Government borrowing costs keep rising as pound sinks to lowest level in over a year

The IndependentFor free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails Sign up to our free breaking news emails Sign up to our free breaking news emails SIGN UP I would like to be emailed about offers, events and updates from The Independent. Read our privacy policy The pound has tumbled to its lowest level against the US dollar for over a year as government borrowing costs surged further, heaping yet more pressure on Labour over its fiscal plans. Sterling weakened again on Thursday morning amid a deepening rout in UK government bonds – also known as gilts – with the pound falling nearly 1 per cent to just under $1.23 US dollars – its lowest level since November 2023. Economists have warned Chancellor Rachel Reeves could be forced into further tax hikes or cuts to spending plans to meet UK fiscal rules after the jump in government borrowing costs. “However, the rhetoric from the Labour government is one reason we are in this mess in the first place, and there are no guarantees that Reeves will be able to calm the market.” The rise in government borrowing costs poses a challenge for Ms Reeves, putting pressure on the Treasury’s ability to increase public spending amid the prospect of higher interest costs.

History of this topic

Markets ‘orderly’ despite soaring borrowing costs, says Treasury minister

The Independent

Reeves may need to cut spending after jump in borrowing costs, say economists

The Independent

Is Britain’s future burning as bright as Rachel Reeves says it is?

The Independent

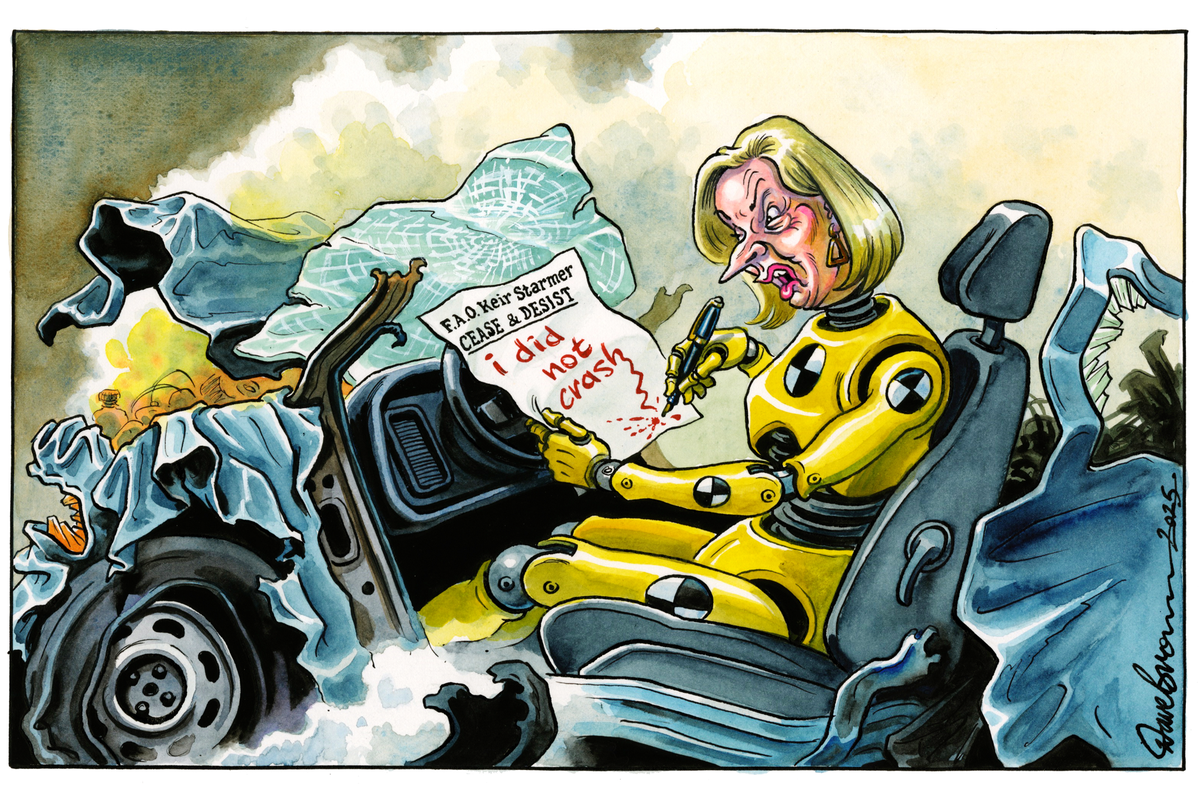

Labour's borrowing costs surge 'worse than Liz Truss chaos': Rachel Reeves faces spending crisis after interest rates hit 27-year high on fears of 'Stagflation'

Daily Mail

UK economy faces threat of ‘stagflation’ after bumpy 2024

The Independent

Reeves warns ministers of cuts as ‘every pound’ of government spending to face review

The Independent

Rachel Reeves warns ministers of cuts as ‘every pound’ of government spending to face review

The Independent

UK interest rates to fall more slowly than expected after Budget – OECD

The Independent

UK interest rates ‘to fall more slowly’ after tax rises and spending hikes in Rachel Reeves’ Budget

The Independent

Why Britain’s inflation nightmare may not be over

The Telegraph

UK debt woe as borrowing costs surge again amid fresh market jitters

Daily Mail

Spike in UK Borrowing Costs Wipes Out Reeves’ Fiscal Headroom

Live Mint

OBR watchdog warns costs of government projects could SOAR after Rachel Reeves' tore up fiscal rules to rush through extraordinary spending splurge

Daily Mail

Financial market worries over the UK budget appear to ease

The Independent

S&P and Moody’s warn of fresh constraints to public finances after Budget

The Independent

Chancellor seeks to calm markets amid jitters after Budget borrowing spree

The Independent

Britain faces years of ‘muted’ growth after Reeves’ Budget, warns Moody’s

The Telegraph

Government borrowing costs rise further after Budget

The Independent

Borrowing costs surge as markets turn on Reeves

The Telegraph

Reeves' sniffle makes the bond markets shiver, says PATRICK TOOHER

Daily Mail

Investors brace for £300bn borrowing binge in Rachel Reeves' Budget

Daily Mail

Ailbhe Rea: The Night Before the Budget

Bloomberg

Reeves confirms change to debt rule and warns of higher taxes as Budget looms

The Independent

Public sector pay rises hand Reeves a £6.7bn headache ahead of Budget

The Independent

Reeves’s Budget to keep interest rates higher for longer, say economists

The Telegraph

Reeves eyes up to £40bn in tax rises and spending cuts in Budget

The Independent

Rachel Reeves boosted by big drop in inflation as she seeks £40bn in Budget tax rises

The Independent

I was Rachel Reeves’s boss at the Bank of England – here’s what she should do now

The Independent

Tax rises inevitable as Budget black hole set to persist, says think tank

The Independent

Rachel Reeves’s potential borrowing plan risks repeat of Truss mini-Budget meltdown, warns financial expert

The Independent

Britain’s borrowing costs nearly double Germany’s as investors brace for Budget

The Telegraph

Rachel Reeves warned potential £50bn spend could cause interest rates to surge

The Independent

For her next trick... how the Chancellor could make debt seem to disappear - as millions brace for a painful October Budget

Daily Mail

Reeves ‘risks jump in interest rates’ by rewriting debt rules

The Telegraph

Rachel Reeves 'will rewrite fiscal rules in Budget so government can borrow another £30BILLION for projects' - despite debt pile already being at an 80-year high

Daily Mail

Rachel Reeves is about to embark upon a massive debt binge

The Telegraph

Borrowing surges to higher than forecast £3.1bn in July in blow to Rachel Reeves

The Independent

Bank of England interest rate cut joy for mortgage holders as Rachel Reeves blames mini-Budget for inflation - UK politics live

The Independent

Chancellor Rachel Reeves is expected to reveal £20billion hole in UK's public finances - intensifying fears that hefty Labour tax hikes are on the way

Daily Mail

Lack of money for tax cuts persuades Rishi Sunak to call general election

The Telegraph

PM insists debt is ‘on schedule’ to fall despite challenges over the claim

The Independent

Inflation falls to a two-year low – now will interest rates follow?

The Independent

Jeremy Hunt accuses Rachel Reeves of 'fairy tale' economics after Labour conference

The Telegraph

Government borrowing binge undermining faith in OBR forecasts, says IFS

The Telegraph

Bank may need to spark recession to control inflation, economist says

The Independent

Rise in debt costs could dash Budget tax cut hope

Daily Mail

Bank of England warns risk of UK financial crisis hasn’t gone away

CNN

Bank of England signals it won't keep borrowing costs down as it rejects £1.9bn of gilts sales

The Telegraph

The UK is going through a sovereign debt crisis

The IndependentDiscover Related