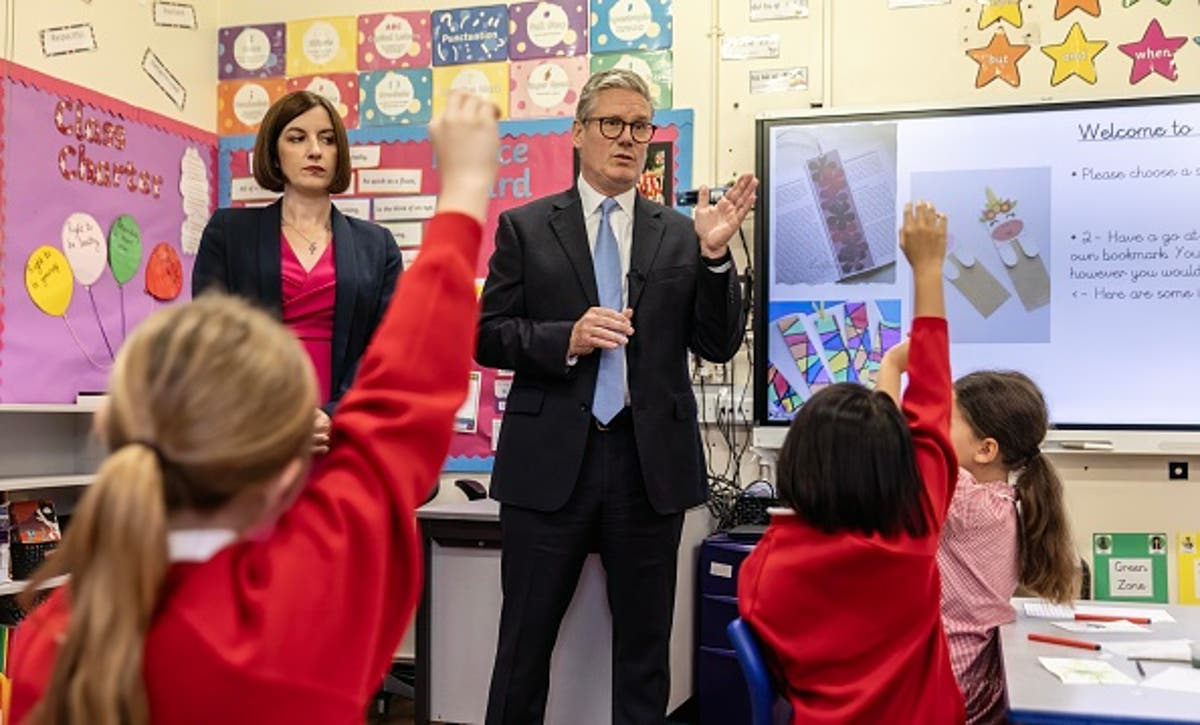

Starmer defends controversial private schools VAT policy by arguing it will benefit middles classes

The IndependentSign up for the View from Westminster email for expert analysis straight to your inbox Get our free View from Westminster email Get our free View from Westminster email SIGN UP I would like to be emailed about offers, events and updates from The Independent. Over the weekend, education secretary Bridget Phillipson called tax exemptions for private schools “a luxury we cannot afford”, arguing that middle-class parents priced out of the independent sector supported Labour’s policy. The average fee has reached something like £18,000 a year, which is clearly out of reach for the majority of parents in our country.” open image in gallery Keir Starmer has defended his controversial policy of imposing VAT on private schools by arguing it will benefit the middles classes When asked if only the rich were able to afford such surging costs, he said: “Middle-class people in good professional jobs with housing costs can’t afford that level of fees.” Insisting that the tax “commands the support of the majority of the public”, the spokesman continued: “The additional investment that we’re able to make into our state schools will drive up standards in our state schools.” He added: “By ending this VAT break for private schools, it means an additional £1.7 billion of investment into our state schools where 94 per cent of this country’s children are educated. It’s the politics of envy and will result in all of us being worse off.” open image in gallery Conservative party leader Kemi Badenoch attacked Labour’s private schools VAT policy again on Monday But Sir Keir’s spokesman rejected claims the tax would lead to children with disabilities and special educational needs losing out, arguing state schools provided the “vast majority” with the education they needed. He said: “If a child can only be supported in a private school, then the local authority will fund that child’s place and the local authority can reclaim the VAT that they pay, so they won’t be affected in those circumstances by this change.” However, the Independent Schools Council still warned VAT will hit families who feel the state sector does not meet their child’s needs.

History of this topic

The VAT ‘raid’ on private schools has finally made me proud to have voted Labour

The Independent

Private schools ‘to raise fees by more than Starmer predicted’ as controversial VAT policy imposed

The Independent

Private school tax breaks ‘a luxury we cannot afford’, says education secretary

The Independent

Starmer’s VAT hike will leave some GCSE students without a school by January, warns council

The Independent

UK to funnel £1.5 billion into public education with private school tax reform

Live Mint

School chiefs turn on Rachel Reeves after 'shameful' claim that VAT raid will give all children the 'best start'

Daily Mail

Starmer’s VAT raid will ensure private schools become even more elitist

The Independent

Labour preparing for private school closures after VAT raid on fees, suggest reports

The Independent

Families launch legal action over government’s private school fees VAT raid

The Independent

Labour's tax raid on private tuition fees is left in CHAOS - as school heads have been unable to register for VAT on HMRC site

Daily Mail

More than 3,000 privately-educated pupils applied to join state schools between June and September as Labour's VAT tax raid forces parents to pay extra £2,000 on fees

Daily Mail

Foreign Office asks private schools to offer discounted fees for diplomats' children following Labour's VAT raid

Daily Mail

Private school group to launch legal action over Government’s VAT plan on fees

The Independent

Meet the parents taking the government to court over VAT on private schools

The Independent

What is Labour’s controversial private school VAT raid policy?

The Independent

Parents already turning down private school places as Labour’s VAT policy looms

The Independent

What is ‘toddler tax’ that could see some parents paying VAT on nursery fees?

The Independent

France and Germany slam Labour's VAT plan for private schools - and warn it could force hundreds of pupils out of international schools

Daily Mail

Military families set to be exempt from Labour’s controversial VAT on private school fees

The Independent

School VAT tax raid to go ahead in win for Bridget Phillipson

The Independent

Private schools plan legal challenge against Starmer’s VAT raid

The Telegraph

Labour’s private school raid ‘risks forcing out ethnic minority families’

The Telegraph

Parents appalled after council asks those trying to move their children to state education from private schools to prove how poor they are

Daily Mail

Thousands of armed forces families depend on help into private schools. Labour's VAT raid plan threatens to hit their children hard, writes LORD KEMPSELL

Daily Mail

Eton 'to impose Labour's 20 per cent VAT rise in January's fees' with costs of attending 584-year-old school set to rise to £63,000 per year

Daily Mail

Government’s private schools VAT raid ‘could cost taxpayer £1.8bn’

The Telegraph

Eton College tells parents fees likely to rise by 20% over Labour’s VAT plan

The Independent

Eton College to raise fees by 20% following Labour’s VAT on private schools

The Independent

Biggest private girls’ school chain raises fees by 12pc over VAT raid

The Telegraph

Military families fear being 'priced out' of boarding schools by Sir Keir Starmer's plans to place VAT on private schools

Daily Mail

Private schools at risk of closure over VAT hike already face big budget shortfalls, says Phillipson

The Independent

Fury as Education Secretary Bridget Phillipson says parents were given 'ample warning' about Labour's VAT raid on private school fees

Daily Mail

Labour private school VAT tax plan could come soon – what parents need to know

The Independent

Phillipson blames private schools for ‘pricing out’ middle classes in row over VAT on fees

The Independent

Budget rules mean private schools VAT raid won’t start before Sept 2025, Labour insiders claim

The Telegraph

Labour VAT raid on private schools could harm vulnerable children, warns former Ofsted chief

The Telegraph

Labour’s VAT raid: ‘I already work two jobs and cannot fathom a third’

The Telegraph

The real losers from Labour’s VAT raid on private schools? The children

The Independent

Labour’s VAT raid will lead to ‘McDonaldsisation’ of education

The Telegraph

State schools report rise in applications amid fears over Labour’s private school VAT raid

The Telegraph

Second private school blames Labour’s tax raid for closure

The Telegraph

Don’t bash the global rich, Keir Starmer – tax them instead

The Independent

Military families will be priced out of private schools under Labour

The Telegraph

Labour’s VAT raid will force private schools to close, education chief warns

The Telegraph

Labour’s private schools tax plans ‘blamed for fall in entries’

The Independent

State schools unprepared for flood of pupils sparked by Labour’s VAT raid

The Telegraph

Labour's planned tax raid on private schools would 'cost more than it saves' for the education system, report warns

Daily Mail

Labour’s private school tax raid ‘could cost taxpayer £1.6bn a year’

The Telegraph

Almost half of voters do not think private schools should be exempt from VAT

The TelegraphDiscover Related