Corporate tax rates slashed as govt announces ₹1.45 lakh crore stimulus

Live MintFinance Minister Nirmala Sitharaman today announced a big reduction in income tax rate for corporates. The government has slashed basic corporate tax rate to 22% from 30% while for new manufacturing companies it has been cut down to 15% from 25%. Revenue foregone for the reduction in corporate tax rate and other relief measures announced today will cost the government ₹1.45 lakh crore per year, the finance minister said. Here are some of the key announcements: Govt proposes to slash corporate tax rate for domestic tax rate Ordinance regarding this has already been passed A domestic company can pay income tax at 22% if they don't seek any exemption or incentives Effective Tax Rate 25.17% inclusive of all surcharges and cess for such domestic companies Such companies also not required to pay Minimum Alternative Tax Companies availing exemptions can opt to pay tax of 22% after the exemption period is over Enhanced surcharge announced in Budget shall not apply on capital gains arising on sale of any securities including derivatives in the hands of foreign portfolio investors The govt expects to widen tax basket with lower tax rate Buybacks pre-July 5 exempted from buyback tax For new manufacturing companies that start production before March 2023 and incorporated on or after 1st October 2019, corporate tax rate brought down to 15% from 25% Enhanced surcharge announced in Budget not to apply on capital gains arising on sale of equity share in a company or a unit of an equity oriented fund or a unit of a business trust liable for STT MAT for companies that want to use tax exemptions cut to 15% from 18.5% New tax rate will be applicable from the current fiscal which began on April 1.

History of this topic

Budget should announce tax cuts for individuals to boost consumption: Barclays

Live Mint

India’s net direct tax collection swells 16% to ₹16.90 trillion so far in FY25

Live Mint

Net direct tax collections slow down marginally to touch 15.88% in January

The Hindu

Mohandas Pai shares his Budget 2025 wishlist: No tax up to ₹5 lakh, large tax slabs, relief for middle class & more

Live Mint

Centre mulls income tax cut in 2025-26 Budget amid middle-class heat

New Indian Express

Net direct tax collections rise 16.5%

The Hindu

Net direct tax receipts grows 16.45% to ₹15.82 lakh crore till mid-December

Live Mint

Centre’s net direct-tax revenue grows 15.4% to ₹12.1 trillion in April-Nov

Live Mint

Net direct tax collection rises 22% so far this fiscal

Live Mint

Tax defaults in India skyrocket by 1000% over last 10 years, litigations double: Report

Hindustan Times

Income tax benefits, capital gains tax hike, cheaper phones | Key Budget takeaways

Hindustan Times

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

Budget 2024: Income tax slabs changed, standard deduction increased. Read details

Op India

Budget 2024 Highlights on income tax: FM Sitharaman revises personal income tax slabs; taxation rates remain unchanged

The Hindu

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

Budget 2024: Taxpayers, you can expect these 6 income tax benefits on July 23

Hindustan Times

’Middle class bearing more weight than corporates’: Congress slams Centre over taxation policy ahead of Budget 2024

Live Mint

Budget may make some announcements to enable Global Minimum Tax

Deccan Chronicle

Corporate tax cut enriched billionaires by Rs 2 lakh crore; middle-class hit by heavy taxes: Congress

New Indian Express

Direct tax mop-up rises 20% to ₹5.74 lakh cr on higher corporate advance tax

The Hindu

Robust revenues: On direct tax collection target and fiscal consolidation

The Hindu)

Net direct tax collections up 22 % to ₹10.60 lakh crore in FY24

Firstpost

Has India’s corporation tax gamble paid off yet?

Live Mint

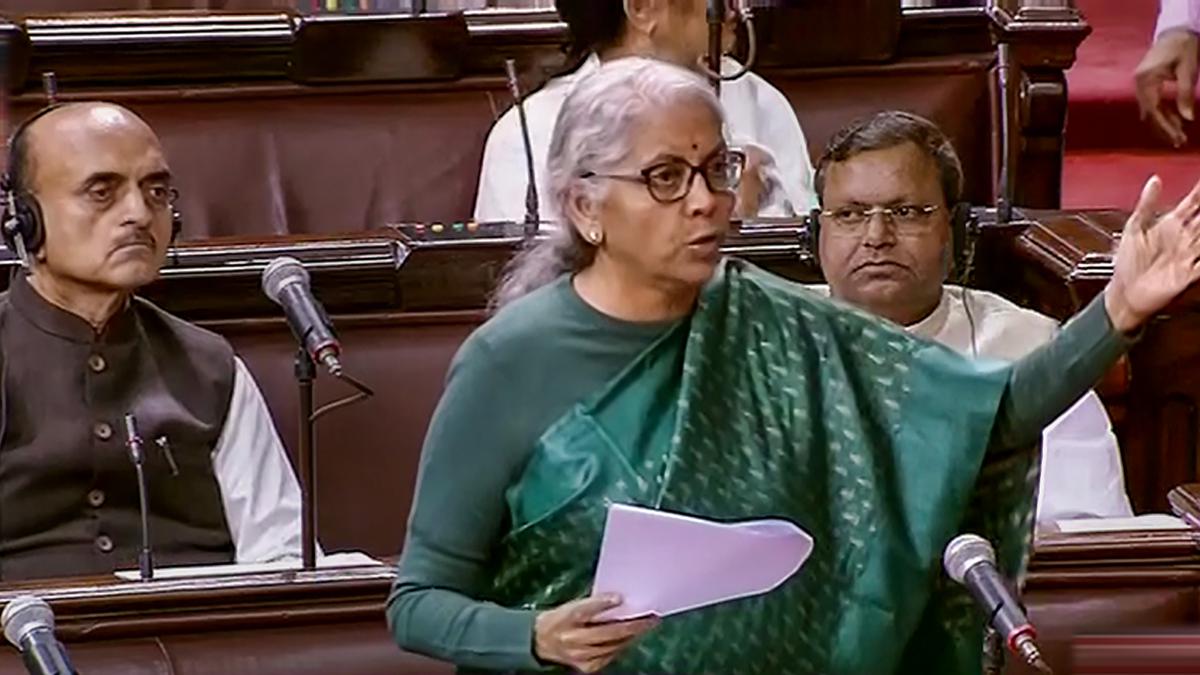

Budget 2023: How Nirmala Sitharaman attempted to simplify tax experience

Live Mint

Targeted relief measures during pandemic saved country from recession: FM

The Hindu

Direct tax revenues up 16.3% at ₹7.45 lakh crore

The Hindu

Direct tax collection rises by 30% to Rs 8.36 lakh crore

Deccan Chronicle

Centre mulls cutting tax rates in new income tax regime

Live Mint

Budget 2022: Replacing Income Tax with Expenditure Tax is the Blockbuster Reform India Needs

News 18

Direct tax collection exceeds FY-21 estimate by 4.42% at ₹9.45 lakh crore

Hindustan Times)

Direct Tax Collection for Ongoing Financial Year Drops by 17.6% Till December 15: Report

News 18

Sitharaman unveils Atmanirbhar 3.0; tax relief for real estate, jobs creation scheme

India TV News)

Tax Collection Trend Showing Signs of Pick Up, Economy on Recovery Path: Finance Secretary

News 18)

At Rs 40,072 Crore, Govt's External Financing Jumps 5-times Till August: Report

News 18)

PM Modi to Launch 'Transparent Taxation

News 18

Govt's endeavour has been to further simplify Direct Tax laws: Sitharaman

India TV News

Modi administration cut corporate taxes, it’s industry’s turn to invest: Anurag Thakur

Live Mint

Govt to consider extension in deadline for availing 15% corporate tax rate benefit: FM Nirmala Sitharaman

Live Mint

TDS, TCS Rates Reduced By 25%, Income Tax Return Deadline Extended To Nov 30, Says FM Nirmala Sitharaman

ABP NewsGovt intends to remove all income tax exemptions in long run: FM

The Hindu

Budget 2020: Personal Income Tax Rates Slashed

Live LawBudget 2020: Income tax slabs lowered for those who forgo exemptions

The Hindu

Budget 2020 Highlights: Nirmala Sitharaman announces tax cuts and an LIC stake sale!

New Indian Express

Corporate tax cut to mostly benefit less than 1% of companies: Economic Survey

Live Mint)

Ahead of Budget 2020, Narendra Modi, Amit Shah meet economists, experts at NITI Aayog; discuss steps to revive growth

Firstpost)

Narendra Modi meets Mukesh Ambani, Ratan Tata, other business heads to discuss economy ahead of Union Budget

Firstpost

Budget 2020 Expectations: Govt Likely To Reduce Personal Income Tax Rates To Spur Economic Growth

ABP News

Tax breaks necessary but India needs more reforms, says CEA

Live Mint

Rajya Sabha members uncertain over investments flow after corporate tax reduction

India TV News

Software, mining, books printing industry not qualify for 15% corporate tax cut: Nirmala Sitharman

Live MintDiscover Related

)

)