Many electric vehicles to lose big tax credit with new rules

Associated PressWASHINGTON — Fewer new electric vehicles will qualify for a full $7,500 federal tax credit later this year, and many will get only half that, under rules proposed Friday by the U.S. Treasury Department. The new rules take effect April 18 and are aimed at reducing U.S. dependence on China and other countries for battery supply chains for electric vehicles. Biden administration officials concede that fewer electric vehicles will be eligible for tax credits in the short term because of the rules, which set standards for where EV battery parts and minerals come from. But Sen. Joe Manchin, the West Virginia Democrat who negotiated terms in the new law that require battery sourcing in North America, said the guidance released by the Treasury Department “completely ignores the intent of the Inflation Reduction Act.’' Manchin called it “horrific” that the Biden administration “continues to ignore the purpose of the law, which is to bring manufacturing back to America and ensure we have reliable and secure supply chains.’' Referring to the proposal’s 60-day comment period, Manchin said, “My comment is simple: Stop this now.

History of this topic

Auto industry’s shift toward EVs is expected to go on despite Trump threat to kill tax credits

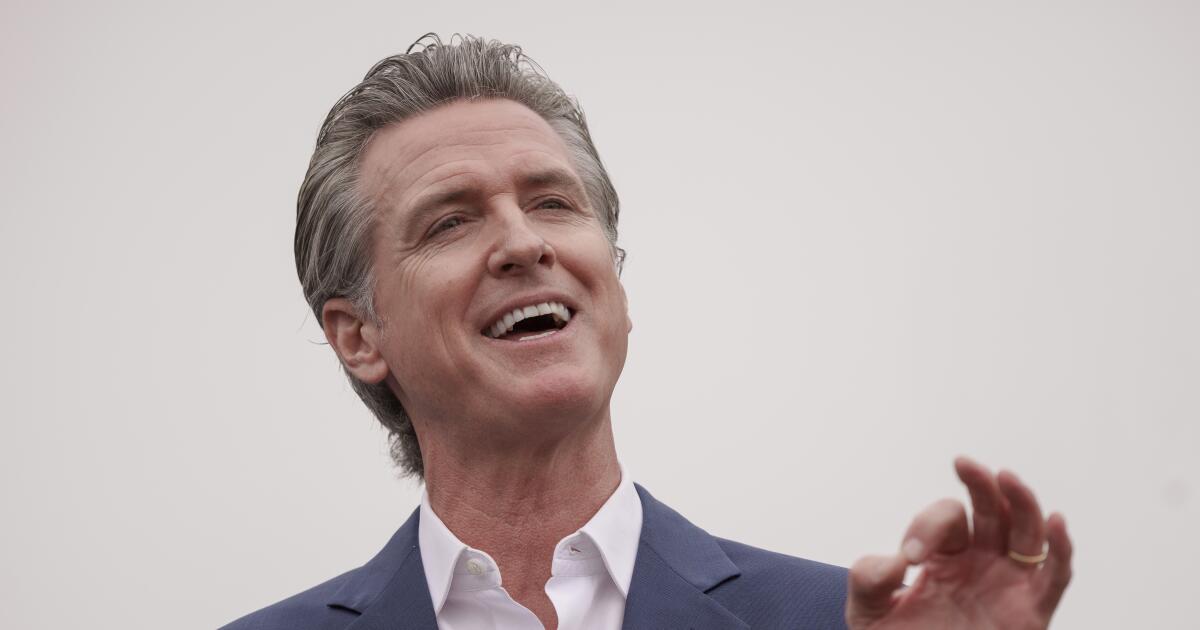

Associated PressNewsom says California could offer electric vehicle rebates if Trump eliminates federal tax credit

Associated Press

The EV Buyer’s Guide to an Uncertain Future

Wired

The withering dream of a cheap American electric car

Live Mint

Seven in ten electric vehicles will be stung with the additional £410-a-year 'luxury car' premium tax when VED exemption ends next year

Daily MailUS loosens some electric vehicle battery rules, potentially making more EVs eligible for tax credits

Associated Press

Research shows interest in electric car ownership is dwindling

NL TimesFor consumers shopping for an EV, new rules mean fewer models qualify for a tax credit

Associated Press

'EVs are £700 a year cheaper to keep on the road than petrol cars', green think tank says

Daily Mail

More electric vehicles lose tax credits due to battery sourcing rules in US

Live Mint

Electric car models eligible for $7,500 tax credit cut to 13

LA TimesNew US rules, aimed at curbing China, could make it harder for EV buyers to claim a full tax credit

Associated Press

The easiest way to get a $7,500 tax credit for an electric vehicle? Consider leasing.

Associated Press

The Ford F-150 qualifies for an EV tax credit, but good luck getting it

LA Times

10 electric and plug-in hybrid cars that qualify for $7,500 tax cut

Daily Mail

Editorial: Only a few EVs made the tax credit list. That’s bad news for the climate

LA Times

See the EVs eligible for tax credits - and why most aren’t

Associated Press

New US tax credit rules narrow the list of eligible EVs

Hindustan Times

These are the EV models that will get you the full $7,500 tax credit

LA Times

Stiff EPA emission limits to boost US electric vehicle sales

Associated Press

4 in 10 say next vehicle may be electric: AP-NORC/EPIC poll

Associated Press

AP sources: EPA car rule to push huge increase in EV sales

Associated Press

Treasury makes more electric SUVs eligible for tax credits

Associated Press

Tesla's price move in US and Europe. Aim: Drive up sales

Hindustan Times

EXPLAINER: 2023 tax credits for EVs will boost their appeal

Associated Press

EXPLAINER: 2023 tax credits for EVs will boost their appeal

Associated Press

2023 tax credits for EVs will boost their appeal

LA Times

Rule delay makes big EV tax credit possible early next year

Associated Press

Rule delay makes big EV tax credit possible early next year

The Independent

Which EVs qualify for new US tax credit? Websites offer help

Associated Press

Most electric vehicles won’t qualify for federal tax credit

Associated Press

Senate deal should make it easier to buy electric vehicles

Associated Press

US electric-vehicle tax credits ending for new Toyota buyers

Associated Press

Harris unveils plan for electric vehicle charging network

Associated Press

Biden pushes electric vehicle chargers as energy costs spike

Associated Press

Proposed US EV tax credit gets global pushback

Al JazeeraToyota, Honda oppose U.S. House electric vehicle tax plan

The Hindu

US automakers pledge huge increase in electric vehicles

Associated PressGM to boost spending on electric vehicles

The Hindu

Biden aims to juice EV sales, but would his plan work?

Associated PressDriver taxes will put Australia even further behind in electric vehicle market, research finds

ABCDiscover Related

)