Coronavirus: Trump loans being delayed by red tape as poll finds quarter of small businesses will close permanently in two months

The IndependentSign up for the daily Inside Washington email for exclusive US coverage and analysis sent to your inbox Get our free Inside Washington email Get our free Inside Washington email SIGN UP I would like to be emailed about offers, events and updates from The Independent. When asked what proposals might offer the most relief, small businesses indicated support for three key provisions included in the recently enacted Coronavirus Aid, Relief, and Economic Security Act : 56 per cent of small businesses say direct cash payments to Americans would be the most helpful form of aid from the government. “American banks will be on the front lines to help businesses survive during this pandemic.” Friday sees the launch of the $350bn lending program to help small businesses struggling with the impact of coronavirus. Mr Mnuchin and Small Business Administrator Jovita Carranza joined President Donald Trump at his daily press briefing on Thursday to encourage small business owners to apply for loans ahead of applications beginning on Friday. Rob Nichols, CEO of the American Bankers Association, commented: “We should all remember that this is an unprecedented expansion of SBA lending that will take some time before it’s fully functioning.” A White House official told Politico: “The White House, in coordination with Treasury and SBA, is in constant contact with the country’s banking industry and has hosted dozens of calls and meetings in the run-up to the launch of the Paycheck Protection Program.” “It is important to keep perspective of the unprecedented nature of this crisis and the rate to which we all need to act to provide immediate, much-needed, relief to America’s small businesses and workers,” they added.

History of this topic

One in 12 businesses default on Covid loans, figures show

The Independent

Covid loan bank went through ‘gigantic shift’ as it funnelled £88bn to UK companies

The Independent

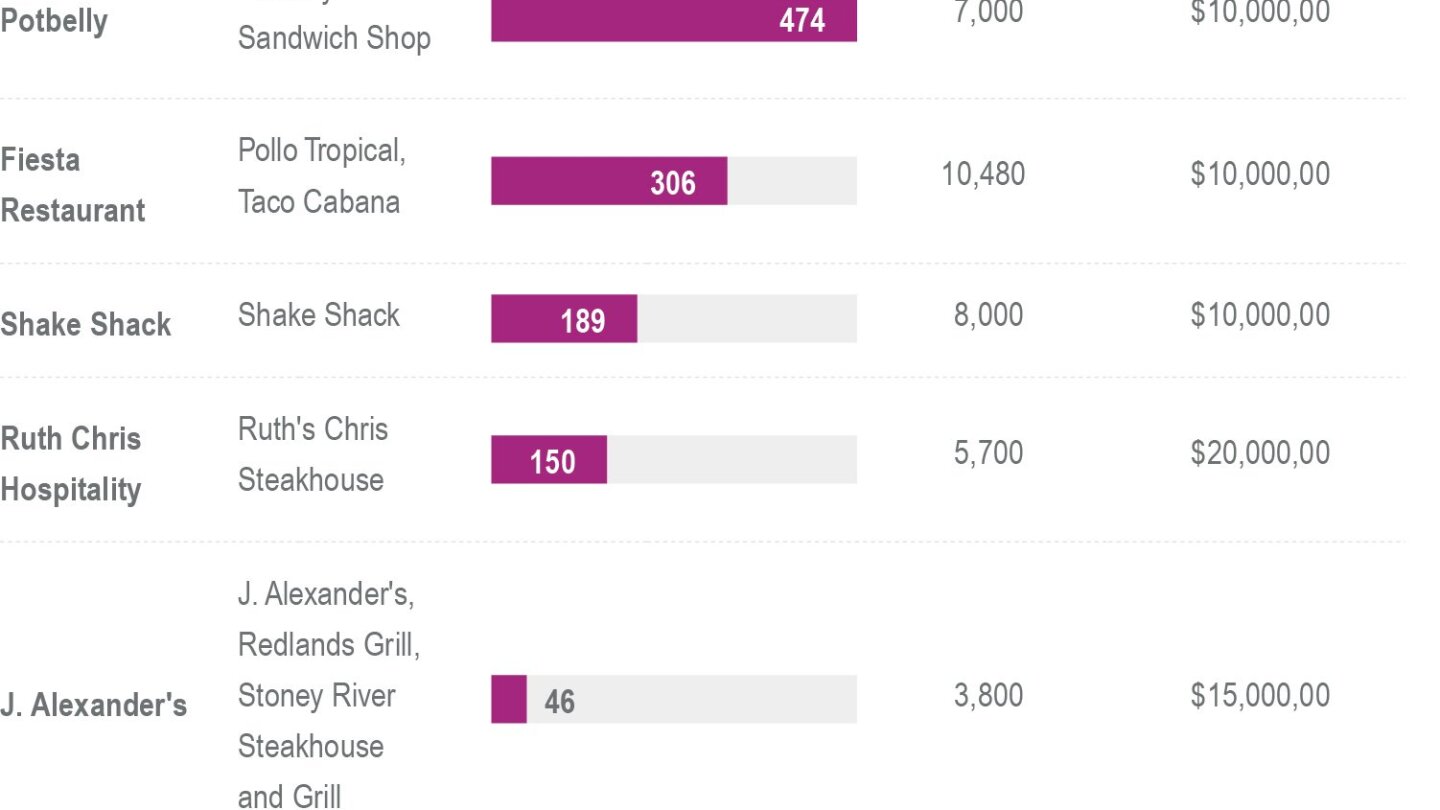

Head of the line: Big companies got coronavirus loans first

Associated Press

Small Business Loans Site Crashes On First Day Of Reopening

NPR

$310B for small business loans likely spoken for, banks say

Associated Press

Coronavirus: Ruth's Chris returns $20 million business loan after backlash

The Independent

3 takeaways from AP review of small-business loan program

Associated Press

Company With Ties To Trump Receives Millions From Small Business Loan Program

NPR

Business owners left out as lending program goes on hold

Associated Press

Government loans start flowing to small businesses

Associated Press

With Survival At Stake, Small Business Owners Frustrated By Aid Delays

NPR

Government's $2 Trillion Coronavirus Response Stumbles Out The Gate

Huff Post

SBA loan program glitches reveal challenge in rolling out billions in coronavirus aid

CNN

The Coronavirus Small Business Loan Program: What You Need To Know

NPR

Federal program for small businesses that are hurt by coronavirus is slowed by snags

LA TimesCoronavirus crisis sees Banking Association announce six-month loan repayment deferrals for small businesses

ABC

Coronavirus impact: Millions of Chinese firms face collapse if banks don’t act fast

Live MintDiscover Related

)