Sri Lanka stares at bankruptcy or redemption

The HinduAll eyes are on Sri Lanka as it endures its worst economic crisis since Independence. Defaulting, debt restructuring Sri Lanka’s strategy of defaulting on its external debt, timed less than a week before negotiations with the IMF in Washington, could not have come about without the Fund’s nod. There is no guarantee that an IMF agreement will lead to even financial stability, going by Sri Lanka’s past engagement as well as the volatility of financial markets today. Explained | Understanding the sovereign debt crisis in Sri Lanka The IMF Staff Report, that was made public in March 2022, outlines a number of recommendations likely to be entrenched in the upcoming agreement: revenue-based fiscal consolidation through increasing tax rates and energy pricing reforms; restoring debt sustainability; near-term monetary policy tightening towards inflation targeting; a market-determined and flexible exchange rate; and targeted social safety nets. Technocratic solutions During its postcolonial history, Sri Lanka has gone through 16 IMF agreements, most recently an Extended Fund Facility of U.S.$1.5 billion in June 2016.

History of this topic

Sri Lanka's ambitious governance and macro-linked bonds | Explained

The Hindu

Sri Lanka To Ink Debt Deals By Year's End: Economic Development Deputy Minister

Deccan Chronicle)

5 things about Sri Lanka's debt swap deal to end first-ever external loan default

FirstpostIMF approves third review of Sri Lanka's $2.9 billion bailout

The Hindu

IMF approves third review of Sri Lanka’s $2.9bn bailout, but warns of risks

Al Jazeera

Sri Lanka's president makes U-turn on IMF bailout

The Hindu

Sri Lanka’s Marxist-leaning president appoints his Cabinet after a resounding election win

Live Mint

‘We’ve tried everybody else’: What’s next for Sri Lanka’s turn to the left?

Al Jazeera

India’s foreign minister becomes the first such dignitary to visit Sri Lanka since the election

Associated Press

IMF expresses willingness to collaborate with Sri Lanka's new president on economic recovery

China Daily

JVP victory and its effect on the Lankan economy

Hindustan Times

Marxist Dissanayake wins Sri Lanka's presidential election as voters reject old guard

NPRSri Lanka’s presidential election a test for current leader, 2 years after its economy hit bottom

Associated Press

Sri Lanka president defends IMF bailout in campaign launch

Hindustan TimesSri Lanka will hold presidential election on Sept. 21, its first since declaring bankruptcy in 2022

Associated Press

Sri Lanka inks pacts with OCC, China to restructure debt

Hindustan TimesSri Lanka reaches deal on debt restructuring with bilateral creditors including China and France

Associated Press

Sri Lanka finalises debt restructure agreement with official creditor committee

Hindustan Times

Sri Lanka seals debt deal with Official Creditor Committee after financial crisis

The Hindu

'Procedural issues' delaying Sri Lanka debt deal: IMF

The Hindu

Sri Lanka has made 'strong progress' on debt restructuring front: IMF

The Hindu

Economic conditions in debt-stricken Sri Lanka improving, IMF says

Al JazeeraIMF says the economic situation in debt-stricken Sri Lanka is gradually improving

Associated Press

Sri Lankan president says he is seeking to defer loan payments until 2028 amid economic crisis

The Independent

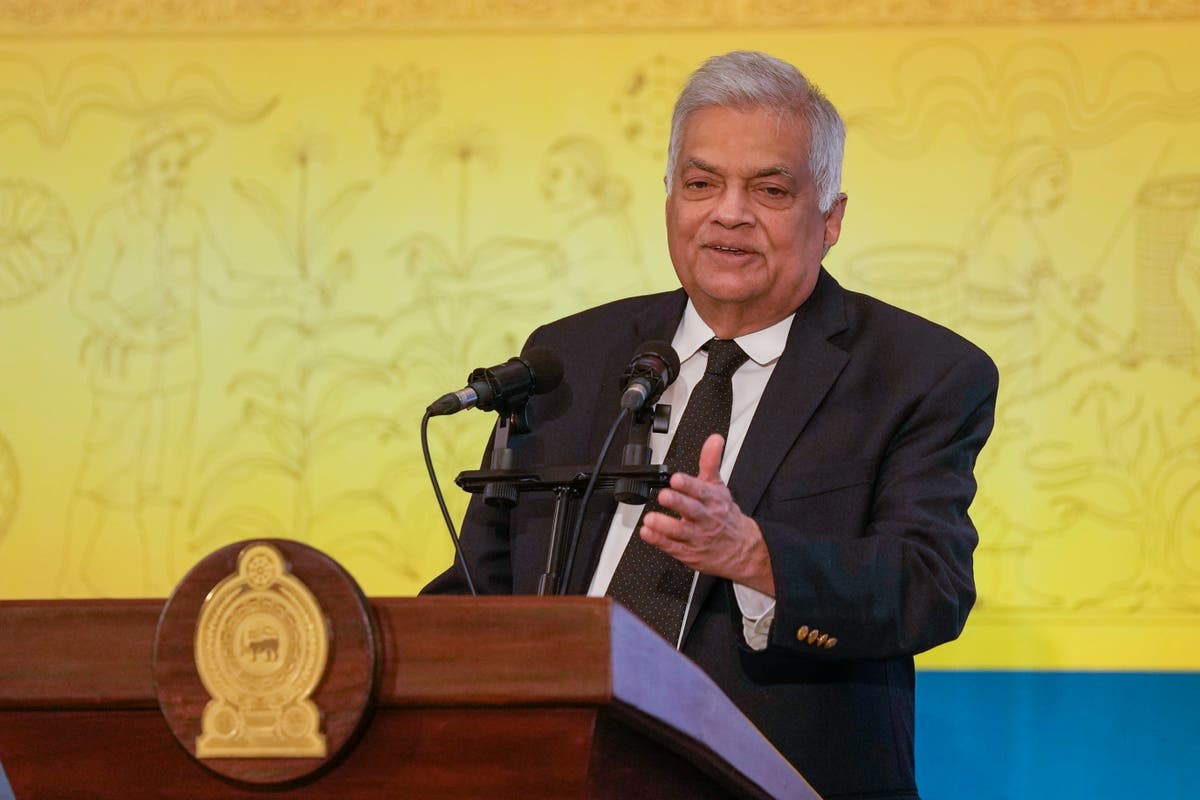

Sri Lanka’s Financial Crisis Gradually Easing: Ranil Wickremesinghe

News 18Pulling Sri Lanka out of the abyss

The Hindu

Crisis-ridden Sri Lanka’s economic reforms are yielding results, but challenges remain, IMF says

Associated Press

Sri Lanka says debt restructure finalised by April

The Hindu

Sri Lanka will get the second tranche of a much-need bailout package from the IMF

The Independent

Sri Lanka reaches agreement with India, Paris Club on debt treatment

The Hindu

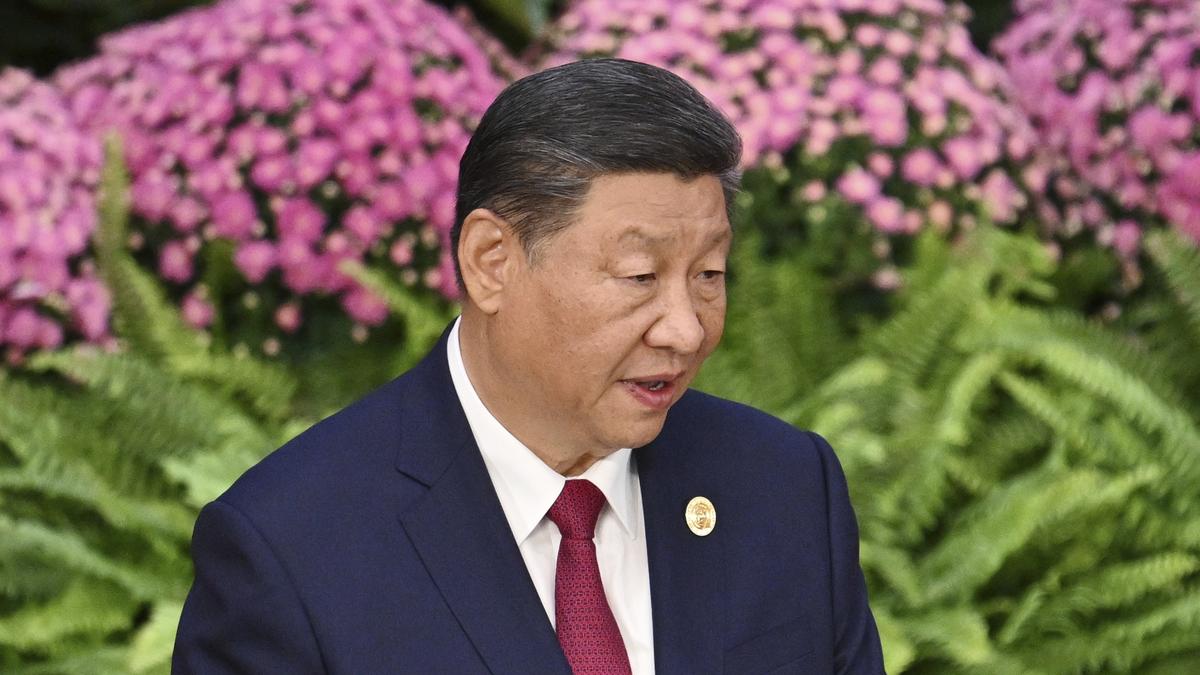

No ‘political strings attached’ to China’s support for Sri Lanka: Xi tells Ranil

The HinduSri Lanka says it has reached an agreement with China’s EXIM Bank on debt, clearing IMF funding snag

Associated Press

Sri Lanka confirms major debt deal with China

The HinduIMF says Sri Lanka needs to boost reforms and collect more taxes for its bailout funding package

Associated Press

Over half of Sri Lanka’s population ‘multidimensionally vulnerable’: UNDP study

The HinduSri Lanka on path of economic recovery: FM Shehan Semasinghe

The Hindu

G20’s response to debt distress: The case of Sri Lanka

Hindustan Times

ECONOMIC PERSPECTIVES | Sri Lankan debt crisis to get worse if IMF prescription is heeded

The HinduCash-strapped Sri Lanka gets parliamentary nod for domestic debt restructuring plan

The Hindu

Sri Lankan Central Bank moots recast of pension funds, haircut on sovereign bonds

The Hindu

World Bank approves $700 million for crisis-hit Sri Lanka

The Hindu

India Continues To Help Sri Lanka Stand Economically, But Colombo’s Love For Beijing Keeps Soaring

ABP News)

World Bank doles out $700 million to cash-strapped Sri Lanka

Firstpost

The key points of Sri Lanka’s plan to restructure domestic debt

Al JazeeraSri Lanka to restructure domestic debt amid challenges

The Hindu)

Sri Lanka has no money to hold presidential polls in 2023: Cabinet spokesman

Firstpost

IMF says Sri Lanka’s economic recovery shows signs of improvement but challenges remain

Associated Press

Debt-ridden Sri Lanka gets $350 million loan from Asian Development Bank

Live Mint

IMF urges crisis-hit Sri Lanka to decide on debt restructuring

Live MintTimely debt restructuring crucial for Sri Lanka, says IMF

The HinduDiscover Related

)

)

)

)