1 year, 10 months ago

Budget 2023: This is how much tax you can save under New Tax Regime

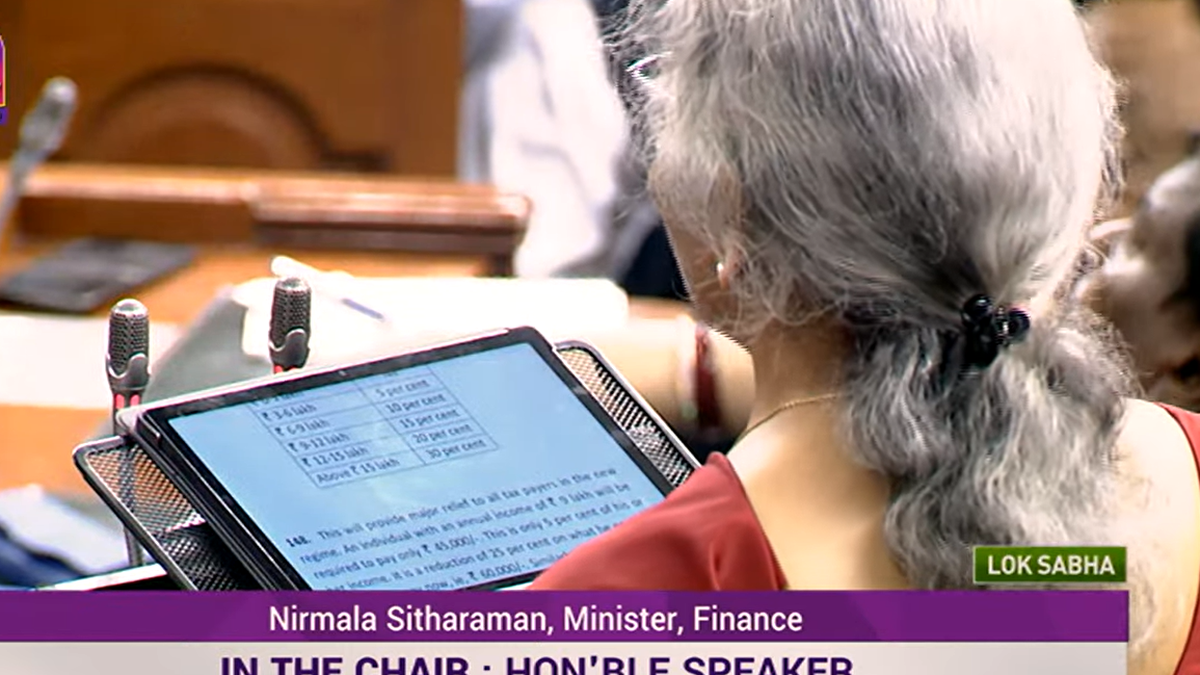

Live MintMaintaining consistency in the foundation laid in previous Budgets, the FinMin has announced various measures to make the New Tax Regime seem more tax beneficial to individual taxpayers as compared to the existing/Old Tax Regime. The amendments in the proposed NTR could result in tax savings as below: -The basic exemption limit under the proposed NTR has been enhanced by ₹50,000. While the incremental tax was ₹75,000 i.e., OTR-NTR; the incremental tax under the proposed NTR would be reduced by 50% to ₹37,500 i.e., OTR-proposed NTR. -Rebate under Section 87A of the Income-tax Act, 1961 is available to resident individuals only whereby for taxable income up to ₹5,00,000 individuals are not required to pay tax under OTR and NTR.

Tax

Budget

Income

Ntr

Proposed

Taxable Income

Taxable

Tax Savings

Otr

savings

budget

ntr

proposed

regime

save

surcharge

2023

income

vs

taxpayers

tax

otr

taxable

History of this topic

1 month, 1 week ago

Can you expect major income tax changes in Budget 2025? Check details

India Today

Trending News

1 month, 1 week ago

It is time India started indexing tax slabs and exemptions with inflation

Live Mint

5 months ago

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

5 months ago

Budget 2024: Is the new income tax regime beneficial for all salaried taxpayers?

Hindustan Times

5 months ago

New income tax regime: Check how much tax you will pay now

India Today

5 months ago

Budget 2024: Time to opt out of old tax regime? Explained

Hindustan Times

5 months ago

Income tax benefits, capital gains tax hike, cheaper phones | Key Budget takeaways

Hindustan Times

5 months ago

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times

5 months ago

Revised income tax slab rates, Budget 2024: Salaried individuals stand to save up to ₹17,500, standard deductions hiked

The Hindu)

5 months ago

Union Budget 2024: Should you pick new tax regime? How can you save Rs 17,500 in income tax every year?

Firstpost)

5 months ago

Calculation: Will you pay more income tax or less after Budget 2024 changes?

Firstpost

5 months ago

Afternoon briefing: New tax regime slabs revised in Budget 2024; IIT Delhi's submission to SC in NEET row; and more

Hindustan Times

5 months ago

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

5 months ago

Budget 2024: Income tax slabs changed, standard deduction increased. Read details

Op India

5 months ago

Budget 2024 Highlights on income tax: FM Sitharaman revises personal income tax slabs; taxation rates remain unchanged

The Hindu

5 months ago

Budget 2024 Boost To New Tax Regime: Standard Deduction Raised To Rs 75k From Rs 50k

News 18

5 months ago

Budget 2024 announcements on new tax regime: Standard deduction increased, check new tax slabs

India TV News

5 months ago

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

5 months ago

Budget 2024: Taxpayers, you can expect these 6 income tax benefits on July 23

Hindustan Times

5 months ago

Budget 2024: What income tax benefits can taxpayers expect on July 23?

India Today

5 months, 1 week ago

Budget 2024: This change to old income tax regime can provide relief to millions

India Today

5 months, 1 week ago

India's 2024 Budget: A push for tax reform

India Today

6 months ago

Budget 2024: Low-income individuals likely to get big tax relief, says report

India Today

6 months ago

Budget 2024: Finance minister Nirmala Sitharaman to increase income tax exemption limit?

Hindustan Times

6 months ago

Budget 2024: Exemption limit under new tax regime may be hiked to Rs 5 lakh, says report

India Today

8 months, 3 weeks ago

New Tax regime rules to come into effect from today: Check deductions, rebates, changes in tax slab

India TV News

10 months, 3 weeks ago

Budget 2024: 6 key changes taxpayers want from FM Sitharaman

India Today

1 year, 4 months ago

More Than 5 Crore Taxpayers Opt for New Tax Regime 2023

News 18

1 year, 4 months ago

Direct tax collections rise 16% to ₹6.53 lakh crore so far this fiscal

Hindustan Times

1 year, 8 months ago

From Apr 1, these 10 big income tax rule changes to be effective. Details

Hindustan Times

1 year, 8 months ago

Net direct tax growth for 2022-23 to slow to 15%

The Hindu

1 year, 8 months ago

New tax regime, rules to roll out from Apr 1. Here’s what taxpayers need to know

Live Mint

1 year, 10 months ago

Haryana CM presents ₹1,83,950 crore budget for 2023-24, up 11.6%; no new tax imposed

The Hindu

1 year, 10 months ago

Everything To Know About the New Income Tax Regime 2023

Hindustan Times

1 year, 10 months ago

New income tax regime: How to save tax if annual income is above ₹7 lakh?

Live Mint

1 year, 10 months ago

How taxes are calculated on salary above ₹7 lakh in new regime? A quick view

Live Mint

1 year, 10 months ago

Budget 2023: How Nirmala Sitharaman attempted to simplify tax experience

Live Mint

1 year, 10 months ago

Budget 2023: New tax regime to be default; who will benefit from it?

Hindustan Times

1 year, 10 months ago

Budget 2023: How the new tax regime is different from the existing one

Hindustan Times

1 year, 10 months ago

Budget 2023: Big hike in tax exemption on encashed leaves for non-govt staff

Hindustan Times

1 year, 10 months ago

No income-tax upto Rs 7 lakh in new tax regime

Deccan Chronicle

1 year, 10 months ago

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax

The Hindu

1 year, 10 months ago

Budget 2023 new income tax slabs: How to calculate your tax

Hindustan Times

1 year, 10 months ago

Budget 2023: No income tax up to ₹7 lakh, revised tax slabs for new regime

Hindustan Times

1 year, 10 months ago

Budget 2023: How are old and new income tax slabs different from each other

Hindustan Times

1 year, 10 months ago

Budget 2023 Key Highlights: Are You Under New Tax Regime? Nirmala Sitharaman Has Good News for You

News 18

1 year, 10 months ago

Budget 2023: Govt increases income tax rebate to Rs 7 lakh per annum | 5 major announcements

India TV News

2 years, 3 months ago

Centre mulls cutting tax rates in new income tax regime

Live Mint

2 years, 10 months ago

Income tax rebate to PPF, top 5 budget 2022 announcements expected

Live MintDiscover Related

23 hours, 48 minutes ago

1 day, 9 hours ago

1 day, 12 hours ago

Top News

3 days, 10 hours ago

4 days, 9 hours ago

6 days ago

6 days, 3 hours ago

6 days, 6 hours ago

6 days, 17 hours ago

1 week ago

1 week ago

1 week, 1 day ago

1 week, 4 days ago

1 week, 5 days ago

1 week, 5 days ago

2 weeks, 4 days ago

2 weeks, 4 days ago

Trending News

2 weeks, 6 days ago

2 weeks, 6 days ago

)

3 weeks ago

3 weeks, 1 day ago

Trending News

3 weeks, 1 day ago

3 weeks, 4 days ago

3 weeks, 6 days ago

4 weeks ago

1 month ago

1 month ago

1 month, 1 week ago

1 month, 1 week ago

)

1 month, 1 week ago

1 month, 1 week ago

Trending News

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

Trending News

1 month, 1 week ago

)

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 2 weeks ago

1 month, 2 weeks ago

1 month, 2 weeks ago

1 month, 2 weeks ago

1 month, 2 weeks ago