Standard Glass Lining IPO: Hyderabad-based firm garners ₹123 crore from anchor investors ahead of public issue

Live MintStandard Glass Lining Technology Limited has raised ₹123.02 crores from anchor investors ahead of its upcoming initial public offering, set to open for public subscription on Monday, January 6, 2025. The company announced that it has allocated 87,86,809 equity shares to anchor investors at a price of ₹140 per share on Friday, January 3, 2025. Foreign and Domestic Institutions who participated in the anchor included Amansa Holdings Private Ltd, Clarus Capital I, ICICI Prudential MF, Kotak Mahindra Trustee Co Ltd A/C Kotak Manufacture In India Fund, Tata MF, Motilal Oswal MF, 3P India Equity Fund I, Kotak Infinity Fund – Class AC, Massachusetts Institute of Technology, ITI Large Cap Fund. Standard Glass Lining IPO details Standard Glass Lining IPO consists of a fresh issue worth up to ₹210 crore and the sale of up to 1,42,89,367 equity shares by promoter selling, Promoter Group Selling Shareholders, and Other Selling Shareholders.

History of this topic

Strong Debut! Standard Glass Lining shares list at ₹172 on NSE, up 22.8% from IPO price

Live Mint

Standard Glass Lining IPO listing date today. GMP, experts signal strong debut of shares in stock market today

Live Mint

Standard Glass Lining share price: Stock lists at 23% premium over IPO price on Dalal Street

India Today

Standard Glass Lining IPO listing: Shares to make strong market debut? Check GMP

India Today

Upcoming IPOs: Five new public issues, 8 listings scheduled for next week; check full list

Live Mint

Standard Glass Lining IPO: What GMP signals as listing date fixed on Monday

Live Mint

Robust Debut! Fabtech Technologies Cleanrooms shares list at ₹161.50, up 90% from IPO price

Live Mint

Standard Glass Lining IPO allotment out. Latest GMP, steps to check share allotment status online

Live Mint

Standard Glass Lining IPO allotment: Step-by-step guide to check status

India Today

Upcoming IPOs: Dr. Agarwal’s and Regreen Excel get SEBI nod to raise funds via public issue

Live Mint

Indo Farm Equipment shares list at ₹256 on NSE, up 19% from IPO price

Live Mint

Standard Glass Lining IPO Day 2: Check GMP, price band, subscription

India Today

Standard Glass Lining Technology IPO: Issue subscribed 13.32 times on day 1, led by NII & retail portion; details here

Live Mint

Standard Glass Lining IPO day 2: GMP, subscription status to review. Apply or not?

Live Mint

Standard Glass Lining IPO fully booked on Day 1: Should you subscribe or skip?

India Today

Standard Glass Lining IPO opens today: Check latest GMP, price band, key details

India Today

Upcoming IPOs: 7 new public issues, 6 listings scheduled for next week; check full list

Live Mint

Standard Glass Lining Technology IPO opens tomorrow: GMP, review, other details among 10 key things to know

Live Mint

Star-studded IPO: From Amitabh Bachchan, Shah Rukh, to Tiger Shroff. How many celebs have invested in this realty IPO?

Live Mint

Standard Glass Lining IPO opens next week. Check GMP, price band, other key details

Live Mint

Upcoming IPO: Rajputana Stainless, Caliber Mining and Regaal Resources files DRHP with SEBI for IPO

Live Mint

Indo Farm Equipment IPO subscribed 229.31 times; Check latest GMP, subscription status, other details

Live Mint

Parmeshwar Metal IPO day 1: GMP, subscription status, review, other details about BSE SME IPO in 10 points

Live Mint

Standard Glass to Capital Infra: 3 IPOs to raise over Rs 2,200 crore next week

India Today

Standard Glass Lining IPO to open on January 6: Check price band, issue size, and other details

Live Mint

Indo Farm Equipment IPO day 1: GMP, subscription status, review, other details. Good or bad for investors?

Live Mint

Indo Farm Equipment mobilises ₹78 crore from anchor investors for ₹260-crore IPO ahead of subscription

Live Mint

Indo Farm Equipment IPO opens today: GMP, price band, issue size among 10 key things to know

Live Mint

Senores Pharmaceuticals IPO listing date today. GMP, experts signal up to 70% gain for share allottees

Live Mint

Upcoming IPOs: Six IPO share listings in focus. one mainboard, one SME IPO also to hit D-Street in coming week

Live Mint

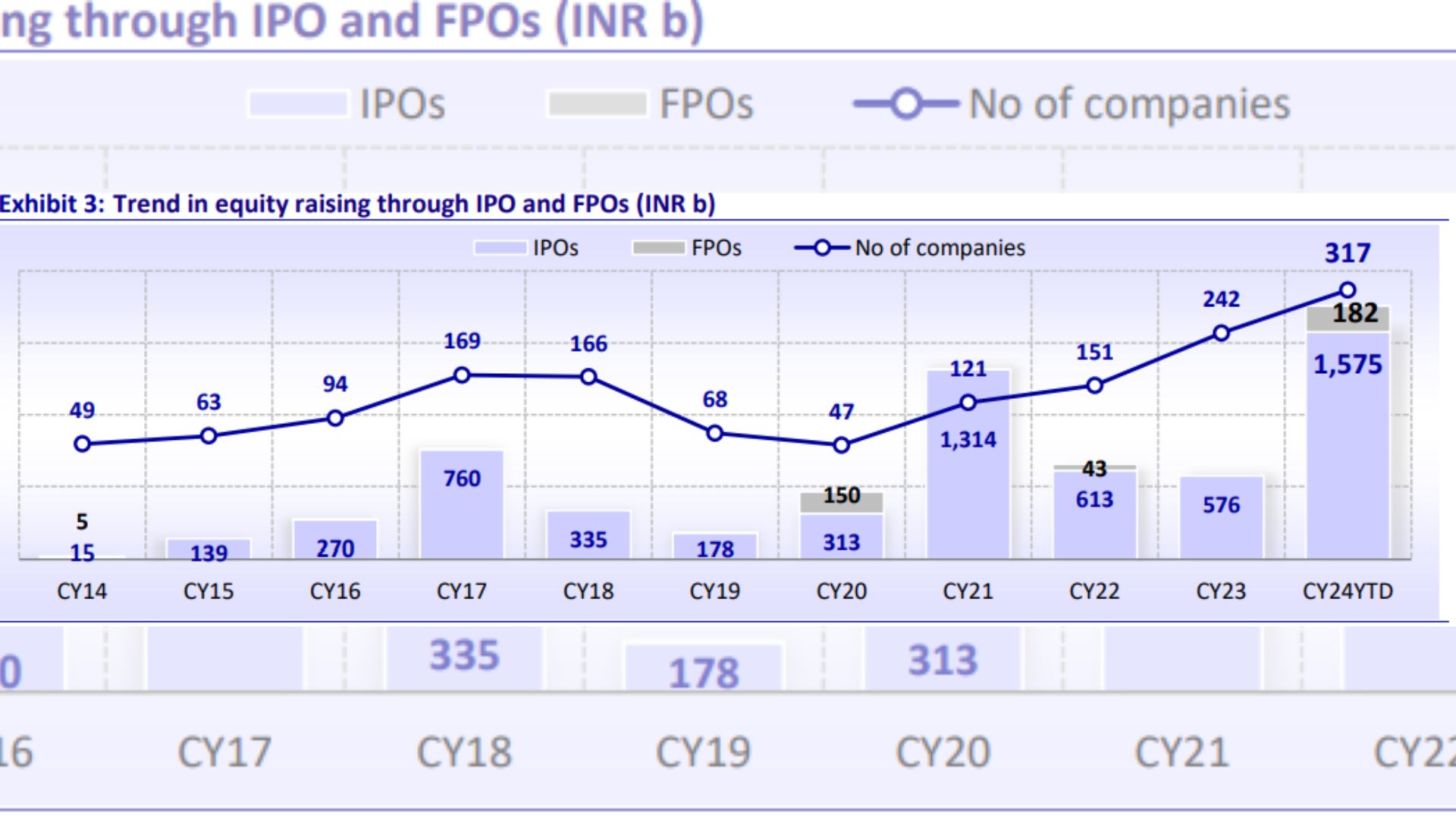

2024 Review: Indian IPO market shatters records as 317 issues raise ₹1.8 trillion

Live Mint

2024 IPOs: Ones that flew over the market's best

Hindustan Times

2024 Sees Record IPO Fundraising of Rs 1.8 Lakh Crore

Deccan Chronicle

Singapore-based FII invests ₹40 crore through private placement in this IPO-bound company

Live Mint

Robust Debut! International Gemmological shares list at ₹510 on NSE, up 22.3% from IPO price

Live Mint

Senores Pharmaceuticals IPO raises ₹261 crore from anchor investors ahead of public issue

Live Mint

Senores Pharmaceuticals IPO: From price band, GMP, to lot size: 10 key things to know as issue opens on December 20

Live Mint

Unimech Aerospace and Senores Pharmaceuticals Announce IPOs

Deccan Chronicle

Sanathan Textiles IPO day 2: GMP, subscription status, review, other details. Good or bad bet for investors?

Live Mint

DAM Capital Advisors IPO raises ₹251.4 crore from anchor investors ahead of public issue

Live Mint

Senores Pharma IPO: Price band set at ₹372-391 per share; check key dates, issue details, and more

Live Mint

Robust Debut! Toss The Coin shares list at ₹345.80 on BSE SME, up 90% from IPO price

Live Mint

Anand Rathi Group’s brokerage arm Anand Rathi Share and Stock Brokers files DRHP with SEBI for ₹745 crore IPO

Live Mint

DAM Capital IPO: Price band set at ₹269-283 per share; check issue details, key dates, more

Live MintOne MobiKwik Systems IPO subscribed 7.3 times on first day of offer

The Hindu

India IPO share sales rise to record in 2024, growing about 3-fold from last year on upbeat investor appetite

Live Mint

MobiKwik’s $67 million India IPO fully sold in first hour as retail investors rush in

Live Mint

MobiKwik IPO: Fintech major raises ₹257 crore from anchor investors ahead of subscription

Live Mint

IPOs Ahead: Equity Markets To See Rush Of 11 Maiden Offers Including Mobikwik, Vishal Mega Mart

ABP NewsDiscover Related