GST: GoM Meet On Casino, Online Gaming Remains Inconclusive; To Meet Again Next Month

News 18Goods and Services Tax : The group of ministers on casinos, online gaming and horse racing, which has been tasked with examining the issue of levying a 28 per cent GST on these activities, met on Tuesday and the meeting remained inconclusive, a source told CNBC-TV18. The GoM, headed by GST Council Meghalaya Chief Minister Conrad Sangma, discussed the valuation mechanism and expressed the opinion that GST should be levied on gross gaming revenue, as per international best practices, and not the overall pool as was recommended earlier, said the source. The source also said GoM members were all on board on levying a 28 per cent GST on all three activities — online gaming, casinos and race courses. The GoM had earlier recommended that online gaming should be taxed at the full value of the consideration, including the contest entry fee paid by the player on participating in the game. On the valuation, the GoM had earlier said that in the case of online gaming, it should be full value of consideration, including contest entry fee, paid by the player for participation.

History of this topic

53rd GST Council Meet Tomorrow: What's The Key Expectations?

Live Law

GST Council to meet on June 22, likely to review online gaming taxation

India TV NewsOnline gaming companies get ₹1 lakh crore GST show cause notices so far

The Hindu

All states for 28% GST on online money gaming effective from 1 Oct: Revenue Secy

Live Mint

Online gaming companies to collect 28% on full bet value, offshore platforms to be GST registered from October 1

The Hindu

28 per cent GST rate on online gaming from October 1

Hindustan Times

Parliament clears 28% GST on online gaming, casinos

Live Mint

Parliament clears 28% GST on online gaming, casinos, horse racing clubs

Live Mint

Parliament paves way for 28% GST on online gaming

The Hindu

Central GST (Amendment) Bill To Be Tabled To Include 28% GST On Online Gaming, Casinos, Horse Race Clubs

Live Law

28% GST on online gaming: How will new tax work for players and companies

Business Standard

GST Council sticks to its guns, imposes 28% tax on online gaming

The Hindu

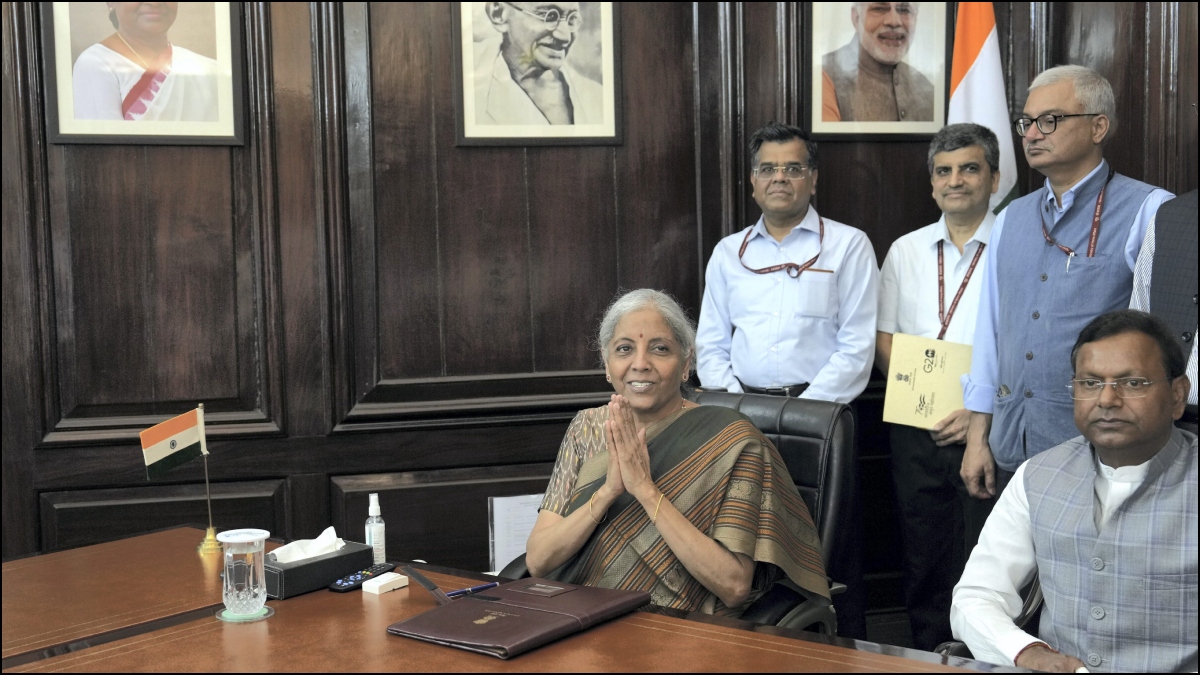

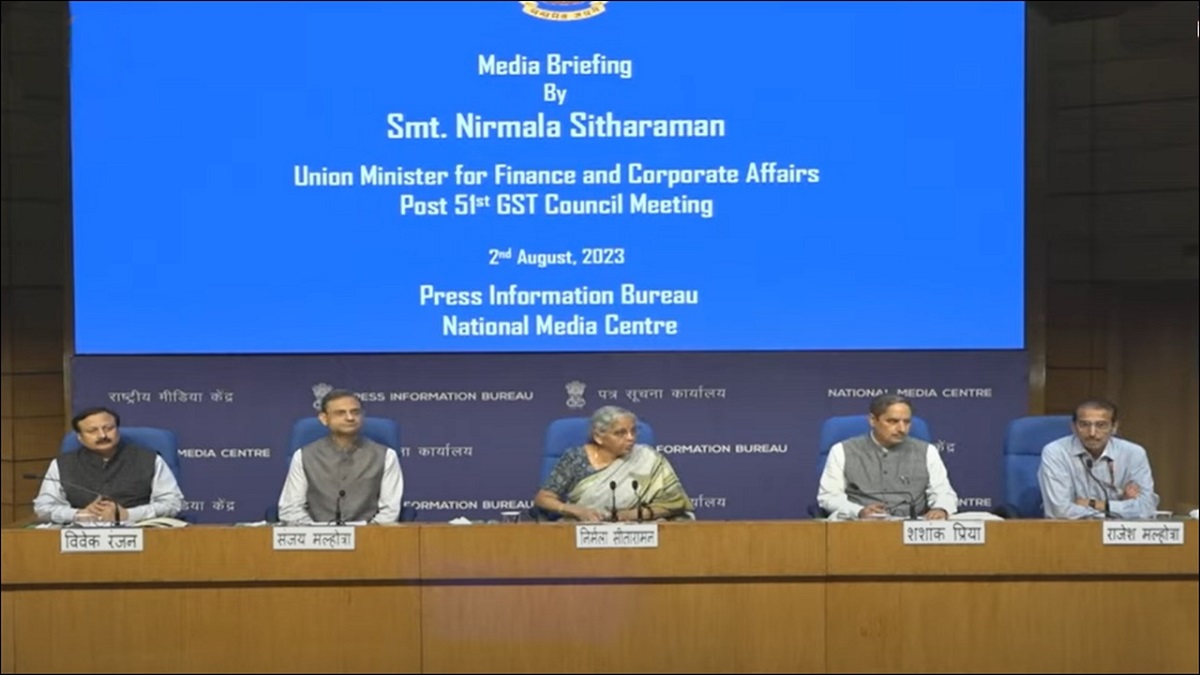

GST council meet: 28% tax on online gaming effective from Oct 1, announces FM

Hindustan Times

GST Council Keeps 28% Tax on Online Gaming, To Be Effective From Oct 1, Review After 6 Months

News 18

28 per cent tax on online gaming to be implemented from October 1: Nirmala Sitharaman

India TV News

GST Council To Meet On August 2 On Online Gaming, Casino Rules: Reports

News 18

GST Council to meet on August 2 to finalise 28% online gaming tax: Report

India Today

Online Gaming GST Tax Rajeev Chandrasekhar MeitY Approach Council Once Sustainable Framework Is Established

ABP NewsExplained | Will 28% GST on online gaming affect its growth?

The Hindu

Online Gaming GST Council 28 percent Nirmala Sitharaman India Industry Reaction Ashneer Grover Twitter

ABP News

’Implementation of 28% GST rate will bring challenges to online gaming industry’

Live Mint

GST Council Meet: 28% Tax Imposed On Online Gaming On Full Face Value

ABP News

Delta Corp shares in focus after GST Council clears 28% tax on online gaming

Live Mint

Real money gaming industry reacts with shock to GST on deposits

The Hindu

GST Council to impose 28% tax on online gaming firms

The Hindu

28% GST on online gaming, horse racing, casinos on full face value. Explained

Hindustan Times

50th GST council meeting: Setback for online gaming, horse racing, casinos; to attract 28% tax

India TV News

Online Rummy Games Played Are Not Taxable As ‘Betting’ And ‘Gambling: Karnataka High Court Quashes GST Intimation Notice Demanding Rs. 21,000 Crores Against Gameskraft

Live Law

Online games of skill like rummy are not taxable as ‘betting and gambling’ under GST Act: Karnataka High Court

The Hindu)

Online gaming in India likely to attract 28 per cent GST instead of 18, calculation method to be tweaked

Firstpost

Online gaming gst india gom report finance minister panel recommend 28 per cent tax

ABP News

Online Gaming Taxation: GoM Likely To Finalise Report Within 10 Days

ABP News

28% GST on Online Gaming - Huge Win for the Exchequer

The Quint

OPINION | Is Online Gaming A Conundrum For GST?

ABP News

GST Meet Highlights: GoM Suggestions on GST Exemptions, Correction of Inverted Duty Accepted, Says FM

News 18

GST Council meet: What FM said on rate rationalisation, tax on casinos, lottery

Live Mint

GST Council Meet: Pre-Packed Items Under GST; 28% Tax On Casino Deferred; Key Decisions

News 18

GST Council Defers 28% Tax On Casinos, Online Gaming; GoM To Submit Fresh Report Till July 15

News 18GST rate increase will kill online skill gaming industry: associations

The Hindu

Govt may put online games in 28 per cent GST tax slab, council to discuss on June 28

India Today

Against The Run of Play: 28% Possible GST on Online Gaming Worries Industry Experts about Future Growth

News 18

GST Council may approve 28% rate on online games, casinos, race courses

Live Mint

Online gaming GST tax 28 percent gross revenue casino horse race betting Group of ministers conrad sangma

ABP News

Highest tax slab on online gaming may stunt growth

Live Mint

GST Council May Discuss Changes In Law To Set Up Tribunals; GoM Report On Online Gaming, Casinos

News 18

GST Council-Appointed GoM to Meet on June 17; Likely To Discuss GST Rate Rationalisation

News 18

EXPLAINED | India Now Has An Online Gaming Regulatory Panel. What This Means For Gamers

ABP News

Online gaming gst tax slab 28 percent gom decision explained details gamers companies problem issues

ABP News

GST of 28% to be levied on casinos, race course, online gaming

The HinduDiscover Related

![GNLU: 3rd Legislative Drafting Competition : Online Gaming And Gambling Regulation Act 2025 [Register By 26th December]](https://www.livelaw.in/h-upload/2024/12/10/575538-untitled-design-82.jpg)