Average Income Is To Be Considered If Variations Found In Income Tax Returns Filed By Claimant: Karnataka High Court

Live LawThe Karnataka High Court has held that if income tax returns are available the same should be considered as best a piece of evidence and if variations are found in the income tax returns, considered for different assessment years, it would be appropriate to consider the average income of three assessment years to arrive at the annual stable income of the claimant seeking compensation under the Motor Vehicles Act. Further, the date of the accident is 09.04.2019, but no income tax returns have been filed for the Assessment Year 2019-20. Thus it was said “In view of the settled position of law and also considering the nature of the injuries and disability suffered, we are of the view that it would be appropriate to assess the whole body disability at 12%.” Referring to the Income Tax returns filed by the claimant, it was said “The contention of the claimant that while considering the income tax returns for three assessment years the return of income having higher income is to be considered, is not acceptable and the contrary contention of the insurer that income on the lower side among three years is to be considered is equally not sustainable.” Then it held “When the income declared by a person engaged in a profession or business is not stable, in order to assess the income of the injured/deceased to arrive at established income, which would be the foundation for assessing the compensation, the average of the income of the years considered would be appropriate. If average income is not considered, if an established income of the injured/deceased is reduced in the year of accident or due to windfall the income of the victim/deceased increased in the year of accident, the process of determining the established income would fail.” It added “We are of the view that when the income of the victim/deceased is inconsistent in the income tax returns filed, it is the aggregate income declared in the income tax returns is to be considered.” Noting that the accident took place on 09.04.2019 and the due date for filing income tax returns for the Assessment Year 2019-2020 was still available.

History of this topic

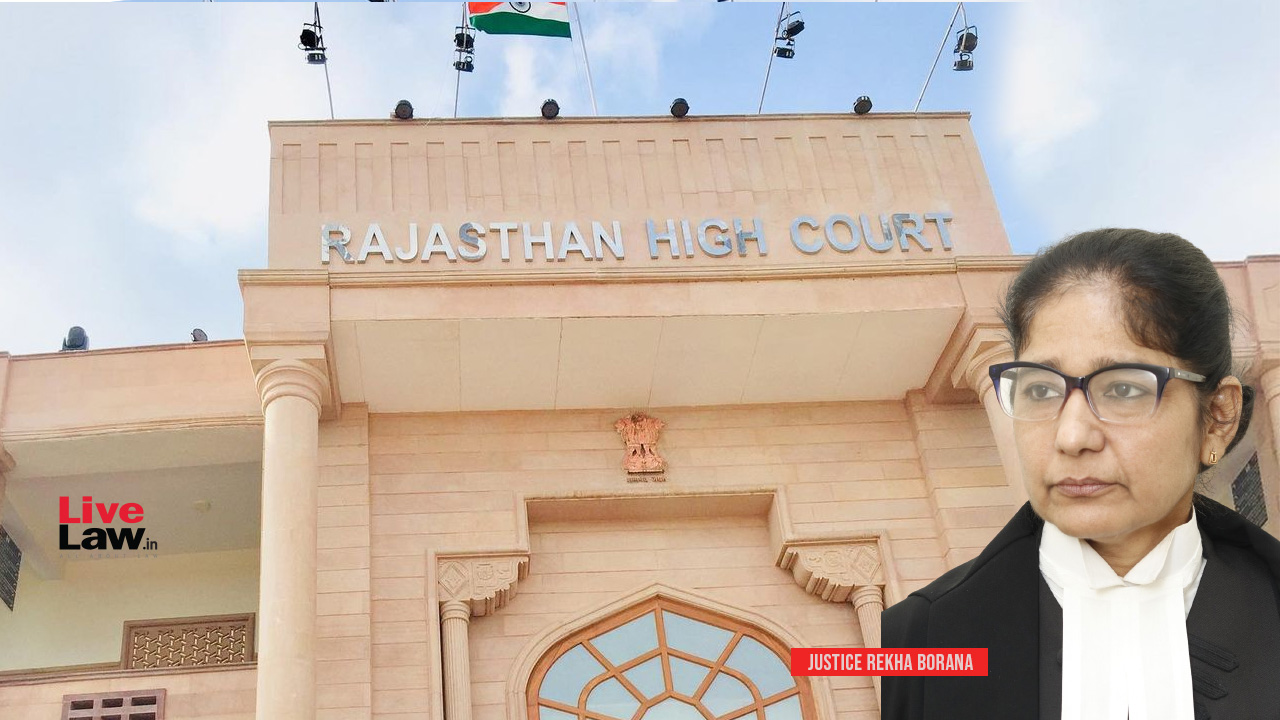

Income Tax Return Is Statutory Document, Holds Precedence Over Salary Certificate When Determining Compensation Under MV Act: Rajasthan HC

Live Law

After Amendment Mere Reason To Believe Can't Be Ground For Carrying Out Reassessment: Karnataka High Court

Live Law

Dysfunctional Limbs Render 100% Functional Disability: Karnataka High Court Orders ₹21.86 Lakh Compensation For Minor Victim In Motor Accident

Live LawDiscover Related

![[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court](https://www.livelaw.in/h-upload/2024/10/31/568956-allahabad-high-court-prayagraj.jpg)

![[Income Tax] Assessing Authority Can't Reassess Prior Years Without Inquiry While Determining Relevant Year's Assessment: Kerala High Court](https://www.livelaw.in/h-upload/2024/05/30/542245-justice-jayasankaran-nambiar-justice-syam-kumar-kerala-hc.jpg)