RBI Rejects IMF Warning of India's Debt to GDP Exceeding 100%

Deccan ChronicleMumbai: Spending on social and physical infrastructure, climate mitigation,digitalisation and skilling the labour force can yield long-lasting growth dividends. Using a dynamic stochastic general equilibrium model, the economists found that if the government expenditure is directed towards employment-generating sectors, climate risk mitigation and digitalisation, the debt-GDP ratio of the general government can decline substantially to 73.4 per cent of GDP by 2030-31 from an estimated 81.6 percent in 2023-24. The RBI economists in the article titled 'The Shape of Growth Compatible Fiscal Consolidation' released on Tuesday as part of the central bank's February Bulletin rejected the International Monetary Fund's warning that India’s debt to GDP could exceed 100 percent in the coming years. "It is in this context that we reject the IMF's contention that if historical shocks materialise, India's general government debt would exceed 100 percent of GDP in the medium-term and hence further fiscal tightening is needed," it added. In their analysis, the RBI economists examined how India's general government debt – the debt of the central government and the states – would move as a percentage of the national GDP under four different scenarios assuming annual real GDP growth of 7.3 percent and headline retail inflation of 4.3 percent.

History of this topic

Economists ask Finance Minister to focus on growth rather than fiscal consolidation

New Indian Express

RBI must restore balance between inflation, growth

New Indian Express

RBI must restore balance between inflation, growth

New Indian Express

India’s GDP growth shocker: Bad news can be good too

Live Mint

India’s GDP growth estimated to decelerate to 6.3% in 2025, says Goldman Sachs; sees shallow RBI rate cut from Q1CY25

Live Mint

India's Economy Shows Satisfactory Performance in First Half of FY25, But Risks from Geopolitical Conflicts and Global Factors

Hindustan Times

Central government debt set to double to ₹185 trillion by FY25 amid fiscal challenges and policy shifts

Live Mint

Govt Estimates Centre's Debt To Rise To Rs 185 Lakh Cr In FY25

News 18

Economic Survey 2023-24: ‘Focus on macro stability ensured minimal impact from external challenges’

The Hindu

Economic Survey out ahead of Budget: What it says on GDP, inflation and more

Hindustan Times

Explained: Why Economic Survey 2024 has taken a cautious stance

India Today

IMF raises India’s FY25 growth forecast upward to 7%

Hindustan Times

India should bring back fiscal positions to pre-pandemic levels: IMF

Deccan Chronicle)

IMF predicts India’s GDP growth to be 7% in 2024, 6.5% in 2025 as pent-up demand fades

FirstpostDebt, fiscal challenges facing low-income countries worry IMF

The Hindu

India is the bright spot in sluggish economy

Hindustan Times

UNCTAD sees India’s GDP growth slip to 6.5% in 2024 vs 6.7% in 2023: ‘RBI likely to keep interest rates constant’

Live MintIMF forecasts India’s economy to grow 6.8% this fiscal year

The Hindu

Raging inflation, stagnant wages forcing households into debt: Congress

The Hindu

Decoding India’s economic realities: Comparing the state of the economy under the NDA and UPA governments

The Hindu

Budget 2024: Can India become a $7 trillion economy by 2030?

India Today

Centre refutes IMF's debt warning, recalls ‘far worse’ conditions of US, China

Hindustan Times

'Still below debt level of 2002,' India terms IMF's latest report 'misconstrued'

India TV News

India’s GDP grew by 7.6 per cent during July-September quarter

Op India

IMF raises India’s growth forecast to 6.3% for 2023-24, cites strong consumption

India TV News

India's external debt at $629.1 billion at June-end, says RBI data

Hindustan Times

Wrong to assess economic activity on GDP alone: Finance Ministry

The Hindu

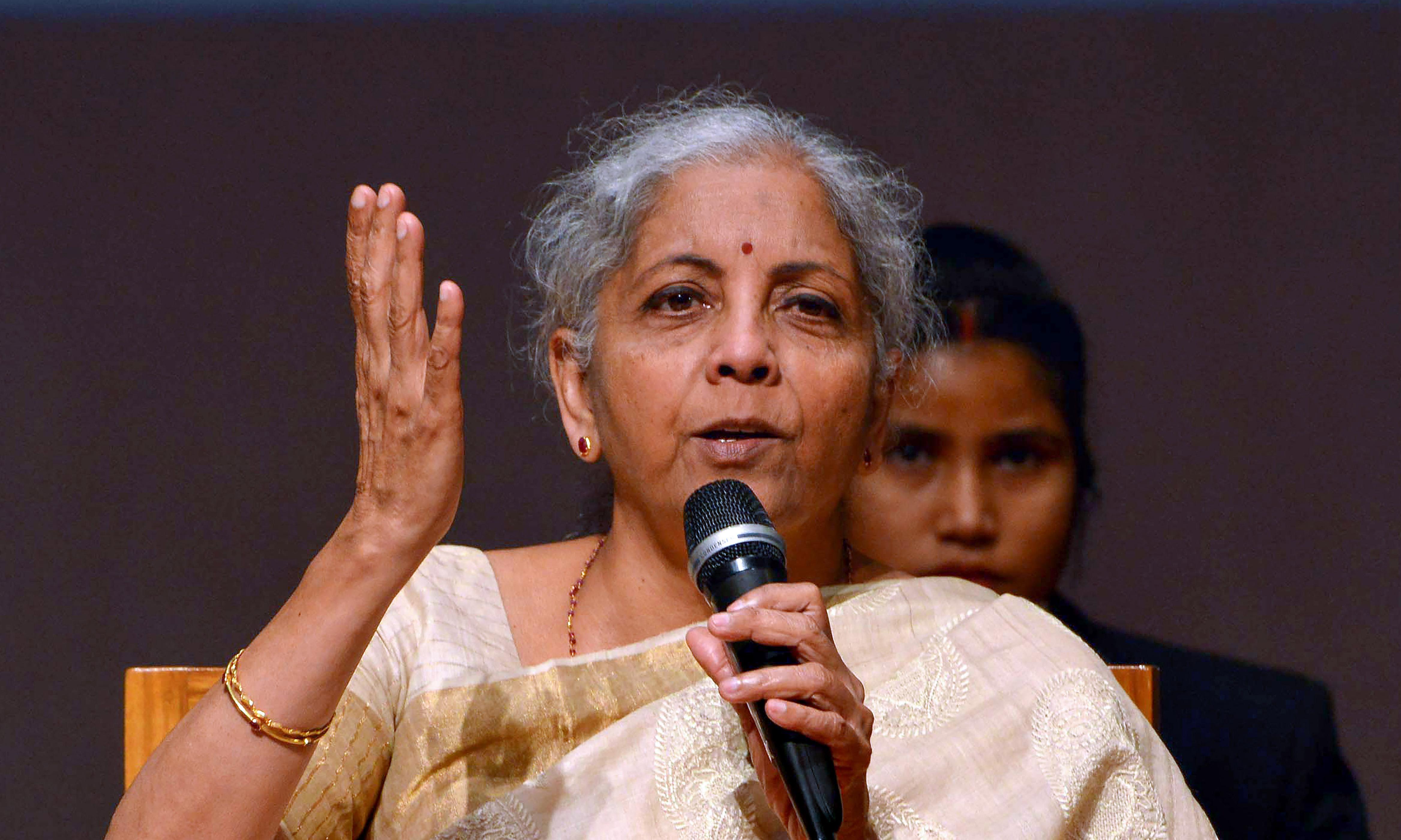

India's external debt at USD 624.7 bn within comfort zone, says FM Sitharaman

Hindustan Times

IMF raises India’s 2023 GDP growth forecast to 6.1%

Live Mint

IMF Raises India's GDP Forecast To 6.1% For FY24, Lowers Global Economy Growth Projection

ABP News

IMF projects Indian economy to grow at 6.1% in 2023

The HinduFitch pares India’s GDP growth forecast for this year to 6% from 6.2%

The HinduIndia likely to have stable debt-to-GDP ratio going forward, says IMF official

Deccan Chronicle

India set to grow by 5.9% this fiscal: IMF

The Hindu

IMF Lowers India's Economic Growth Forecast To 5.9% For FY24

ABP News

IMF cuts India's FY24 growth forecast to 5.9%, says will remain fastest growing economy

India Today

IMF chief warns of a gloomy growth scenario

Hindustan TimesWorld Bank lowers India’s growth forecast to 6.3%, says labour market needs to be more inclusive

The HinduIndia to buck global slowdown, maintain pace of expansion: RBI officials

The HinduSlowdown in GDP growth late last year temporary: Moody's Analytics

The Hindu)

RBI projects economic growth at 6.4% for next fiscal

Firstpost

India to face challenges in meeting fiscal deficit target: Report

Hindustan Times

Economic Survey Pegs FY24 GDP Growth at 6-6.8%: What Does It Mean?

News 18

Economic Survey 2022-23 Highlights: 6.5% FY24 GDP Growth, Inflation To Be 'Less Stiff', CAD Concerns

News 18Inflation in India expected to come down to 5% in 2023, 4% in 2024: IMF

The Hindu

Budget 2023 may peg gross borrowing under ₹16 trillion: Report

Live Mint

India expected to become USD 7 trillion economy in seven years: Chief Economic Advisor

India TV News

6.5% growth with sub-5% inflation key to $5 trillion economy: Govt paper

Hindustan Times

Explained | Is the economy driving with the brakes on?

The HinduDiscover Related

)

)