)

First Citizens Bank buys SVB's deposits, loans from FDIC

FirstpostThe deal has given markets some respite as it was the first weekend in several weeks that did not bring news of fresh banking collapses, rescue deals or emergency help from authorities to shore up confidence A buyer for Silicon Valley Bank’s deposits and loans helped cast an uneasy calm over fragile markets on Monday, which have been roiled by worries of a credit crunch and systemic bank stress. First Citizen acquires about $72 billion in SVB assets at a discount of $16.5 billion and the estimated cost of SVB’s failure to FDIC’s deposit insurance fund is about $20 billion, the FDIC said. “It’s a little bit of calm before the next storm.” Last week ended with indicators of financial market stress flashing and Germany’s biggest lender Deutsche Bank in the crosshairs, with its shares down 8.5 per cent on Friday and the cost of insuring its bonds against default up sharply. “I don’t think you can sit here and say, ‘Well, that’s all done, Silicon Valley Bank and Credit Suisse and, you know, life will go back to normal,’” Elliott said.

History of this topic

How to protect YOUR cash from banking Armageddon: Shark Tank star Kevin O'Leary warns THOUSANDS more 'radioactive' regional banks could fail like SVB - you'll be amazed how simple it is to be safe

Daily Mail

US regulators seize California's First Republic in latest banking failure

Raw Story

First Citizens Bank will buy SVB’s deposits, loans from FDIC

Live Mint

The global banking turmoil explained; what’s happening at SVB, Credit Suisse

Live Mint

SVB Collapse: What Banks Do With Your Money And What Happens To The Deposits If A Bank Fails

ABP News

US regulators race to start returning some uninsured SVB deposits from Monday

Live Mint)

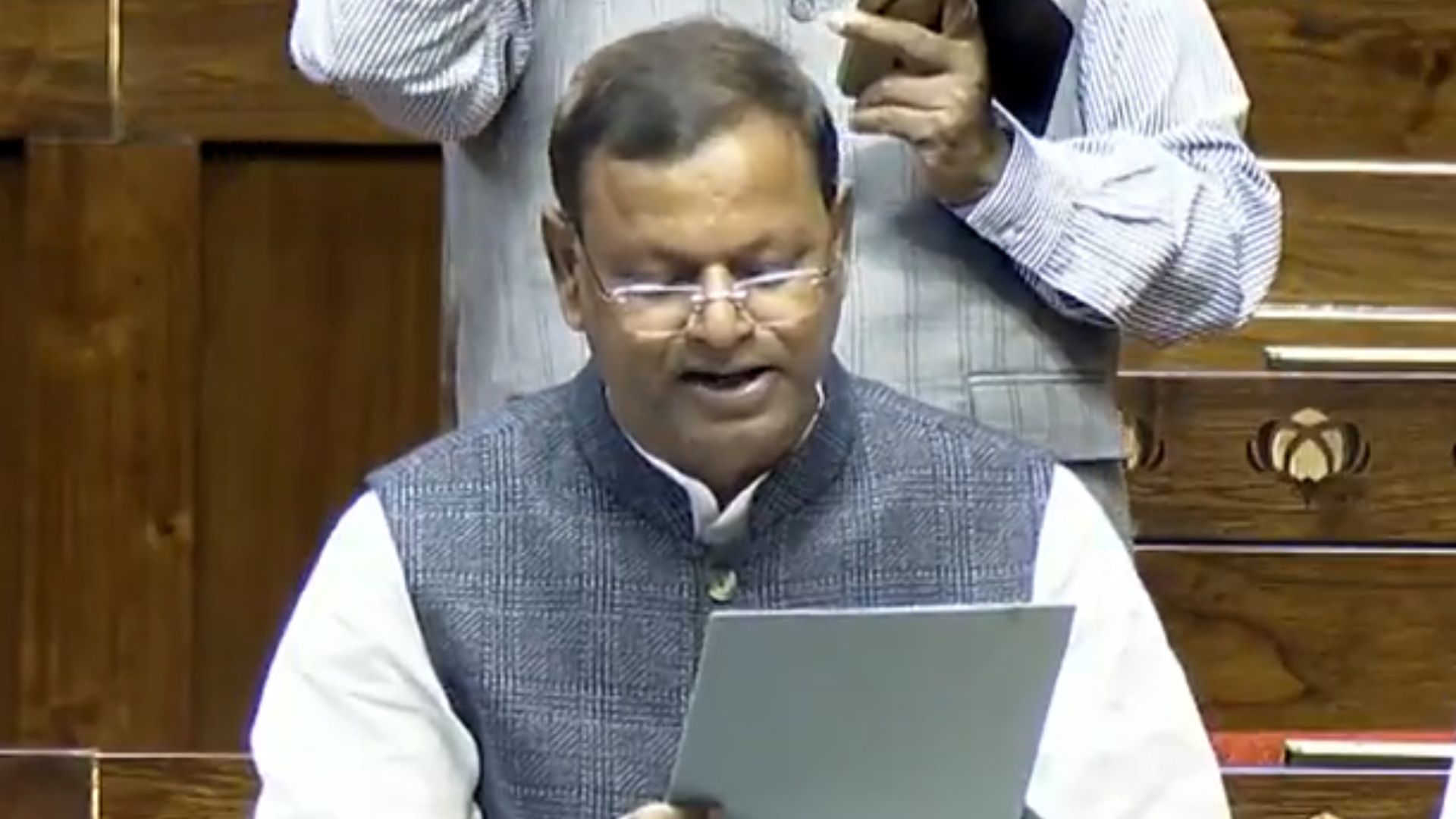

State Ownership Helps Deposit Franchise of PSBs, Divesting Majority Stakes 'Credit Negative': Icra

News 18Discover Related

)