UK borrowers brace for more expensive loans as inflation fails to fall as anticipated

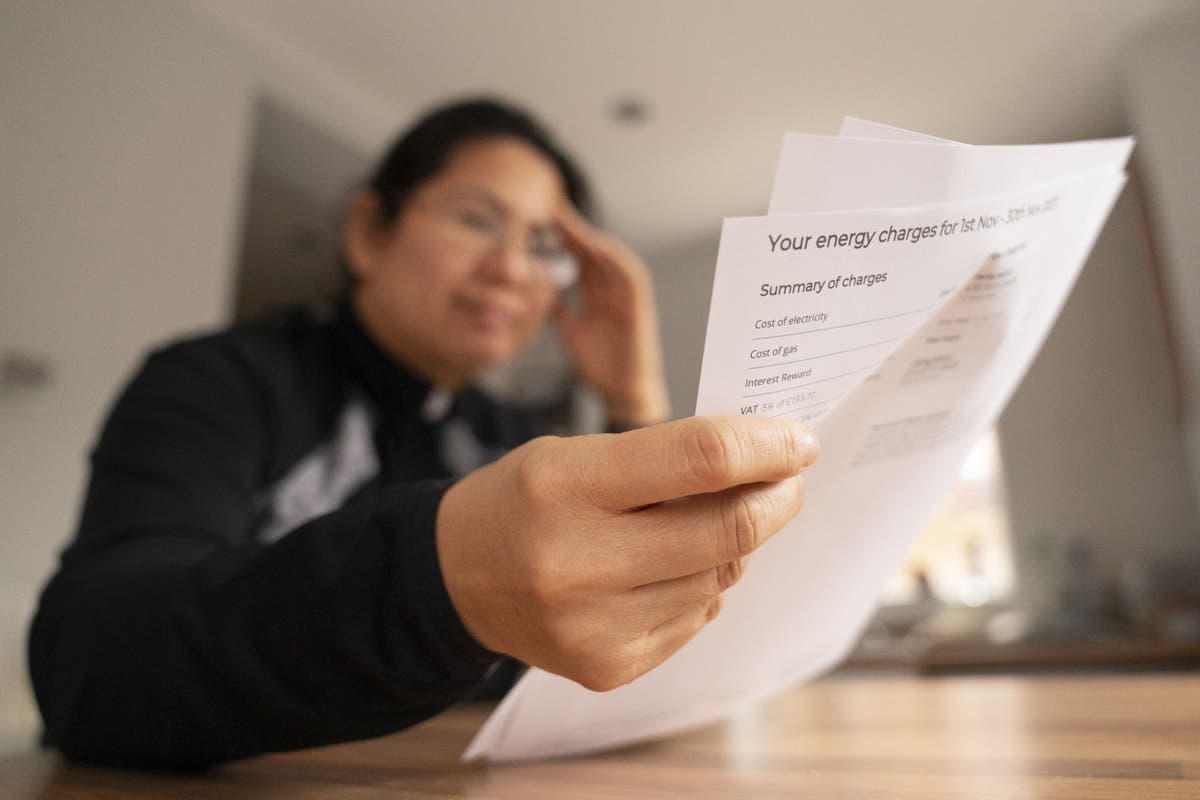

Associated PressLONDON — U.K. borrowers will be bracing themselves for further increases in lending costs after official figures Wednesday showed inflation failing to fall as anticipated in May. Higher interest rates help lower inflation by making it more expensive for households and businesses to borrow, meaning they potentially spend less, thereby reducing demand pressure on prices. “We know how much high inflation hurts families and businesses across the country, and our plan to halve the rate this year is the best way we can keep costs and interest rates down,” Treasury chief Jeremy Hunt said. “It’s a ticking time bomb as 1.4 million borrowers will see an end to their low fixed rates this year,” said Jamie Elvin, director at mortgage broker Strive Mortgages. Like other central banks, the Bank of England has aggressively raised borrowing rates over the past 18 months or so after inflation spiked sharply, first because of bottlenecks caused by the coronavirus pandemic and then because of Russia’s invasion of Ukraine, which sent energy and food prices surging.

History of this topic

Bank of England HOLDS interest rates despite UK economy stalling after Labour's Budget raid - with fears over resurgent inflation

Daily MailBank of England warns of ‘heightened uncertainty’ as it keeps interest rates on hold

Associated Press

Interest rates live updates: Bank of England verdict due after surprise inflation rise

The Independent

Bank of England set to keep interest rates on hold TODAY despite UK economy stalling after Labour's Budget raid - with fears over resurgent inflation

Daily Mail

Inflation rates live: Bank of England expected to hold interest rates at 4.75 per cent

The Independent

What does rising inflation mean for you - and has it killed off a Bank of England interest rate cut?

Daily Mail

U.K. Inflation rises further above Bank of England's target in November

The HinduUK inflation increase solidifies expectations interest rates will be kept on hold

Associated Press

Surge in wages means beleaguered borrowers must wait for interest rates cut

The Independent

Bank of England expected to hold interest rates after jump in inflation

The Independent

Personal Loan: How inflation influences your interest rates? Explore here

Live Mint

UK interest rates to fall more slowly than expected after Budget – OECD

The Independent

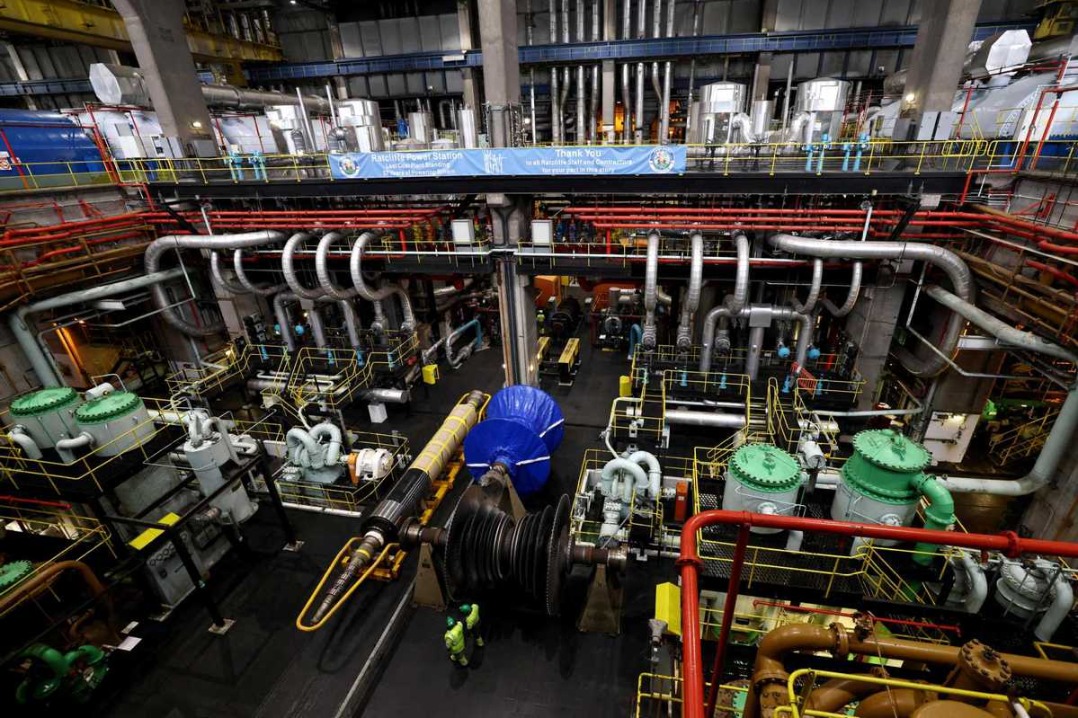

Energy costs push UK inflation to 2.3 percent

China Daily

Millions hit with mortgage blow as rise in inflation crushes hopes of interest rate cut

Daily Mail

UK inflation hits six-month high of 2.3% on high energy bills; BoE stresses on gradual rate cuts

Live Mint

What rising inflation means for you: HUGO DUNCAN on why it dashes hopes of a Christmas Bank of England rate cut

Daily Mail

Inflation set to rebound after jump in energy bills

The Independent

Inflation set to rebound after jump in energy bills

The Independent)

Bank of England cuts interest rate to 4.75% as UK inflation drops, but economic uncertainty looms

Firstpost

Boost for Brits as Bank of England trims interest rates from 5% to 4.75%... but will hopes of 'aggressive' cuts be dashed by Labour's big-spending Budget?

Daily Mail

Brits hope for mortgage relief with Bank of England poised to cut interest rates TODAY… but fears big-spending Budget could keep borrowing costs higher for years

Daily MailBank of England cuts UK interest rates again despite modest budget-related inflation spike

Associated Press

Why Britain’s inflation nightmare may not be over

The Telegraph

Interest rate cut ‘nailed on’ after UK inflation falls to three-year low

The Independent

Why has inflation slowed and what does it mean for households?

The Independent

Why is the drop in wage growth good news for borrowers?

The Independent

Bank of England could be ‘more aggressive’ with interest rate cuts, says governor

The Independent

Could the conflict in the Middle East have a knock-on effect on interest rates?

The Independent

Bank says interest rates could be cut ‘gradually’ after holding at 5%

The Independent

UK interest rates kept at 5% as Bank of England says ‘vital’ inflation stays low

The Independent

Inflation steady – but chances of another rate cut are slim

The Independent

Why the rise in inflation might actually be... good news

The Independent

Bank of England interest rate cut joy for mortgage holders as Rachel Reeves blames mini-Budget for inflation - UK politics live

The Independent)

In a first since pandemic, Bank of England lowers key interest rates

FirstpostBank of England lowers its main interest rate by 0.25%, to 5%, its first cut in over 4 years

Associated Press

UK inflation stays at 2% target in June, leaving rate cut on a 'knife edge'

Hindustan Times

Inflation is down in Europe. But the European Central Bank is in no hurry to make more rate cuts

The Independent

UK inflation rate back down to 2%

China DailyFurther rate rises look increasingly possible, but would they fix inflation?

ABCWith election looming, UK’s governing Conservatives seize on inflation fall to 2% target

Associated Press

UK inflation - live: Tories call for Bank of England to cut interest rates despite market gloom over rising prices

The IndependentUK inflation lowest in 3 years. Prime Minister Sunak makes it a focus in election call for July 4

Associated Press

Inflation improves slightly in April, but high cost of housing remains a big obstacle

LA TimesBank of England edges closer to rate cut, possibly in June, as it predicts below-target inflation

Associated PressUK inflation falls to lowest level since late 2021 as food prices ease further

Associated Press

House prices fell in March. Here’s why that shouldn’t surprise us

The IndependentUK inflation is heading in ‘right direction,’ but Bank of England isn’t ready to cut rates

Associated Press

Inflation is falling fast – but will the Bank of England move to cut interest rates?

The Independent

What does the steep fall in inflation mean for UK households?

The IndependentUK inflation falls by more than expected in February, triggering talk of lower interest rates

Associated PressDiscover Related

)