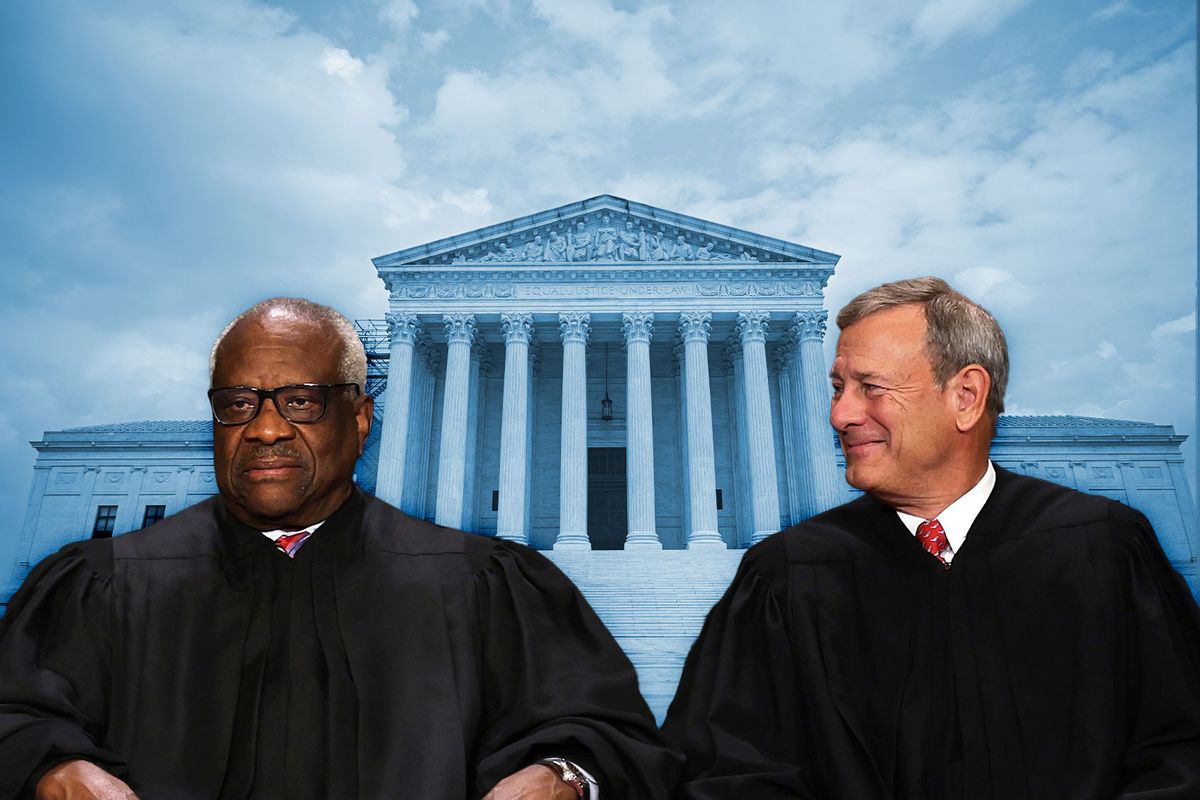

Column: How the Supreme Court could kill a wealth tax before it’s been tried

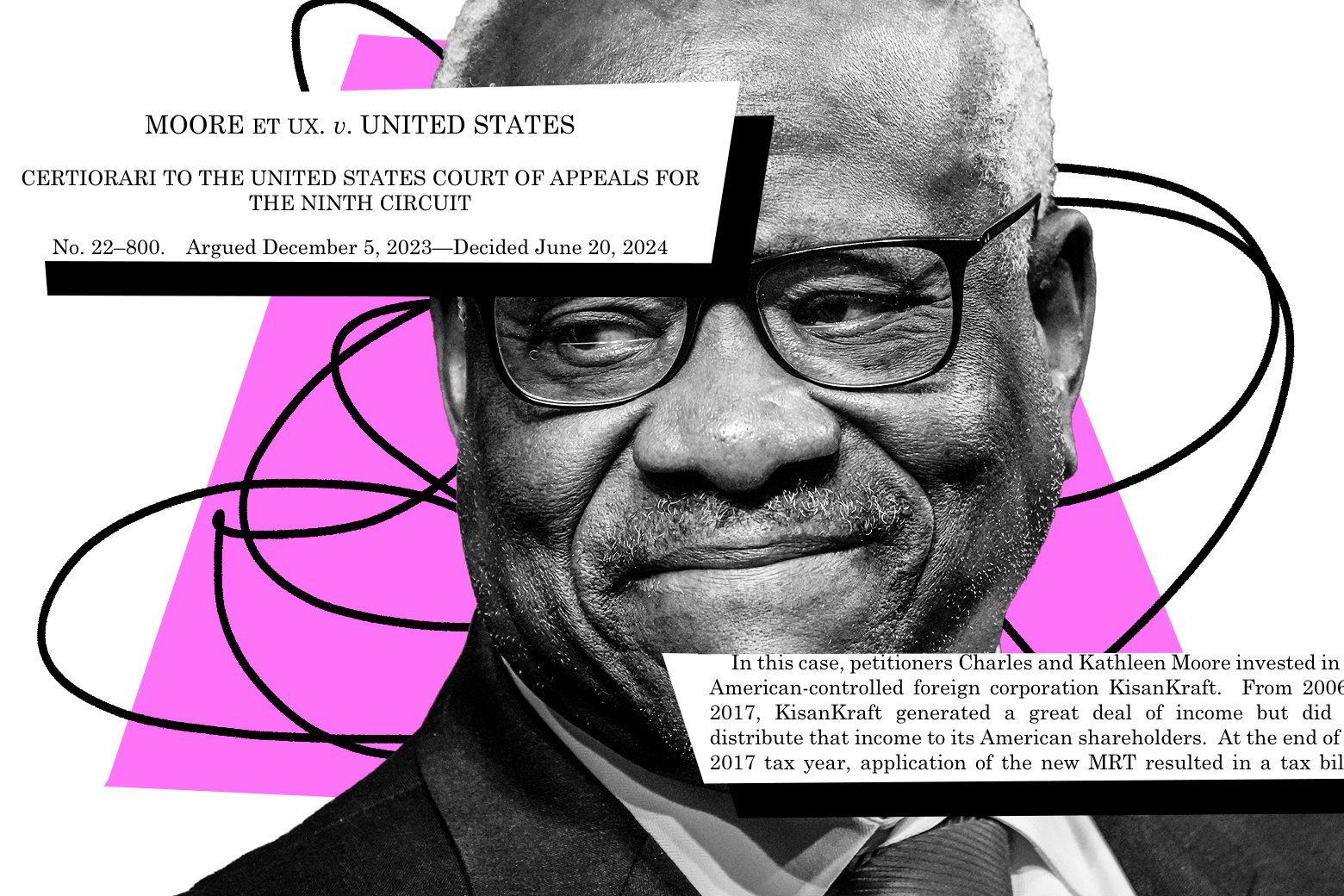

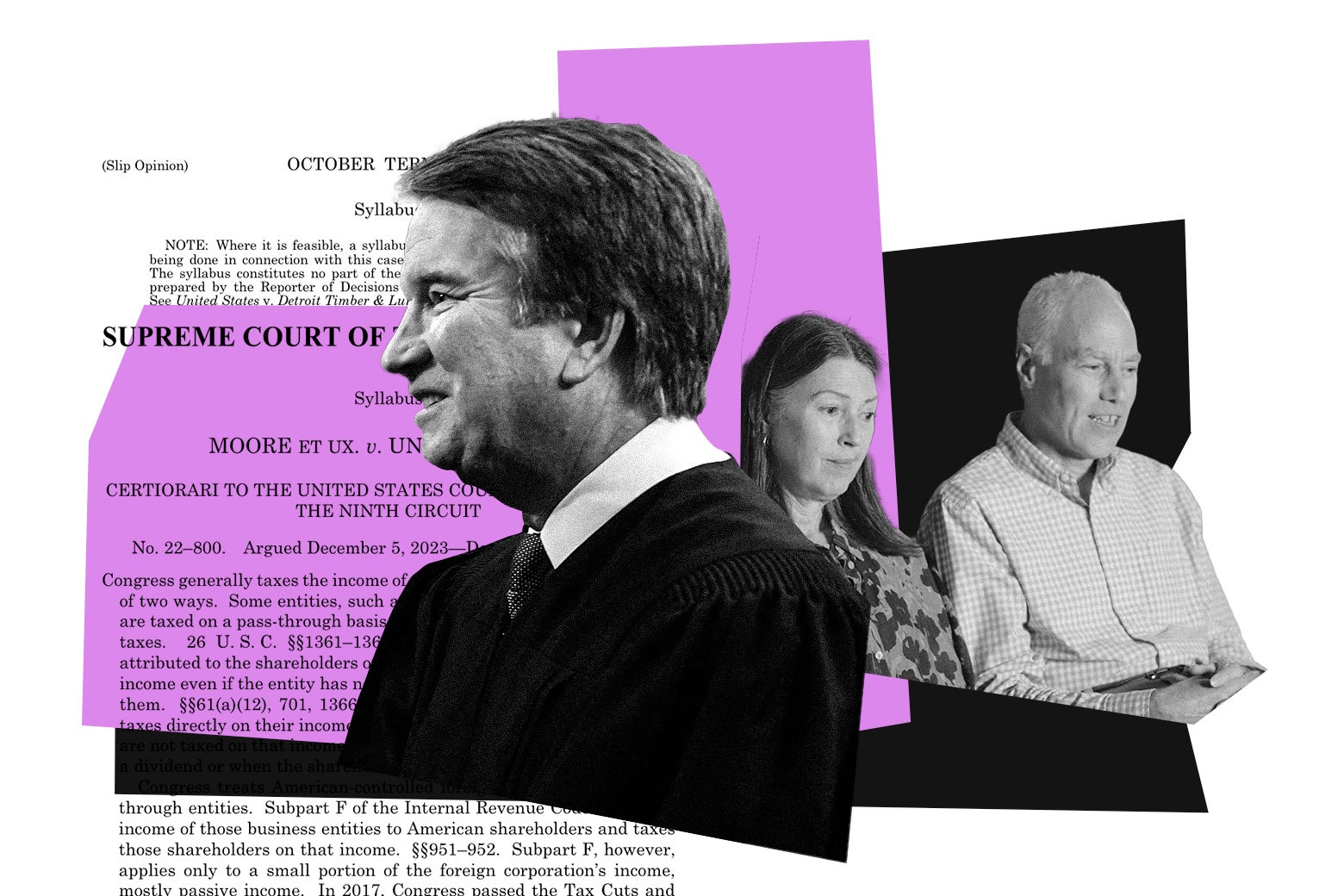

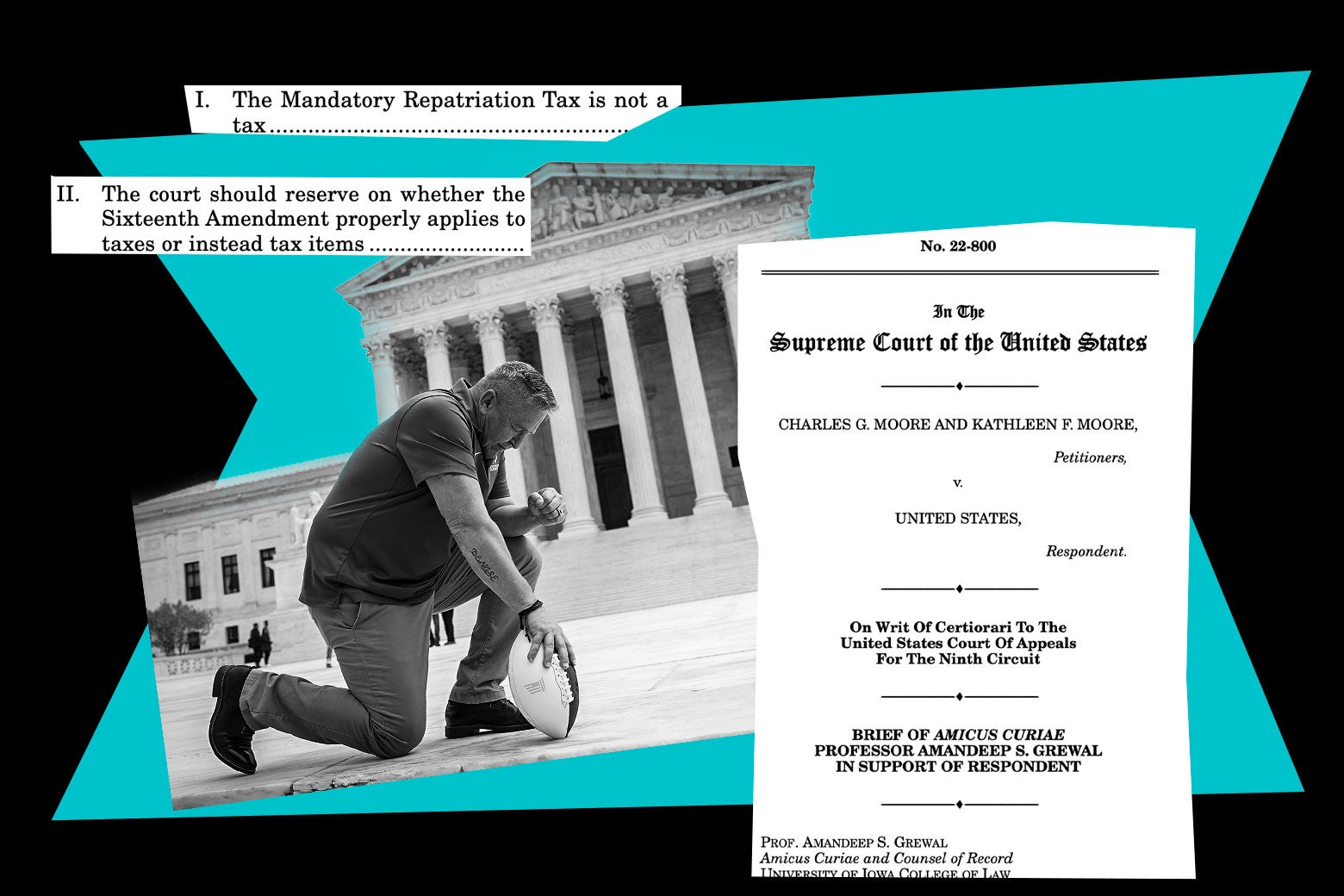

LA TimesSen. Elizabeth Warren has campaigned for a wealth tax on billionaires. “As efforts to design new federal tax systems with potentially troubling constitutional infirmities continue to pick up steam,” the conservative Manhattan Institute warned in one of two friend-of-the-court briefs it has filed to support the Moores, it’s up to the court to “clarify the limits of Congress’s taxing power before the train has begun rolling unstoppably down the hill.” The anti-tax gang’s targets are proposals — by Sens. Indeed, the amendment refers to “incomes, from whatever source derived.” Previous rulings by the Supreme Court and appellate courts have held that income doesn’t have to land in a recipient’s pockets to be taxed. In an oft-cited 1940 Supreme Court opinion, for example, Justice Harlan F. Stone described the concept of realization as an “administrative convenience,” and didn’t mean that a taxpayer could “escape taxation because he did not actually receive the money.” Any other interpretation, Stone implied, would invite large-scale tax evasion by allowing taxpayers to give away their right to a taxable payout by giving it away before pocketing it. He’s the son of Thomas Gale Moore, an economist connected with the Competitive Enterprise Institute and emeritus fellow of the conservative Hoover Institution, who is known for the 1998 Cato Institute-published book “Climate of Fear: Why We Shouldn’t Worry About Global Warming.” As for whether the Moores actually realized any income from their investment, public accounts of KisanKraft document that Moore sold shares in three tranches in 2019 to reduce his stock holdings to about 9.9% of the company from 12.9%.

History of this topic

Discover Related