Loans Given By Co-Operative Banks To Their Nominal Members Qualify For Deduction U/s 80P(2)(A)(I), Reiterates Bangalore ITAT

Live LawWhile considering the definition of 'member' under the Kerala Act, as per which loans given to nominal members would qualify for purpose of deduction u/s 80P of the Income Tax Act, 1961, the Bangalore ITAT directed the AO to grant relief to the assessee by allowing the claim of deduction under said provision. Relying on the decision of Supreme Court in the case of Mavilayi Service Cooperative Bank Ltd. v. CIT 123 taxmann.com 161, the Bench comprising Beena Pillai and Chandra Poojari observed that, “Section 80P is to be read as a proviso, which proviso now specifically excludes co-operative banks which are co-operative societies engaged in banking business, i.e. Clearly, therefore, once Section 80P is out of harm's way, all the Assessees in the present case are entitled to the benefit of the deduction contained in section 80P, notwithstanding that they may also be giving loans to their members which are not related to agriculture.” As per the brief facts of the case, the assesee had earned interest and dividend on investment in South Canara District Co-op. The Coram reiterated while referring the Supreme Court decision in the case of Mavilayi Service Cooperative Bank Ltd. v. CIT reported in 123 taxmann.com 161 that, “if the Banking Regulation Act, 1949 is not to be seen, what is clear from Section 3 read with section 56 is that a primary co-operative bank cannot be a primary agricultural credit society, as such co-operative bank must be engaged in the business of banking as defined by section 5 of the Banking Regulation Act, 1949, which means the accepting, for the purpose of lending or investment of deposits of money from the public.” The Bench further added that, “Likewise, under section 22 of the Banking Regulation Act, 1949 as applicable to co-operative societies, no co-operative society shall carry on banking business in India, unless it is a cooperative bank and holds a license issued in that behalf by the RBI.” Therefore, relying on the previous decisions of the Apex Court, the ITAT allowed the assessee's appeal.

History of this topic

Interest Income Earned From Deposits With Co-Operative Banks Shall Be Allowed As Deduction U/s 80P(2)(D): Ahmedabad ITAT

Live Law

Mere Difference Of Opinion With AO Is No Basis To Exercise Revisionary Power U/s 263: Chandigarh ITAT Confirms Sec 80P Deduction Granted By AO

Live Law

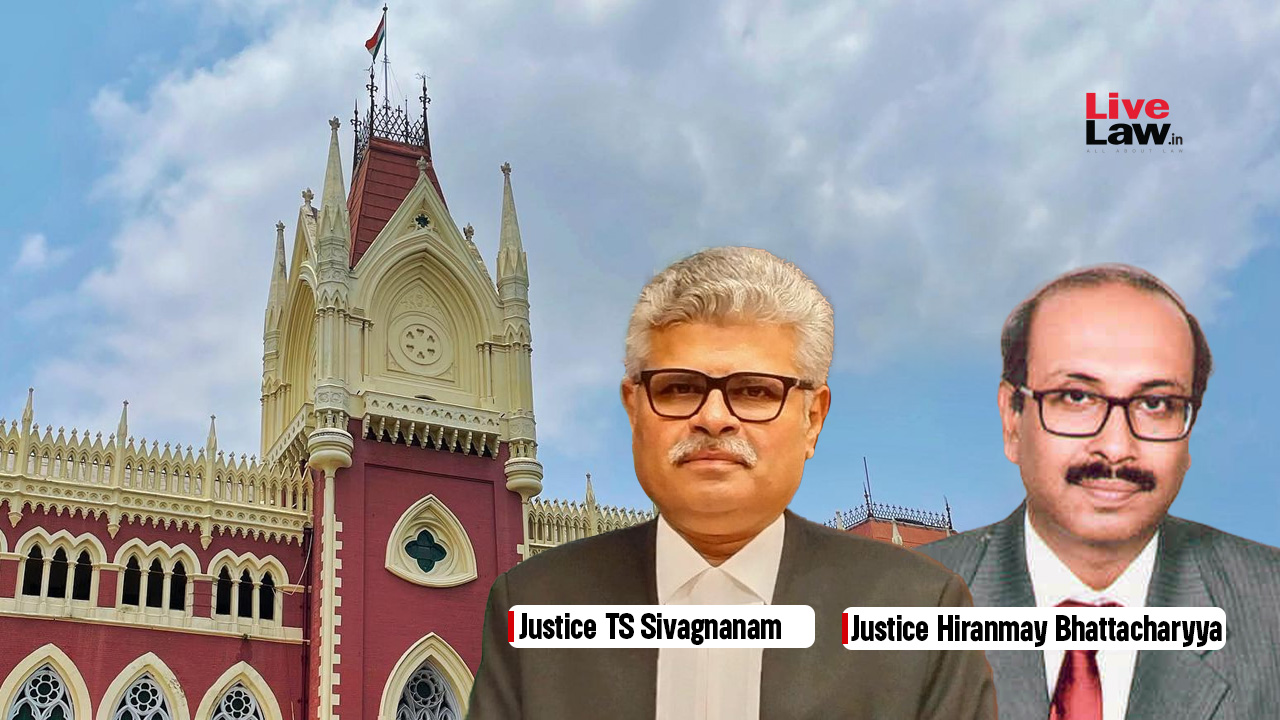

Prima Facie Adjustment Made By CPC Towards Deduction U/s 80P Prior To Apr 01, 2021 Is Beyond Its Jurisdiction: Kolkata ITAT

Live Law

Interest & Dividend Derived By One Cooperative Society From Its Investment Held With Another One Is Eligible For Deduction U/s 80P(2)(D): Pune ITAT

Live Law

Interest Income Derived By Co-Operative Society From Its Investment With Any Other Co-Operative Society Is Allowable U/s 80P(2)(D): Mumbai ITAT

Live Law

Section 80P(2)(d) Deduction Available On Interest Earned From Investments Made In A Co-Operative Bank: Madras High Court Quashes Reassessment

Live Law

Cooperative Banks Qualified As Cooperative Societies : CESTAT Allows Section 80P Deduction On Interest Received From Co-Operative Banks

Live Law

Orissa High Court Allows Deduction To The Co-operative Society Involved In The Business Of Banking

Live Law

Interest Income Earned By A Co-Operative Society Eligible For Deduction: ITAT

Live Law

Deposit Received From Nominal Members Of Society, Non-Deduction Of TDS On Interest Paid By Them. ITAT Deletes Addition Of Income.

Live Law

Primary Agricultural Credit Society Entitled To Deduction U/s 80P Income Tax Act Even If They Give Loans To Members For Non-Agricultural Activities : Supreme Court

Live LawDiscover Related

![[IT Act] Section 80IB Doesn't Mandate Setting Off Losses Of One Eligible Unit Against Profits Of Another Eligible Unit: Mumbai ITAT](https://www.livelaw.in/h-upload/2024/03/13/527767-itat-mumbai.jpg)

![[Income Tax Act] Placing Funds In One Account Before Transferring It To Another Does Not Attract S. 69A: Allahabad High Court](https://www.livelaw.in/h-upload/2024/12/07/575113-allahabad-high-court.jpg)