White House proposes tougher bank rules, new tests after crisis

LA TimesThe Biden administration is proposing to tighten rules on midsize institutions as it searches for tools to further calm the banking crisis and prevent another failure, such as those of Silicon Valley Bank and Signature Bank. The changes include reinstating rules for banks with assets between $100 billion and $250 billion — a category that Silicon Valley Bank, one of the institutions that failed, fell into — including liquidity requirements, enhanced stress testing and “living wills” that show how banks that size could be wound down. The White House backed calls for community banks to not share the cost of replenishing the Deposit Insurance Fund, which was used to backstop SVB and Signature Bank, which also failed. House Financial Services Committee Chairman Patrick McHenry of North Carolina said in a statement that the “Biden administration continues to politicize the failure of SVB and Signature Bank to push long-held progressive priorities unrelated to the causes of the collapses.” The Bank Policy Institute, a trade group for the largest banks, urged caution on adopting new regulations. “We look forward to prompt action by the agencies following up on today’s important words and directives from the White House,” said Dennis M. Kelleher, the group’s chief executive.

History of this topic

Trump advisers seek to shrink or eliminate bank regulators

Live Mint

Big bank CEOs warn that new regulations may severely impact economy

The IndependentCEOs of the nation’s biggest banks warn that new regulations could harm the economy

Associated Press

California bank regulator finds own faults in bank’s demise

Associated Press

'First Republic Bank was severely mismanaged, would be held accountable': White House

Hindustan Times

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank Collapse

Live MintSilicon Valley Bank: US Fed calls for tougher bank rules after SVB collapse

Live Mint

Fed Admits to Failures in Oversight of Silicon Valley Bank Collapse in New Report

News 18

Congress Helped Set Stage For Silicon Valley Bank’s Failure, Federal Reserve Says

Huff Post

Fed blames itself for Silicon Valley Bank collapse

The Independent

US Federal Reserve admits faults and calls for stronger banking oversight after Silicon Valley Bank collapse

Hindustan Times

Regulators to Publish Postmortems on Silicon Valley Bank, Signature Failures

Live Mint

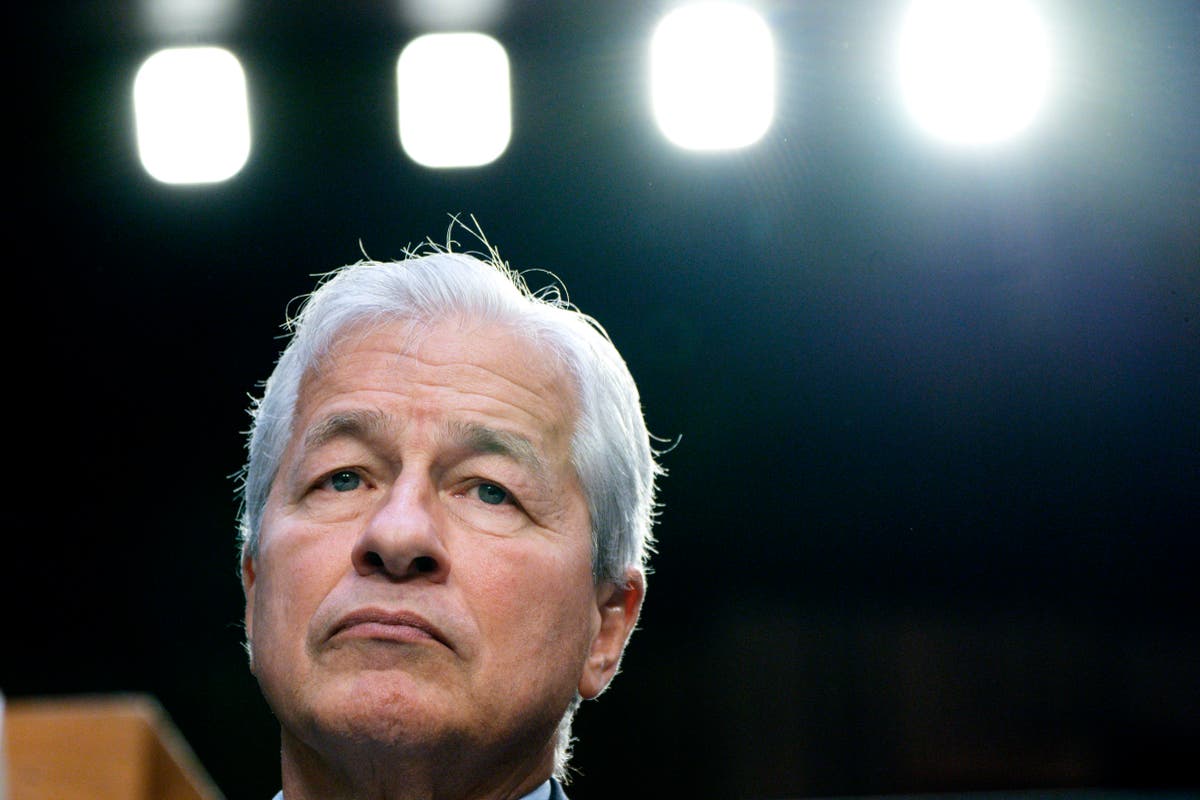

Dimon: Bank rules should change after Silicon Valley Bank

Associated Press

White House skirts Congress to push new regional bank rules

Daily Mail

Biden urges US regulators to restore strict rules on midsize banks

Hindustan Times

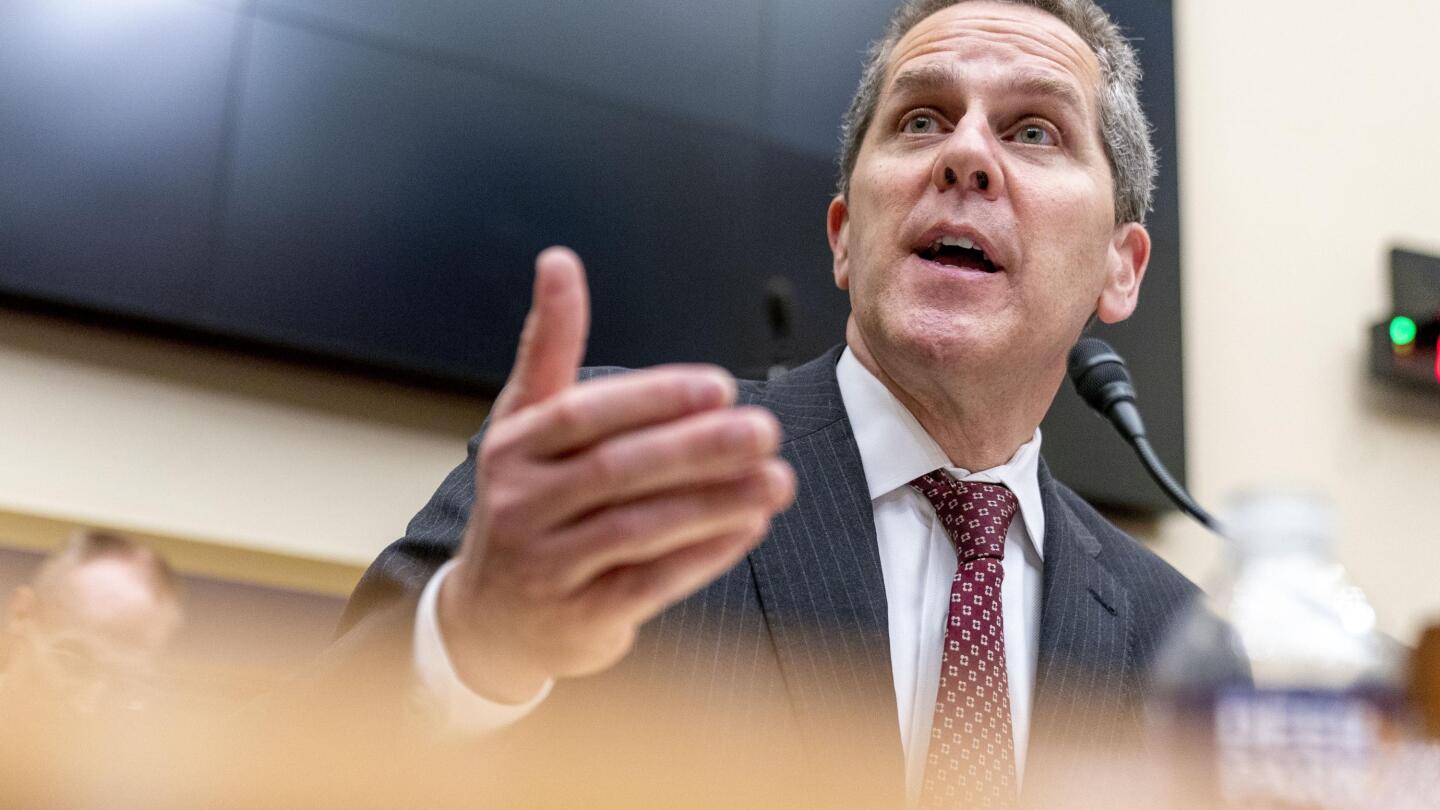

GOP lawmakers accuse Fed of being lax before bank failure

Associated Press

Fed official: Bank rules under review in wake of SVB failure

Associated Press

Bank failures and rescue test Yellen’s decades of experience

Associated Press

Biden says U.S. banks are in good shape, turmoil will ease

LA Times

Yellen says US prepared to take more action to keep bank deposits safe

Live Mint

Bank failures: Anger in Congress, but division on what to do

Associated Press

Washington turns to Wall Street to help rescue dying bank

Associated Press

Biden calls for tougher penalties for execs of failed banks

Associated Press

Yellen declares bank system sound, as new rescues ordered

Associated Press

Experts, banks look for ideas to stop next bank failure

Associated Press

Republicans Accept No Blame For Bank Failures After They Voted To Deregulate Banks

Huff Post)

Silicon Valley Bank Collapse: How Washington ended up rescuing US banks

Firstpost

How Washington came to rescue US banks

Associated Press

Silicon Valley Bank collapse: 96 hours after biggest US bank failure in 15 years

Hindustan Times

Silicon Valley Bank crisis: Fed faces flak for ‘missing’ warning signs| 5 points

Hindustan Times

Why Silicon Valley Bank’s collapse put the spotlight on Trump

Al Jazeera

Timeline: How US gov’t scrambled as Silicon Valley Bank collapsed

Al Jazeera

“Threatening our entire economy”: Warren introduces bill to repeal “Trump’s bank law”

Salon

Fed criticized for missing red flags before bank collapse

Associated PressSilicon Valley Bank crisis: Did bank regulators, investors ignore warning signs?

Hindustan Times

On Silicon valley bank crisis, Joe Biden's message to US taxpayers is...

Hindustan TimesHow the US Federal Reserve is handling the Silicon Valley Bank crisis

Hindustan Times

Biden says Americans can "rest assured" banking system is secure after SVB collapse

CBS News

The White House is avoiding one word when it comes to Silicon Valley Bank: bailout

NPR

Can the chaos from Silicon Valley Bank’s fall be contained?

Associated Press‘We won’t do that again': US rules out federal bailout for Silicon Valley Bank

Hindustan TimesDiscover Related

)