India rupee may stay under pressure, bonds to follow cenbank policy decision

Live MintBy Dharamraj Dhutia and Jaspreet Kalra MUMBAI, Dec 2 - The Indian rupee is likely to remain pressured this week amid persistent portfolio outflows, and take cues from the central bank's monetary policy decision and U.S. labor market data, which will also be key for government bond yields. The Reserve Bank of India's policy decision on Friday will be in focus, followed by U.S. labor market data to gauge the trajectory of U.S. interest rates, especially as analysts reckon Trump's policies may put upward pressure on inflation. "Despite the sharp slowdown in GDP growth, we maintain our view of a pause by the RBI next week given elevated inflation and uncertain global environment," said Upasna Bhardwaj, chief economist at Kotak Mahindra Bank. KEY EVENTS: India ** HSBC India November manufacturing PMI data - Dec. 2, Monday ** HSBC India November services PMI data - Dec. 4, Wednesday ** Reserve Bank of India's interest rate decision - Dec. 6, Friday U.S. ** November S&P global manufacturing PMI final - Dec. 2, Monday ** November ISM manufacturing PMI - Dec. 2, Monday ** November S&P global composite PMI final - Dec. 4, Wednesday ** November S&P global services PMI final - Dec. 4, Wednesday ** November ISM non-manufacturing PMI - Dec. 4, Wednesday ** October factory orders - Dec. 4, Wednesday ** October international trade data - Dec. 5, Thursday ** Initial weekly jobless claims week to Nov. 25 - Dec. 5 Thursday ** November non-farm payrolls and unemployment rate - Dec. 6, Friday

History of this topic

Rupee hits all-time low against US dollar. Why is it under pressure?

India TodayRupee falls 14 paise to close at all-time low of 85.08 against U.S. dollar

The Hindu

Rupee weakens to lifetime low hurt by merchant dollar bids, weak equities

Live Mint

Indian rupee to face renewed pressure as US yields climb

Live Mint

Inflows help rupee end higher on day but weekly losing streak persists

Live Mint

Rupee hits record low, RBI intervention counters bearish tilt

Live Mint

Rupee takes a dive, more turbulence in 2025

Live Mint

Rupee ends marginally lower, near-term bearish bias tipped to persist

Live Mint

Rupee recovers from all-time low, rises 3 paise to close at 84.72 against US dollar

Live Mint

Rupee's slide: What it means for economy, markets, and you

India Today

Rupee eyes breathing room as dollar softens, US bond yields dip

Live Mint

India rupee to gauge portfolio flows, bond yields to eye US peers

Live Mint

Dollar rebound and persistent outflows to keep rupee under pressure

Live Mint

Rupee nearly flat; cenbank intervention supports as equities stay tepid

Live Mint

India bond yields marginally down on value buys, fresh cues awaited

Live Mint

India rupee to lean on central bank help; bonds to track US peers

Live Mint

INR vs USD: Indian National Rupee hits record low of 84.38 against the US Dollar; Will it depreciate further?

Live Mint

Rupee plunges to all-time low of 84.38 against US dollar

India Today

Indian rupee touches all-time low due to equity outflows from domestic market; US elections in focus

Live MintRupee opens on flat note against U.S. dollar in early trade

The Hindu

Rupee unlikely to benefit from softer US payrolls, upbeat risk

Hindustan TimesRupee turns flat at 83.33 against U.S. dollar in early trade

The Hindu

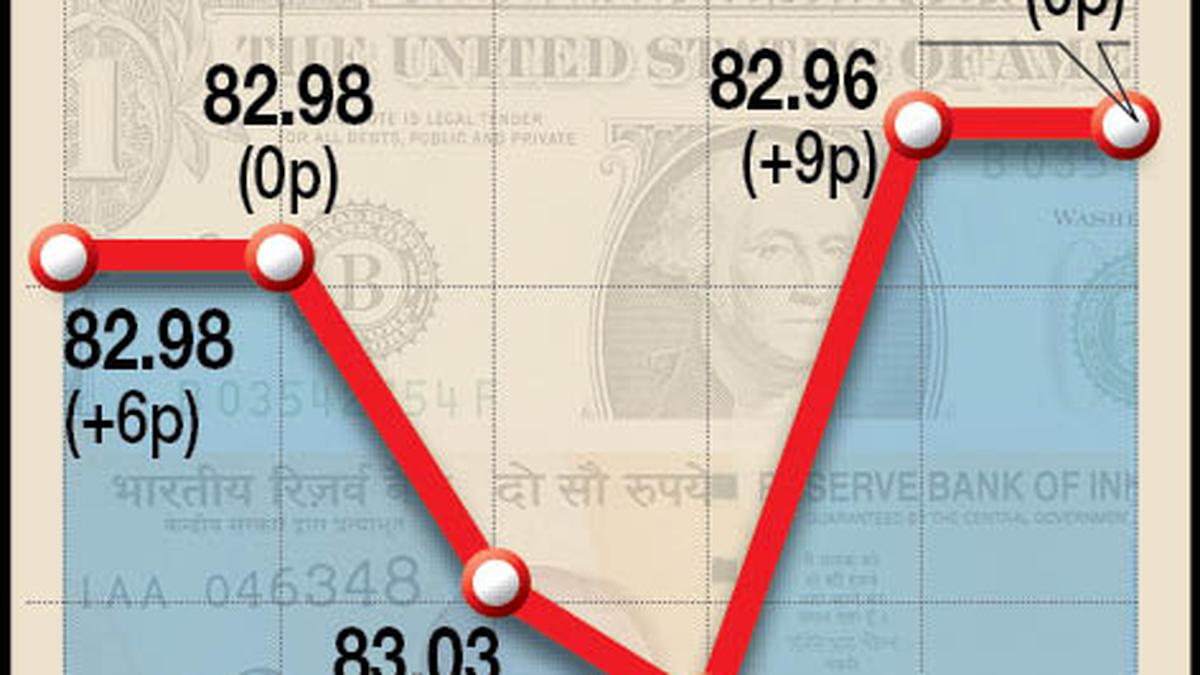

Rupee settles on a flat note at 82.96 after RBI monetary policy decision

The Hindu

Rupee closes stronger, outperforms major Asian peers in January

The Hindu

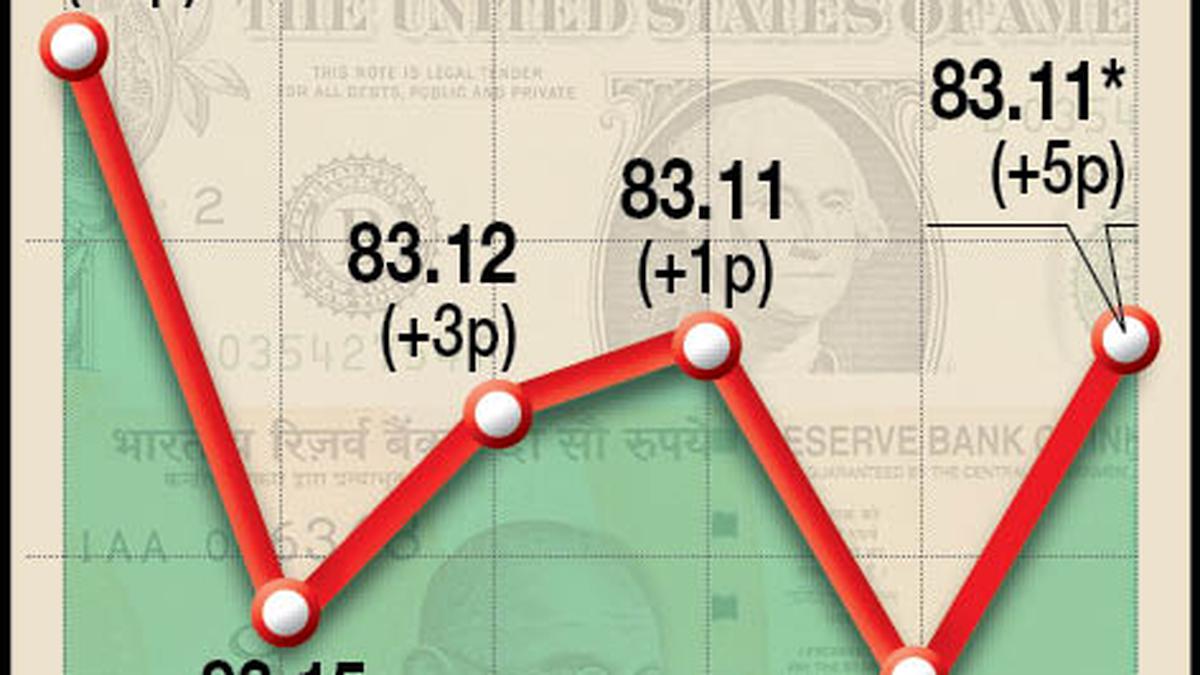

Rupee ends 12 paise lower at 83.18 against the US dollar

Live Mint

Rupee ends little changed at 83.27 against the US dollar

Live Mint

Rupee eyes more gains, bond yield seen in narrow range

Hindustan Times

Rupee, bond yields seen in narrow range as 2022 ends

Live Mint

Rupee falls 27 paise to end at 82.76 against US dollar

Deccan Chronicle

Rupee falls 25 paise to close at 82.53 against US dollar

Deccan Chronicle

Markets end in red; Sensex falls for 3rd day in row, IT stocks worst hit

Live Mint

Rupee depreciates against dollar as focus shifts on Fed minutes, premiums fall

Live Mint

How rupee may move against dollar in November?

Live Mint

With the rupee under pressure, what next

The Hindu

Indian stocks slump on global monetary policy tightening; Rupee at new low

India TV News

Rupee slips to historic low at 80.05 a dollar

The Hindu

Rupee opens at all-time low of 78.86 against US dollar

India Today

A weakening rupee and its broad implications on our economy

Live MintRupee falls to all time low of ₹77.93 against U.S. dollar

The Hindu

Rupee slumps 10 paise to close at all-time low of 77.72/USD

India TV News

Rupee tumbles to a record low on inflation risks, stocks' decline

Hindustan Times

Indian Rupee slumps to all-time low of 77.42 against US dollar

Deccan Chronicle

Rupee slumps 52 paise to all-time low of 77.42 against US dollar in early trade

The Hindu

Rupee Slumps to All-Time Low of 77.42 Against US Dollar Amid Negative Market Sentiments

News 18)

Rupee slips by six paise to 75.02 against US dollar in opening trade

Firstpost

Bond investors see RBI curbing yields amid India’s supply deluge

Live Mint

Rupee closes at 11-month high against dollar

Live MintDiscover Related