Govt’s fiscal position and what to expect from Budget 2022

Live MintIn last year’s Budget, the finance minister announced pillars on which her proposals would rest. These were creation of physical and financial capital, speedy infrastructure development, attention to health and wellbeing, reinvigorating innovation and R&D, improving on human capital, and minimum government and maximum governance. To achieve the budget objectives, the government boldly increased the budgetary outlay by 1% to ₹34.83 lakh crore, with capital expenditure at 15% of the budget outlay, going up by 26.8% over FY 2020-21, the first year of pandemic. Making changes in the direct tax to include them can help the sector’s consolidation through amalgamation and mergers and thereby get the necessary capital to spur growth, generate employment, and also pave way for possible digitisation. Other important tax measures that government could consider including in the Budget are higher standard deduction for individuals, enhancing the limit on interest on home loan for individuals, and recognising the business requirement of work-from-home for unburdening the individuals.

History of this topic

Government may ease quarterly capex limits to achieve record ₹11.11 trillion spending goal for FY25: Report

Live Mint

A ‘corrective’ budget’ to repair AP: Health Minister Yadav

Deccan Chronicle

Education, welfare in focus of ₹2.94 lakh-cr Andhra budget

Hindustan Times

Odisha Budget 2024-25: Rs 2.65 Lakh Crore Focuses on Welfare and Development

Deccan Chronicle

Union Budget 2024-25: No additional allocation for Chandigarh but curbs on new projects go

Hindustan Times

Budget 2024: With ₹2.65 lakh crore outlay, Railways to prioritise safety

The Hindu

The budget echoes the Developed India vision

Hindustan Times

Government cuts borrowing target to ₹14.01 lakh crore for 2024-25

Hindustan Times

Budget 2024-25 CAPEX: ₹11 lakh crore allocated towards capital expenditure, 3.4% of GDP by FM Nirmala Sitharaman

The Hindu

Union Budget 2024: Read Finance Minister Nirmala Sitharaman's full speech

India Today

Mahayuti tables demand of ₹95,000 crore to fund populist schemes ahead of polls

Hindustan Times

Move ahead: On GST and reform

The Hindu

A reform window: On the GST trajectory

The Hindu

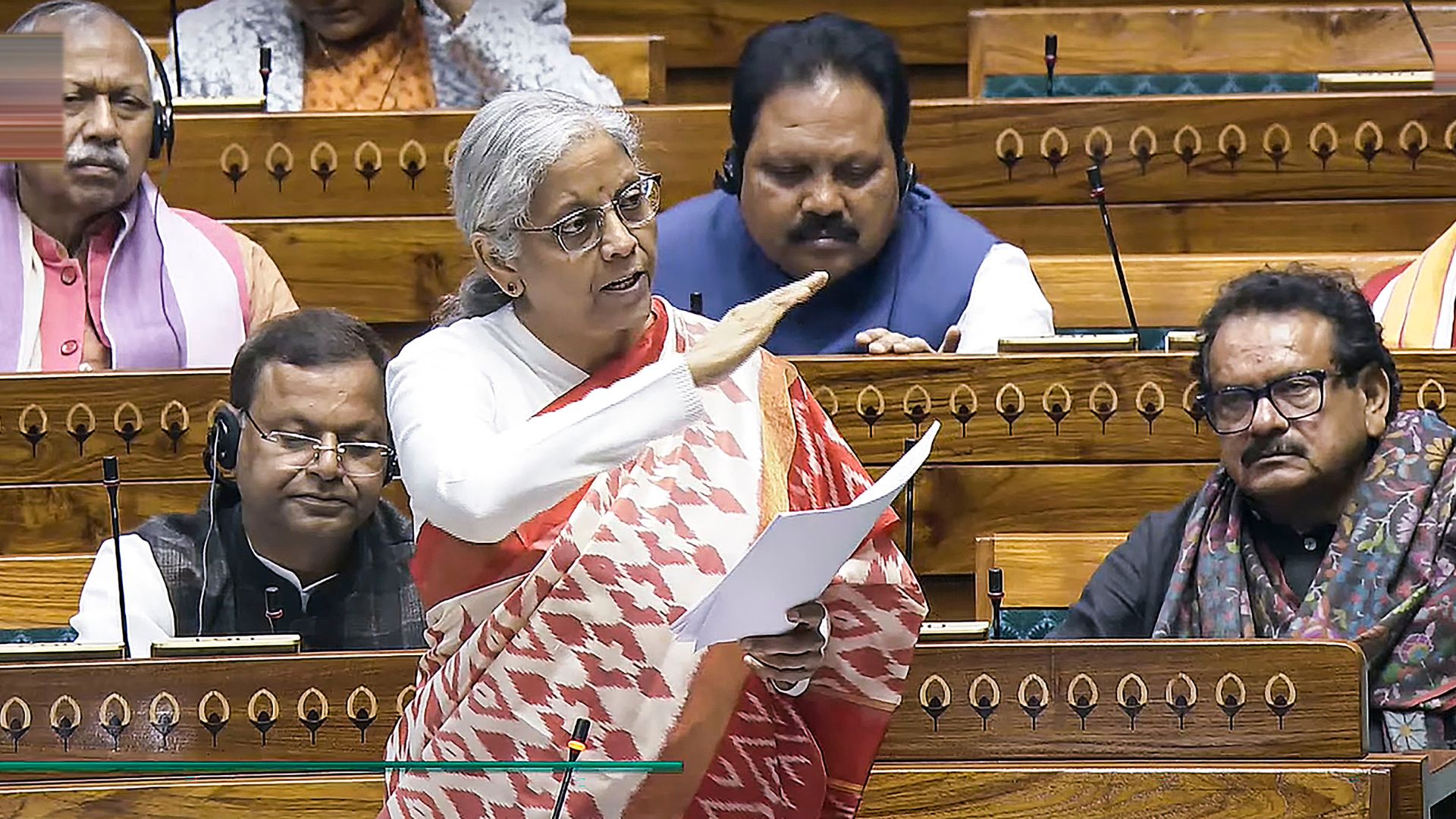

Punjab FM flays Centre for withholding funds, as he presents budget

The Hindu

Ajit Pawar presents interim budget, state debt reaches ₹7.82 lakh crore

Hindustan Times

Bhatti Presents Realistic TS Budget for Rs 2.75 Lakh Cr

Deccan Chronicle

Various Measures Taken To Reduce Debt Burden, Strengthen Economy: FM Nirmala Sitharaman

News 18

Key takeaways from interim Budget 2024-25 in charts

The Hindu

Budget may focus on welfare, infra, adhere to fisc glide path

Hindustan Times

Budget 2024: Government likely to maintain momentum on increasing capital expenditure

India TV News

Growth signals: On GST revenues

The HinduIndia’s fiscal deficit may breach 5.9% of GDP target: India Ratings and Research

The Hindu

Budgetary provisions: UP depts have barely used 50% of funds

Hindustan Times

LS Gives Nod for Additional Cash Outgo of Rs 58,378 Cr in Current Fiscal

Deccan Chronicle

LS Gives Nod for Additional Cash Outgo of Rs 58,378 Crore

Deccan Chronicle

Fund allocations for welfare increased in AP Budget

Deccan Chronicle

MP govt’s ₹3.14 lakh crore budget focuses on women, tribals and religion

Hindustan Times

W.B. Budget for 2023-24 broadens welfare schemes, gives incentives to jobs

The Hindu

TS govt\'s 10 budgets in last 9 years: Targets met only twice

Deccan Chronicle

BJP slams ‘unrealistic’ budget proposals

Deccan Chronicle

42 key provision that make Budget 2023 inclusive and progressive

Op India

Key takeaways from Union Budget 2023-24 in charts

The Hindu)

India keeps aside Rs90,000 Cr in Budget 23-24 for fuel, ammo, spares with eye on China, Ukraine war

Firstpost

A raft of concessions amid consolidation: The Hindu Editorial on Union Budget 2023-24

The Hindu

Math Of Budget 2023: Increase In Taxes To Fund Higher Capex And IT Breaks For Middle Class

ABP News

In Rs 45.03 Lakh Crore Budget, Here Is How Much Each Sector Received

ABP News

Budgeting for Infra: After Defence, Road & Railway Ministries Bag Highest Allocations from FM

News 18

Budget 2023: Defence spending increased by 13% to Rs 5.94 lakh crore

India Today

Budget 2023 | Govt to borrow record ₹15.4 lakh crore in FY24 to bridge revenue gap

The Hindu

Budget 2023: Key Highlights From Modi Govt's Final Full Budget Before 2024 LS Polls

ABP News

Budget: Capital outlay for railways pegged at Rs 2.40 lakh cr, highest ever

Deccan Chronicle

Budget 2023 | Highest-ever capital outlay of ₹2.4 lakh crore for Railways

The Hindu

FM lists 7 Budget priorities: Tax slab changes; middle class focus; Rlys boost

Deccan Chronicle

Budget 2023 Reactions LIVE: Amit Shah Says Push To Cooperative Sector 'All-inclusive, Visionary'

ABP News

Citizens\' expectations of the budget

Deccan Chronicle

Economic Survey 2022-23 | Out-of-pocket health spending still high, despite hike in government expenditure

The Hindu

Union Budget 2023–24 & Public Sector: Can Government Really Boost Disinvestment?

The Quint

Budget 2023 may peg gross borrowing under ₹16 trillion: Report

Live Mint

Budget targets, though higher, will be met, says Harpal Cheema

Hindustan Times

DC Edit | FM’s India Inc investment call raises hard questions

Deccan ChronicleDiscover Related