High street firms face ‘terrible choices’ after Budget tax rises

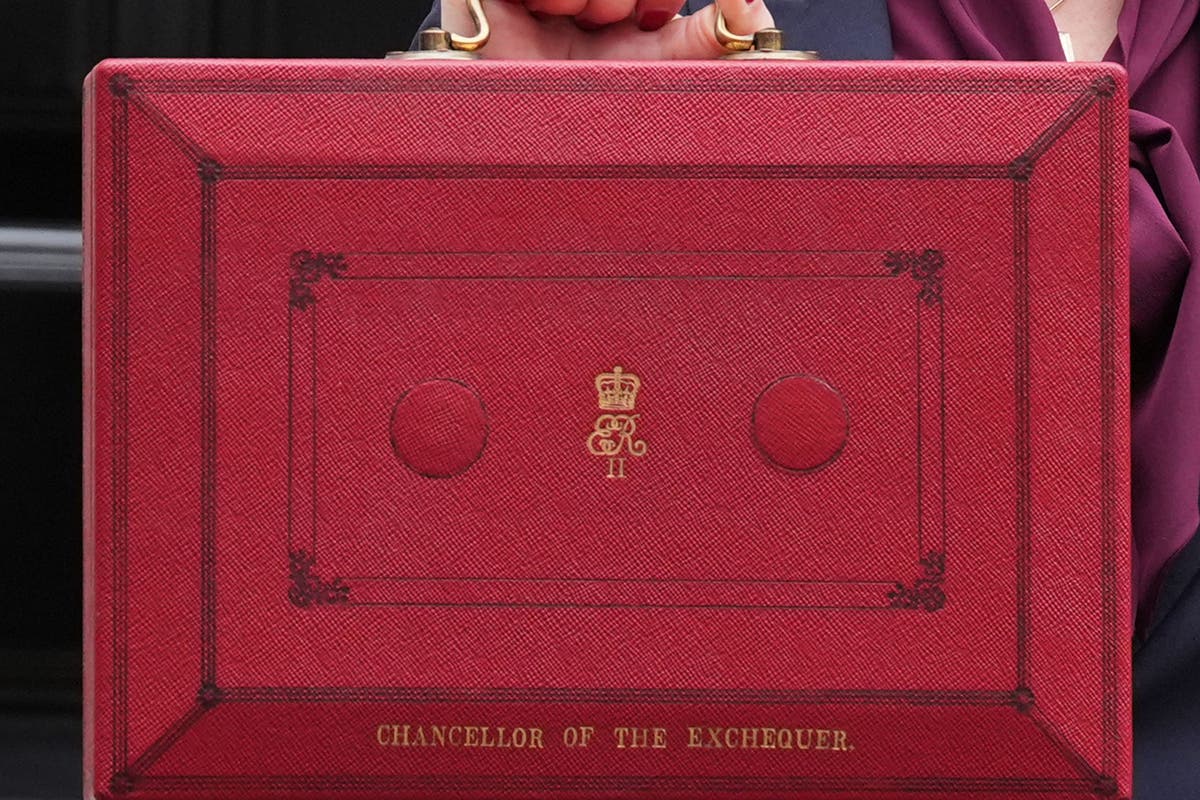

The IndependentFor free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails Sign up to our free breaking news emails Sign up to our free breaking news emails SIGN UP I would like to be emailed about offers, events and updates from The Independent. Read our privacy policy Hospitality and retail businesses have said they have “terrible choices to make” about potential cuts to investment and their workforces due to Budget tax rises. Rachel Reeves revealed a £25.7 billion change to employers’ national insurance contributions in last month’s Budget, which would increase the rate of the tax and the threshold at which firms must pay. Hospitality veteran Luke Johnson, currently an investor and director in bakery chain Gail’s, told BBC Radio 4’s Today programme that companies will now face “really tough choices”. It’s a tax on jobs, a tax on work, it’s a regressive tax because it will hit low earners, and for labour-intensive businesses like hospitality or retail it's enormously discouraging Gail's investor Luke Johnson The former Pizza Express chairman said: “I think it’s a mistake because it’s a tax on jobs, a tax on work, it’s a regressive tax because it will hit low earners, and for labour-intensive businesses like hospitality or retail it’s enormously discouraging.

History of this topic

New Budget blow for Starmer as retailers warn of price hikes and job cuts

The Independent

Currys warns Budget will lead to ‘inevitable’ price rises due to £32m of extra costs

The Independent

Business confidence tumbles to two-year low following Reeves’s raid on employers

The Independent

Britain’s biggest retailers say job losses ‘inevitable’ after Budget tax hikes

The Independent

Retailers warn job losses ‘inevitable’ as they brace for £7bn Budget hit

The Telegraph

Job losses and price hikes inevitable, warn UK’s biggest firms in stark message to Rachel Reeves over Budget

The Independent

Is the ‘Budget for working people’ about to bite supermarket shoppers?

The Independent

Hospitality bosses warn national insurance changes ‘unsustainable’

The Independent

Marks & Spencer boss 'can't rule out' price rises after retailer hit with extra £120m in costs from Labour's tax bomb budget

Daily Mail

Is the backlash against Reeves’s national insurance hike justified?

The Independent

Papers react to Labour’s Budget ‘gamble’

The Independent

Employers warn of crisis as Reeves increases NI contributions

The Telegraph

Employer national insurance hike to slow hiring and wage growth, critics say

The Independent

Millions of working people will suffer from Reeves’s first Budget, warns OBR

The Telegraph

Rachel Reeves 'plans to hike employers' National Insurance by up to two percentage points in Budget to raise £20bn for public services'

Daily Mail

Reeves set to increase employers’ national insurance contributions

The Independent

Tesco workers to share £50m bonuses but supermarket giant warns inflation will hurt profits

The IndependentDiscover Related