1 year, 11 months ago

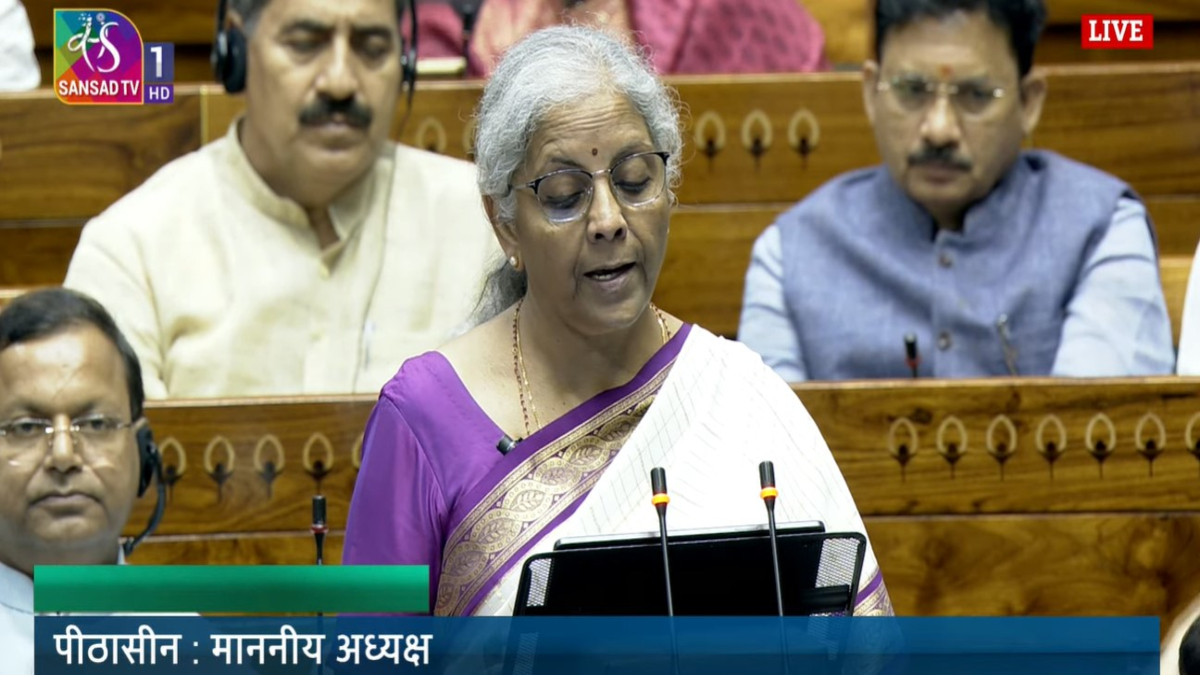

Real estate recommendations for the Union Budget 2023-24

The HinduThe limit of principal deduction on housing loans under Section 80C of the Income Tax Act 1961 stands at ₹1.5 lakh per annum. It is recommended that this be increased to at least ₹4 lakh per annum in the next Union Budget. The interest deduction limit under Section 24 of the IT Act on housing loan stands at ₹2 lakh per annum, respectively, to incentivise homebuyers. Long-term capital gains from the sale of house property are presently taxed at 20% through a special provision like Section 112 for equity shares.

Housing

Tax

Capital

Lakh

Ecb

It Act

recommended

recommendations

limit

union

act

housing

property

lakh

capital

202324

tax

projects

budget

estate

months

real

History of this topic

2 days, 21 hours ago

Budget 2025: NAREDCO pitches for hike in deduction on housing loan interest payment

Hindustan Times

11 months, 3 weeks ago

Interim Budget 2024: What can it do for real estate?

The Hindu)

1 year, 11 months ago

Union Budget 2023-24: Why favourable policies for realty sector can assist in growth, economic sustainability

Firstpost

3 years, 10 months ago

External Commercial Borrowings: A Brief Analysis Of The New Framework

Live Law

4 years, 1 month ago

‘Housing for all’ scheme gets ₹18,000 cr

Live Mint

5 years, 3 months ago

Govt announces steps to boost housing, facilitate homebuyers

The Hindu)

5 years, 6 months ago

Real Estate Sector Budget 2019: Govt hikes tax break on interest paid on home loans to Rs 3.5 lakh for purchase of first house

FirstpostDiscover Related

23 hours, 12 minutes ago

1 day, 2 hours ago

1 week, 6 days ago

2 weeks, 2 days ago

3 weeks ago

3 weeks, 5 days ago

4 weeks, 1 day ago

1 month ago

1 month ago

1 month ago

1 month ago

1 month ago

1 month ago

Trending News

1 month, 1 week ago

1 month, 1 week ago

1 month, 2 weeks ago

1 month, 2 weeks ago

1 month, 3 weeks ago

2 months ago

2 months, 2 weeks ago

3 months ago

3 months, 2 weeks ago

3 months, 3 weeks ago

4 months, 2 weeks ago

4 months, 3 weeks ago

4 months, 4 weeks ago

4 months, 4 weeks ago

4 months, 4 weeks ago

5 months ago

5 months, 1 week ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago

5 months, 2 weeks ago