Bills on corporate tax, unified regulator for IFSCs in Lok Sabha today

Live MintThe government will introduce two important Bills in the Lok Sabha on Monday -- the Taxation Laws Bill and the International Financial Services Centres Authority Bill. A new provision was inserted in the Income Tax Act that with effect from the current financial year, an existing domestic company can opt to pay tax at 22 per cent plus surcharge at 10 per cent and cess at 4 per cent if it does not claim any exemption. The same Cabinet meeting also approved the introduction of International Financial Services Centres Authority Bill, 2019, in the Lok Sabha after its withdrawal from the Rajya Sabha. In order to promote growth and investment, a new provision was inserted in the IT Act to provide that with effect from the current financial year, an existing domestic company may opt to pay tax at 22 per cent plus surcharge at 10 per cent and cess at 4 per cent if it does not claim any incentive/deduction. In order to attract fresh investment in manufacturing and provide a boost to the 'Make in India' initiative of the government, another provision was inserted to the IT Act to provide that a domestic manufacturing company set up on or after October 1, 2019 and which commences manufacturing by March 31, 2023, may opt to pay tax at 15 per cent plus surcharge at 10 per cent and cess at 4 per cent if it does not claim any incentive/deduction.

History of this topic

Lok Sabha passes Finance Bill 2023

Deccan Chronicle

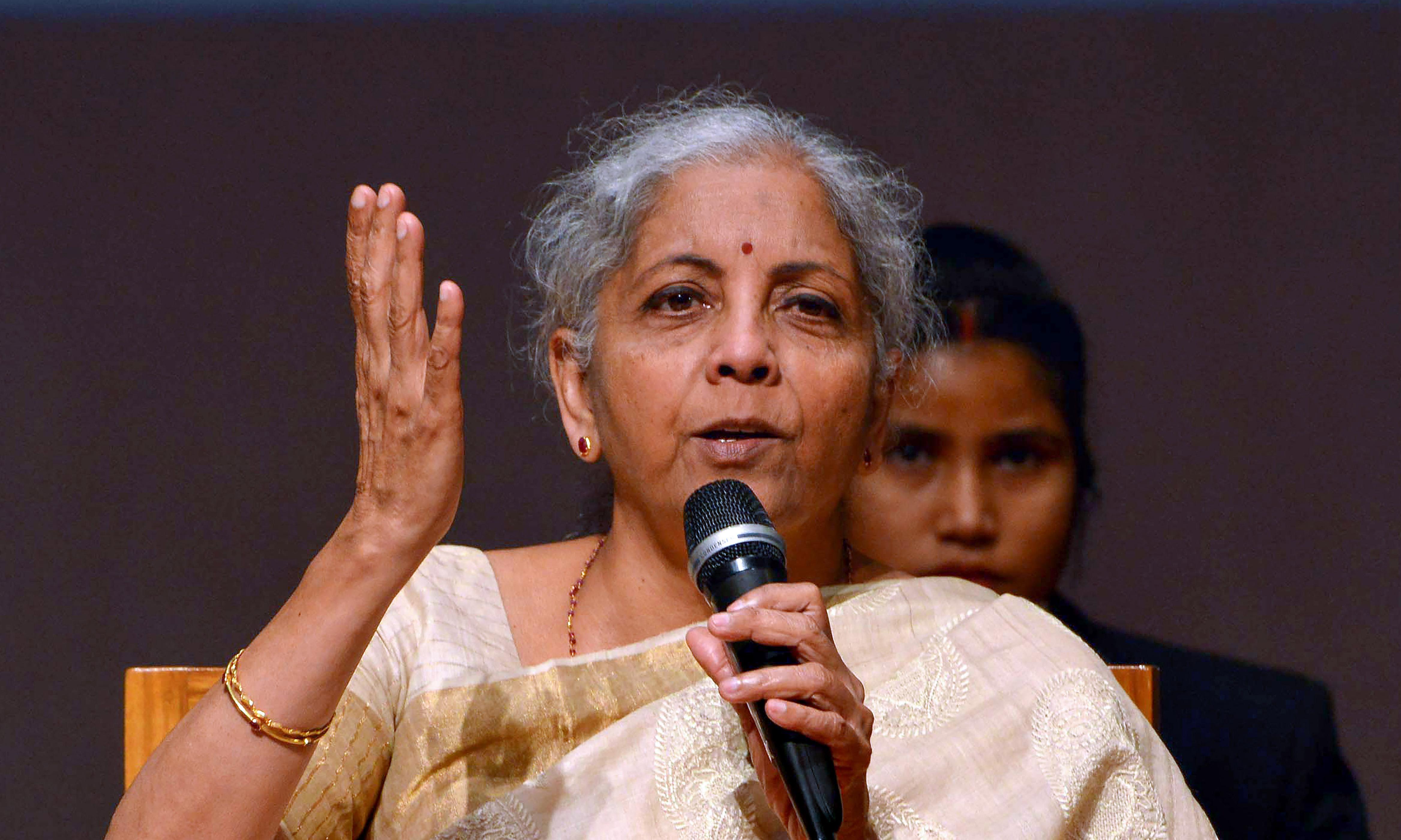

Finance Minister Proposes Tax Incentives To International Financial Services Centre

Live Law

BREAKING : Centre Introduces Taxation Laws Amendment Bill To Nullify Retrospective Tax Demand Provision Brought By Finance Act 2012

Live Law

Lok Sabha Passes Finance Bill 2021

Live Law

Govt introduces IFSC Bill in Rajya Sabha

Live Mint

Govt to set up unified authority for regulating financial services in IFSCs

Live MintDiscover Related