RBI to issue norms on loan resets to boost transparency

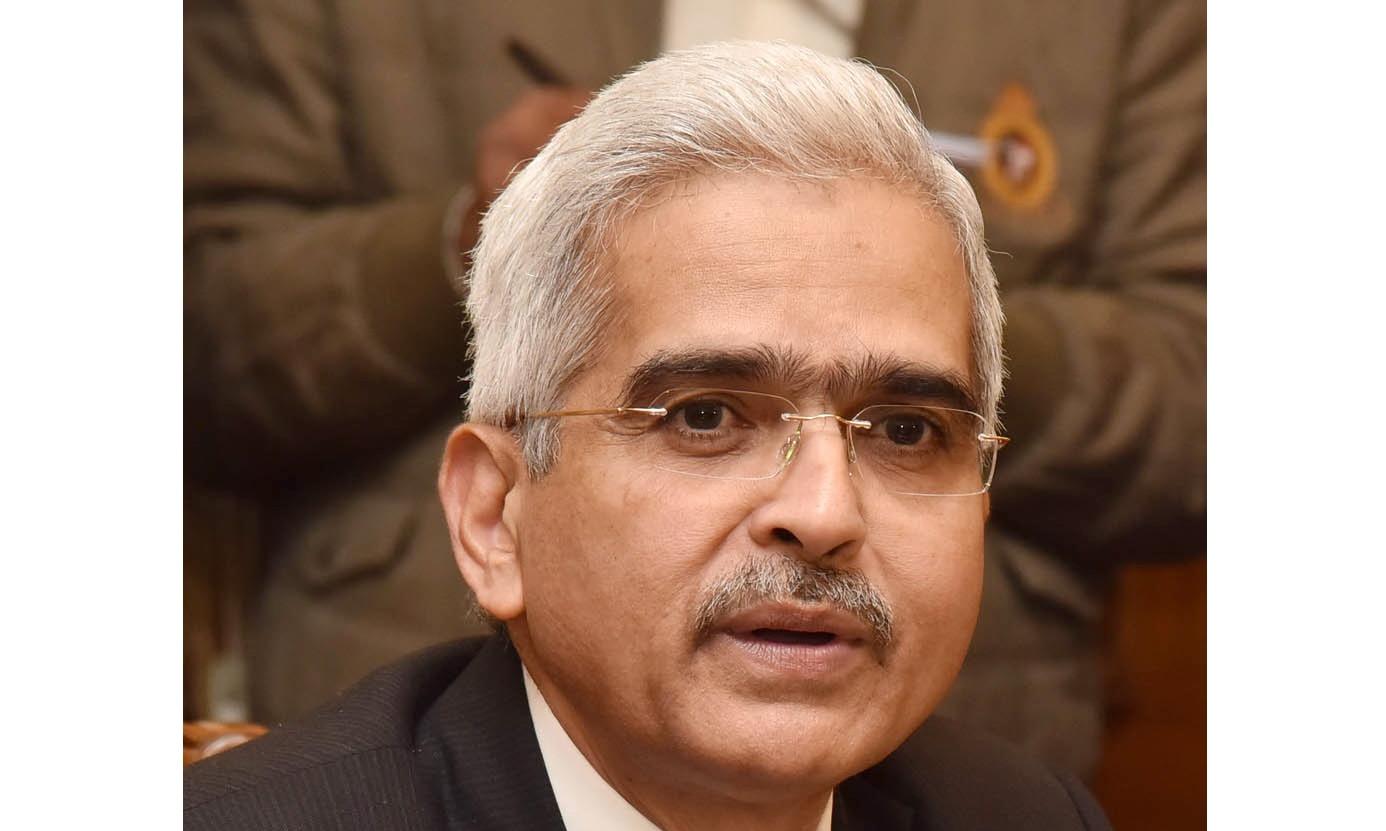

Live MintThe Reserve Bank of India on Thursday said it would set rules to enhance transparency in interest rate and tenor resets for floating loans, an outcome of home-loan repayment periods being extended to as long as 50 years in certain cases. Through supervisory reviews and feedback from the public, RBI on Thursday said it has come across several instances of unreasonable elongation of the tenor of floating-rate loans without proper consent and communication. Asked how RBI would define a tenor elongation as unreasonable, governor Shaktikanta Das said it is something banks will have to assess, taking into account the payment capacity of the borrower. “Given the increasing realization of credit, proposals to transparently disclose the implication of interest rate resets in floating-rate loans and corresponding changes in the tenors, and/or the changes in EMI is a welcome move to educate and inform the borrowers as they can better understand the impact of the changes in these terms,” said A.M. Karthik, vice-president, financial sector ratings, Icra Ltd.

History of this topic

Wilful default: RBI to tweak rules to give lenders flexibility in handling cases

Live MintRBI Allows Borrowers to Change Interest Rate

Deccan Chronicle

RBI prohibits penal interest on loans for contractual non-compliance

Hindustan TimesRBI issues fresh guidelines asking banks, NBFCs not to levy penal interest on borrowers in case of default

The HinduBorrowers can switch to fixed rate loans

Deccan ChronicleRBI loan restructuring plan | A difficult choice for borrowers

The HinduRBI keeps key policy rates unchanged

The HinduDiscover Related

)