnote, a “narrow” change that “left everything else in place, including the federalism principles bound up” in the direct tax clause. Yet the court initially refused to accept the amendment: It defied the will of the people in 1920’s Eisner v. Macomber, elevating Pollock’s repudiating interpretation of the vestigial direct tax clause over the 16th Amendment to limit income taxes once again.

History of this topic

Discover Related

![[Income Tax Act] Supreme Court Decision In UOI v. Ashish Agarwal Applicable To Parties Who Challenged Notice U/S 148: Allahabad High Court](https://www.livelaw.in/h-upload/2022/07/19/426550-allahabad-high-court-prayagraj-live-law.jpg)

)