LPR: China makes biggest-ever cut to key mortgage rate to support housing market

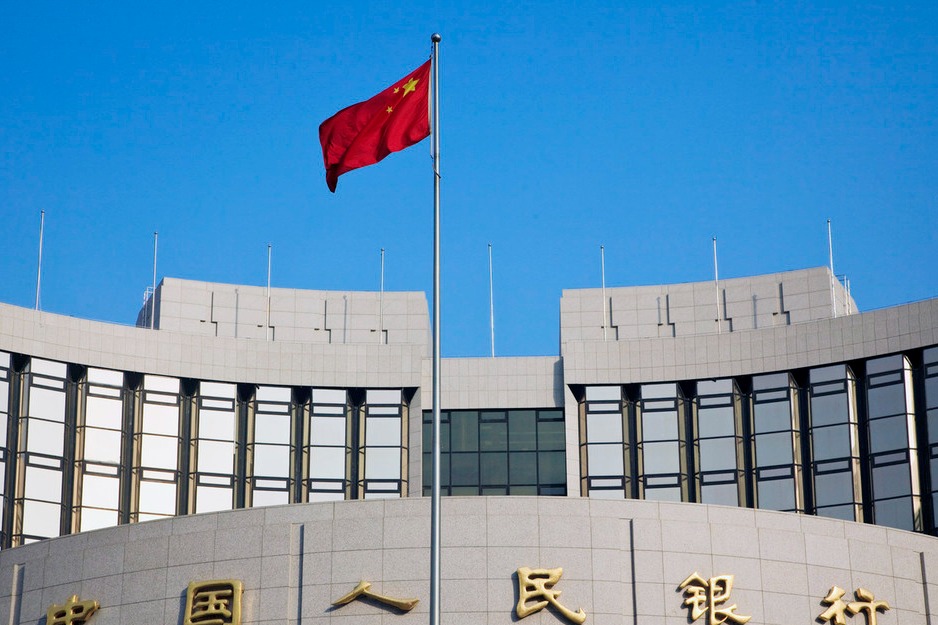

CNNEditor’s Note: Sign up for CNN’s Meanwhile in China newsletter, which explores what you need to know about the country’s rise and how it impacts the world. Hong Kong CNN — China’s central bank has cut its key mortgage reference rate by a record amount, as it ramps up efforts to stem a prolonged property crisis. The People’s Bank of China announced Tuesday that it would cut its five-year loan prime rate from 4.2% to 3.95%, while keeping the one-year LPR unchanged at 3.45%. “Today’s 25 cut to the five-year LPR is clearly aimed at supporting the housing market,” analysts from Capital Economics said in a note on Tuesday. China’s economy has been hobbled by a real estate downturn since 2021, when a government crackdown on developers’ borrowing triggered a liquidity crisis in the sector.

History of this topic

China's loan prime rates remain unchanged

China Daily

Rate cuts set to boost market confidence

China Daily

Housing market hopeful of mortgage rate cuts

China Daily

Big banks cut deposit rates to strengthen sector stability

China DailyChina cuts 1-year benchmark rate and doubles subsidies for EVs in its ‘cash for clunkers’ program

Associated Press

China lowers MLF interest rate to reduce financing costs

China Daily

China lowers MLF interest rate to reduce financing costs

China Daily

Major Chinese banks cut deposit rates

China Daily

Major Chinese banks cut deposit rates

China Daily

China cuts benchmark lending rate LPR

China Daily

China's loan prime rates remain unchanged

China Daily

China leaves benchmark lending rates unchanged, as expected

Hindustan Times

Significant interest rate cuts, just what the market needs

China Daily

China implements biggest LPR cut on record

China DailyChina cuts key interest rate in the latest move to boost its ailing property sector

Associated Press

China cuts mortgage reference rate more than expected to revive property market

Hindustan Times

China implements biggest LPR cut on record

China Daily

China’s central bank eyes reserve ratio cut to boost lending

Live Mint

New deposit rate cuts herald cheaper loans

China Daily

PBOC cuts rates to boost growth

China Daily

PBOC cuts rates to boost growth

China Daily

专家:央行降息将促进我国经济复苏

China Daily

央行超预期下调政策利率,稳增长措施再加码

China Daily

央行超预期下调政策利率,稳增长措施再加码

China Daily

Unchanged LPR signals more aid for economy

China Daily

China signals caution on inflation despite COVID, Ukraine woes

Al Jazeera

一周双语新闻热词汇总(1.15-21)

China Daily

China economy: LPR cut for the first time in 20 months

CNNDiscover Related

)