Adani shock for $3.1 trillion India stock market is ebbing fast

Live MintSigns are fast emerging that investors in Indian stocks are moving beyond the Adani Group’s woes. Fund managers see India’s main equity indexes both ending the year higher than current levels, according to a Bloomberg News survey, as strong domestic demand boosts corporate earnings. The Adani selloff isn’t an India issue because the governance standards of many Indian companies are on par with global ones, while similar problems can be found in many other countries, she said. He told Bloomberg late last month that he plans to put more money into India as the “long-term future of the market is great,” and the investor retreat as a result of the Hindenburg report “is an Adani problem.” Hindenburg published a report on Jan. 24 accusing the Adani group of share manipulation and fraud — charges the conglomerate has repeatedly denied. Fund Survey Sixteen of 22 local fund managers Bloomberg News asked in an informal survey this month said they were still bullish on Indian stocks despite the Adani saga.

History of this topic

Outlook 2025: Top fund managers remain bullish on Indian stock market, suggest these 4 sectors to invest in

Live Mint

Adani Shares Soar As Bribery Allegations Clear; Market Cap Jumps Rs 1.2 Lakh Crore

ABP News

Why the Adani scandal is a problem for India's foreign policy

India Today

Adani bonds slide to year low as investors and lenders weigh bribery allegations

Live Mint

Adani touts financial muscle, says can grow without external debt

The Hindu

Adani bulls cut positions before news of US indictment

Live Mint

Adani Group shares rise for 2nd straight session: 2 reasons behind bull run

India Today

Rising geopolitical tensions, Adani ‘bribery’ case add to Indian market’s woes — expert advice

Live Mint

Friday’s relief rally after Adani shock leaves investors richer by ₹7.27 trillion

Live Mint

Sensex jumps 1,200 points: 3 things to know about today's stock market bull run

India Today

Live tracking Adani Stocks: Six Adani stocks recover on Friday

The Hindu

India’s Adani Group sees $22 billion in value wiped off after US indictments

Live Mint

Adani Group stocks nosedive after US indictment over alleged bribery, investor fraud

New Indian Express

Adani Group to invest $10 billion in US energy and infrastructure projects

Live Mint

India is undergoing an astonishing stock market revolution

Live Mint

India Emerges as a Safe Haven for Global Investors Amid Market Uncertainty

Live Mint

Foreign Investors' Selling Snarls India's Stock Market

Live MintIndia's Adani Group unit raises 19.5 billion rupees via bond issue, say bankers

The Hindu

Adani Group stocks plunge up to 17% following Hindenburg's latest claims

India Today

Stock market rebounds: Sensex, Nifty climb almost 1%. Which stocks are falling?

Hindustan Times

Adani stocks crash up to 18%, wipe out recent gains amid volatility

India Today

India's Adani Energy Solutions to raise up to $1.5 billion

The Hindu

Adani Enterprises stock recovers $30 billion lost after Hindenburg report

Hindustan Times

Adani, a Year Later: Investors Are Embracing India’s Humbled Champion

Live Mint

What's happening? Adani stocks fire up, surge between 7 to 23%

Hindustan Times

Adani Ports share surge over 5 per cent as company returns to bond market after two years hiatus

India TV News

Adani stocks rally as SC ruling wins back confidence of investors

Live Mint

Adani Group to invest Rs 8700 crores in JDU-RJD-ruled Bihar across sectors

Op India

Adani Group Companies Benefit From Market Sentiment, Stocks Soar High

ABP News

OCCRP reveals foreign investors linked to Adani stock manipulation

The Hindu

Adani family's partners used 'opaque' funds to invest in its stocks: Report

Hindustan Times

Adani Ports, Adani Ent shares among top 10 largecap buys by mutual funds in July

Live Mint

Indian stock market back in top 5 ranking across the world

Live Mint

Adani Enterprises Shares Drop 8% as Traders Book Profit; What Should you Do Now?

News 18

Adani stocks soar; market cap jumps by ₹63,000 crore in a day

Live Mint

Adani stocks jump on SC panel report findings

Live Mint

Adani Group firms dollar bonds rise as group considers partial buyback of debt securities

India Today

Reliance, Infosys, Tata Motors among top largecap stocks mutual funds are buying

Live Mint

EPFO subscribers are ‘captive investors’ of two Adani stocks

The Hindu

Adani has $2 bn bonds due for repayment in 2024

Deccan Chronicle

Adani Group stocks zoom for back-to-back trading sessions. Is the worst over?

India Today

Adani Enterprises rises from lows on block deal buzz, other Group stocks gain

Live Mint

How have Adani Group’s stocks behaved over the last month? - The Hindu

The Hindu

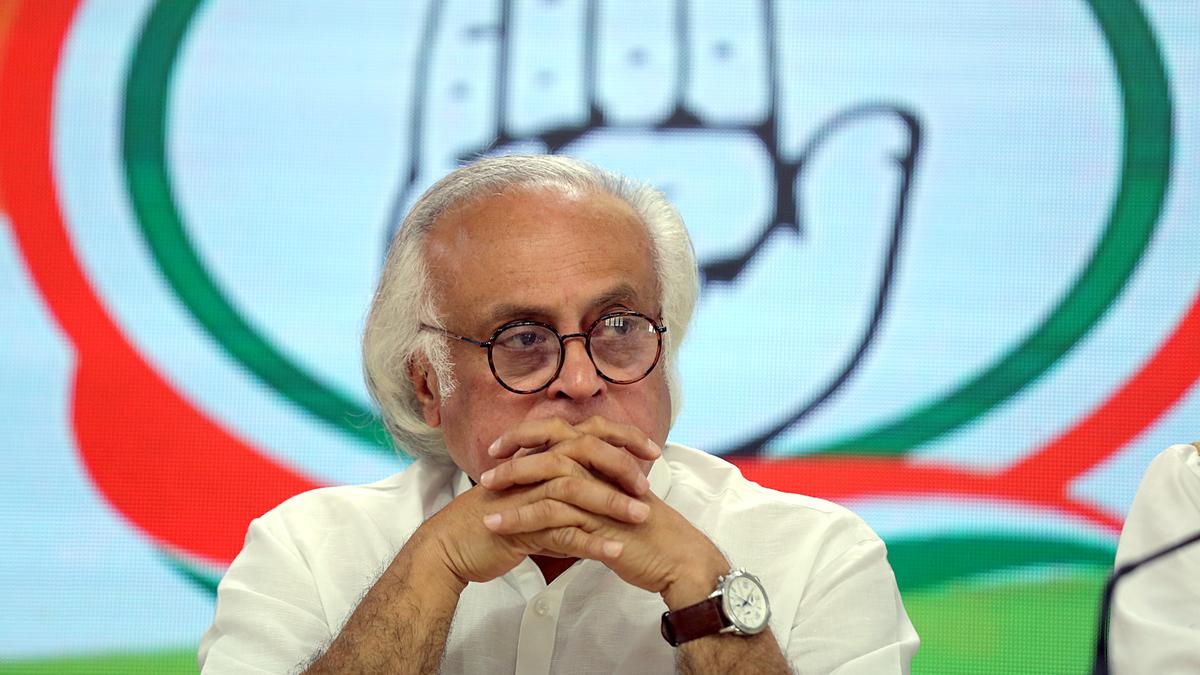

Congress questions the addition of five Adani stocks to NSE indices

The Hindu

Adding Adani firms in 14 NSE indices raises worry

The Hindu

Month after Hindenburg’s bombshell report, Adani loses over ₹12 lakh cr m-cap

Live Mint

MSCI’s India stock gauge heads for correction amid Adani selloff

Live Mint

Adani Group stocks post worst day in two weeks as investors lose ₹51,294 crore

Live MintGUEST COLUMN | End of a roll: The curious rise and fall of Adani stocks

The Hindu

Adani isn’t India, but its troubles mirror the nation’s woes

Live MintDiscover Related